DAX 40-listed Volkswagen AG (DE:VOW) has agreed on cost-cutting strategies with its workforce, paving the way for savings of around €4 billion in 2024. The cost reduction program, which includes multiple measures, aims to contribute earnings of €10 billion by 2026 with a profit margin of 6.5%. This will be a notable increase from the operating margin of 3.4% reported in the first nine months of FY23.

The newly introduced measures are expected to help the company reduce costs, enhance its production timelines, and offset the pressures from the growing competition in the EV (electric vehicle) space.

Volkswagen (VW) is a well-known luxury car manufacturer, owning brands like Volkswagen, Skoda, Audi, Bentley, Ducati, Lamborghini, and others in its portfolio.

Cost-Cutting Drive

As part of the restructuring activities, the company is targeting a 20% reduction in the administrative staff costs at the Volkswagen brand. The company clarified that it is not aiming for a specific number of job reductions but rather a figure sufficient to achieve the 20% savings target. The job cuts are expected to begin in January 2024.

Additionally, the company will implement partial retirement programs for workers born in 1967 (or 1968 for those with severe disabilities). Further, Volkswagen aims to save €320 million annually by improving its procurement process. The company intends to add over €250 million annually by enhancing its after-sales business and more than €200 million through improved production turnaround.

Lastly, it is looking at €400 million in annual savings by reducing the use of test vehicles by up to 50% in technical development and opting for digital processes.

Is Volkswagen a Good Stock to Buy Now?

The Volkswagen share price is trading up by 0.53% today at the time of writing. Year-to-date, the stock has experienced a nearly 20% decline due to margin pressures and profit warnings. Despite the ongoing challenges, analysts maintain a bullish outlook in the long term, pointing to robust delivery numbers as an indication of substantial demand for the company’s vehicles.

The company recently reported a 22.6% growth in its November deliveries, driven by strong vehicle demand in North America and China.

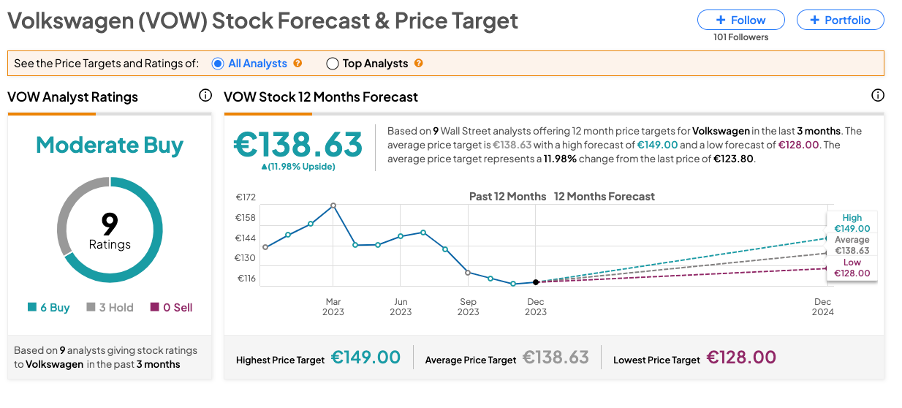

According to TipRanks, VOW stock has received a Moderate Buy consensus rating based on recommendations from nine analysts. This includes six Buy and three Hold recommendations. The Volkswagen share price forecast is €138.63, which is 12% higher than the current price level.