On Tuesday, DAX 40-listed Volkswagen AG (DE:VOW) reported a notable surge of 12% in its deliveries in 2023 to 9.24 million vehicles, signalling a rebound in sales. Deliveries reached closer to pre-pandemic levels as the company overcame supply chain issues resulting from various factors like chip shortages and the Russia-Ukraine war.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Volkswagen is a luxury car manufacturer, owning brands like Volkswagen, Skoda, Audi, Bentley, Ducati, Lamborghini, and others in its portfolio.

The namesake Volkswagen brand witnessed a 6.7% increase in deliveries last year, reaching 4.87 million vehicles globally. Notably, Volkswagen delivered around 394,000 fully electric vehicles (EVs) worldwide in 2023, reflecting a 21.1% increase compared to the previous year.

The Struggling China Market

Volkswagen faces solid competition in China from numerous local rivals, such as BYD Co. Limited (HK:1211), and has been unable to gain traction in the world’s largest car market. The group reported a growth of 1.6% in its sales of 3.2 million cars in China, compared to the overall growth of 5.6% in the region, as reported by the China Passenger Car Association (CPCA).

Many large car makers are struggling to capture a higher EV market share in China as customers prefer locally manufactured vehicles. According to consulting firm Automobility, the market share of foreign brands in China’s passenger vehicle market declined to around 44% in 2023 from 64% in 2020.

Meanwhile, Volkswagen highlighted that attaining higher profitability remains its top priority rather than capturing more market share. The company is scheduled to report more detailed figures on Friday and will publish its annual results for 2023 on March 13, 2024.

Is Volkswagen a Good Stock to Buy Now?

Volkswagen stock fell by over 20% in 2023, reflecting margin pressures and profit warnings. Nevertheless, analysts maintain an optimistic outlook for the long term, pointing to robust delivery numbers as an indication of substantial demand for the company’s vehicles.

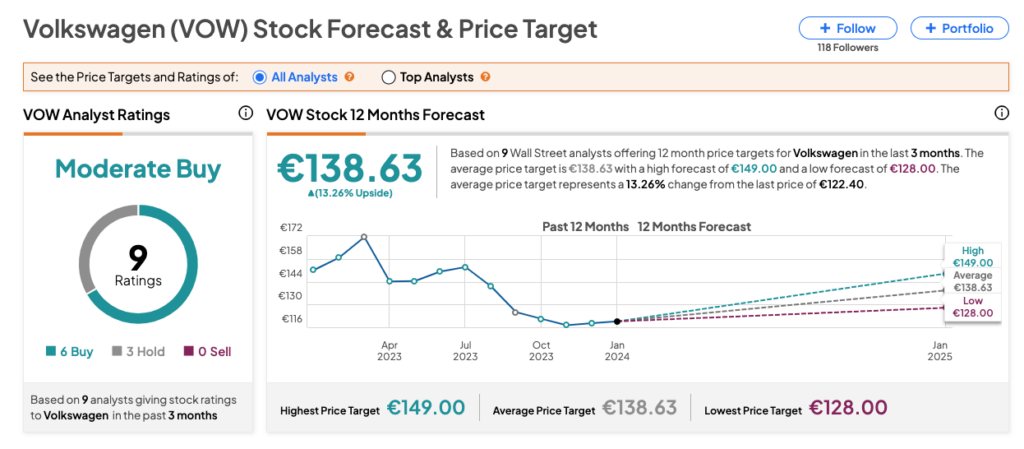

According to TipRanks, VOW stock has received a Moderate Buy consensus rating based on recommendations from nine analysts. This includes six Buy and three Hold recommendations. The Volkswagen share price forecast is €138.63, which is 13.3% higher than the current price level.