France-based media company Vivendi SE (FR:VIV) is contemplating a division into three distinct businesses, all of which would be independently listed. The company’s major shareholder and billionaire businessman, Vincent Bolloré, is leading this potential strategic transformation. The company’s shares on the OTC market in New York traded up by 9% yesterday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Vivendi has a broad presence across the entire media spectrum. The company’s diversified portfolio includes TV, gaming, publishing, media, and telecommunications.

A Major Overhaul

According to the company, since the spin-off of its Universal Music Group (GB:0UMG) in 2021, it has struggled with “conglomerate discount,” which means it is valued less than the sum of its businesses. This led to a reduced valuation for the company and also restricted the growth opportunities for its subsidiaries.

Moreover, the lack of cooperation among the group’s diverse businesses has been a pain area for the company and investors.

As part of this division, Vivendi’s first business will include its film and TV production segment Canal+, which is also its biggest revenue generator. The company’s advertising segment, Havas, would also become a separate company. Lastly, the company intends to create an investment company, which will include Vivendi’s stake in the publishing group Lagardère and its other holdings.

The company has initiated collaboration with financial experts and legal advisors to assess the viability of this strategy. The company stated, “This project will have to prove its added value for all stakeholders.” It expects the process to take some time.

The news also raises some questions about how Bolloré, despite no longer being the chairman, has a significant influence over the company. Over the years, he has been actively involved in reshaping the company through multiple divestments, acquisitions, etc. Investors are concerned that this move from Bolloré could be aimed at gaining more control over the media business and steering it in a new direction.

What is Vivendi’s Stock Price Prediction?

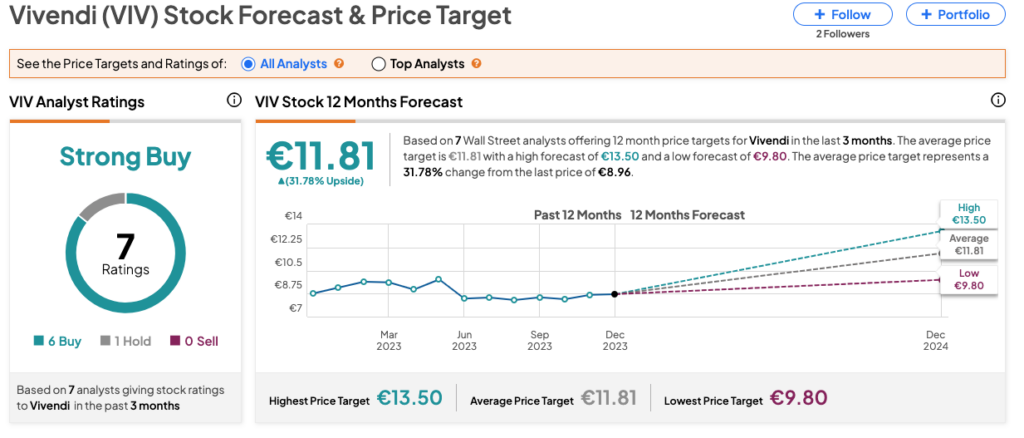

VIV stock is assigned a Strong Buy rating on TipRanks, backed by six Buys versus one Hold recommendation. The Vivendi share price forecast of €11.81 indicates a growth potential of 32% from the current price.