The UK-based Virgin Money PLC (GB:VMUK) fell short of its annual profit expectations as persistent inflation and high borrowing costs put pressure on household finances. The company allocated more funds toward bad loan provisions, reflecting the impact of the ongoing cost of living crisis. It set aside £309 million to cover potential bad loans, a substantial increase from the £52 million in the previous year.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Moving ahead, the company expects a further increase in arrears in its credit card portfolio in the next fiscal year. The credit card segment reported a growth of 10% this year as more customers opted for credit.

Investor response to the numbers has been adverse and the share price traded down by 6.2% yesterday. In 2023, the stock has depreciated by approximately 13% in value so far.

Virgin Money is a financial services brand operating under the Virgin Group, founded by the renowned entrepreneur Richard Branson.

Let’s take a look at some of the numbers.

Positive Outlook Despite Near-Term Challenges

The company disclosed a statutory profit before tax of £345 million for the year ending September 30, 2023, reflecting a decline from £595 million in the previous fiscal year. The total customer lending rose to £72.8 billion from £72.6 billion in the previous year. The company is witnessing a challenging economic outlook due to higher unpaid loans and margin pressure from intense competition for savings and mortgage products. However, it remains optimistic about its outlook and has announced its intention to invest millions in expanding its digital services.

For FY24, Virgin Money anticipates the net interest margin (NIM) to be in the range of 1.90% to 1.95%, in line with analysts’ expectations of 1.90%.

Virgin Money also introduced a new £150 million share buyback program. It also intends to complete £800 million in distributions to its shareholders by the end of 2024.

Are Virgin Money Shares a Good Buy?

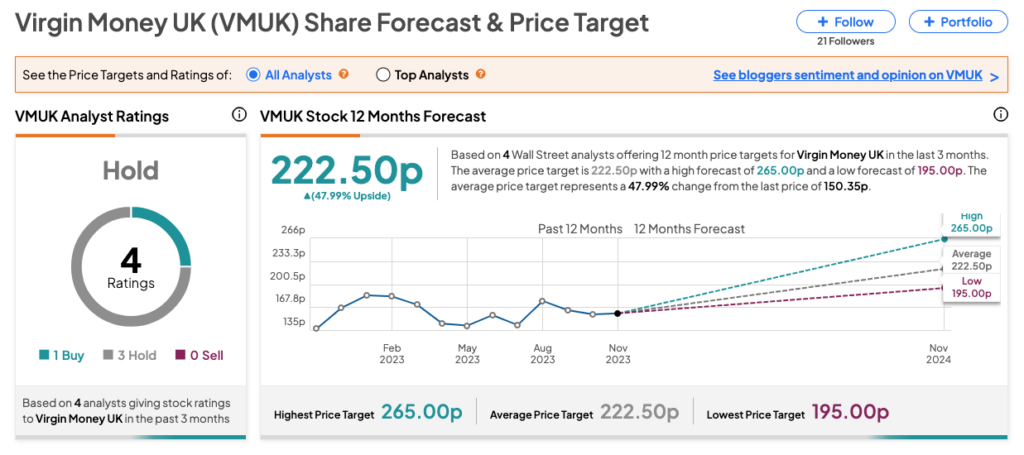

On TipRanks, VMUK stock has been assigned a Hold rating based on one Buy and three Hold recommendations. The Virgin Money share price target is 222.5p, which is 48% above the current trading level.

It’s worth mentioning that these ratings were assigned prior to the results and may be subject to change.