The stocks of German companies Vonovia SA (DE:VNA) and Bayerische Motoren Werke AG (DE:BMW) are two options for investors, looking for some extra income from their portfolio. VNA carries a dividend yield of 4.5%, while BMW offers a much higher rate of more than 7%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In terms of capital appreciation, analysts suggest that Vonovia holds considerable upside potential in its share price. In contrast, BMW stock, which is already trading at elevated levels, lacks further growth prospects.

TipRanks provides users with a range of tools to assist them in selecting the most suitable dividend stocks, according to their specific requirements. Here, we have used the Best German Dividend Stocks to screen these two companies while comparing them on various other factors.

Let’s see the two stocks in detail.

Vonovia SE

Vonovia is a leading entity in Europe’s residential real estate market. The company has solidified its position by providing premium rental homes throughout Germany and Austria.

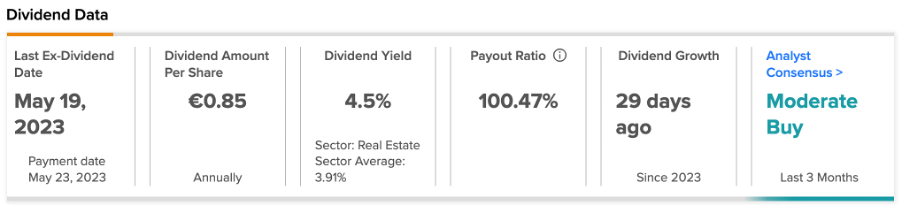

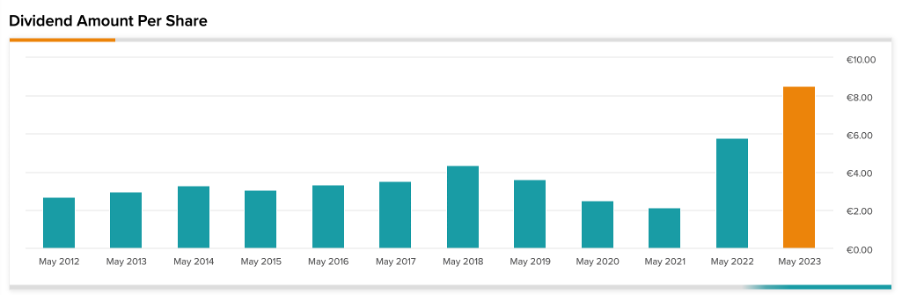

Even though the company has slashed its dividend by 50% to €0.85 per share in 2022, the dividend yield still remains attractive at 4.5%. Considering the current debt levels, the dividend cut seemed like a fair move.

The company’s stock has been trading down by 36% in the last year due to macroeconomic factors affecting the real estate industry. However, the operational performance of the company has consistently demonstrated strength, and it is focused on reducing its substantial debt levels. Analysts feel the decline presents a more appealing opportunity for investors to grab the shares.

Is Vonovia a Good Stock to Buy?

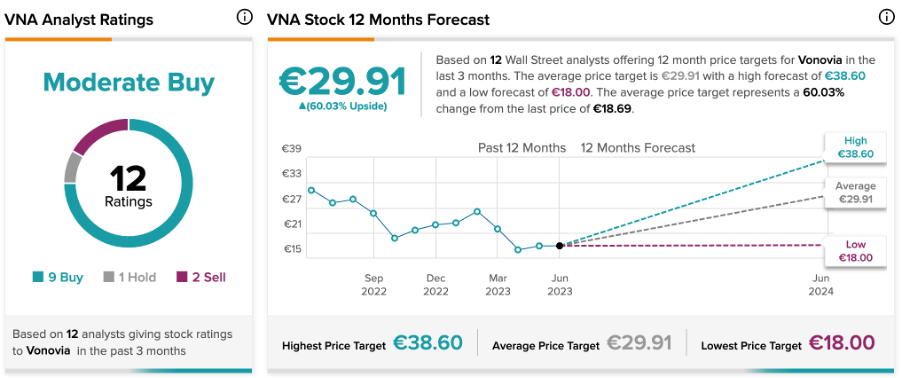

Yesterday, Jonathan Kownator from Goldman Sachs confirmed his Buy rating on the stock, forecasting a huge upside of almost 90% in the share price.

According to TipRanks, VNA stock has a Moderate Buy rating based on nine Buy, two Sell, and one Hold recommendations. The average price forecast is €29.91, which is 60% above the current trading levels.

Bayerische Motoren Werke AG (BMW)

BMW is a German luxury automobile company specializing in manufacturing high-end cars, motorcycles, and other exceptional vehicles.

The company paid a total dividend of €8.5 per share in 2022, up from €5.80 in 2021. This leads to the current dividend yield of 7.11%, as compared to the industry average of 1.63%.

The company has increased its focus on BEVs (battery electric vehicles) with a strong product line-up of premium products. This indicates that earnings will remain solid, supported by strong free cash generation. The company is expected to continue returning the generated free cash flow to shareholders through dividends and share buybacks.

Is BMW a Good Share to Buy?

BMW stock has a Hold rating on TipRanks based on a total of 15 recommendations, of which four are Buy. The target price of €105.36 is around 5% lower than the current level.

Conclusion

With a stable dividend outlook, these companies present a favorable option for investors, seeking income-oriented opportunities.