Using the TipRanks Top Singapore Dividend Stocks tool, we have shortlisted two SGX-listed companies: UOL Group (SG:U14) and Keppel Corporation Limited (SG:BN4). These companies not only provide steady dividends, but they also have the potential for their share prices to increase by over 20%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let’s take a look at the details.

UOL Group Limited

UOL is a prominent company in the property and hospitality sectors with a diversified portfolio of assets spanning Asia, Europe, Oceania, and North America.

UOL Group has been known for paying stable dividends over the years. Even though its dividend yield is quite modest at 2.14%, the consistent payments make it an attractive option for income investors. In February, the company announced a cash dividend of S$0.15 per share along with a special dividend of S$0.03, leading to a total dividend of S$0.18 for 2022.

Moving forward, analysts are bullish on the company’s growth prospects, considering the reopening of borders and the resumption of economic and social activities. Moreover, the company’s residential inventory possesses compelling locational attributes, thereby appealing to both homebuyers and investors.

Two days ago, DBS analyst Rachael Tan reiterated her Buy rating on the stock and predicted an upside of 21.7%.

What is the Price Target for UOL Group Share?

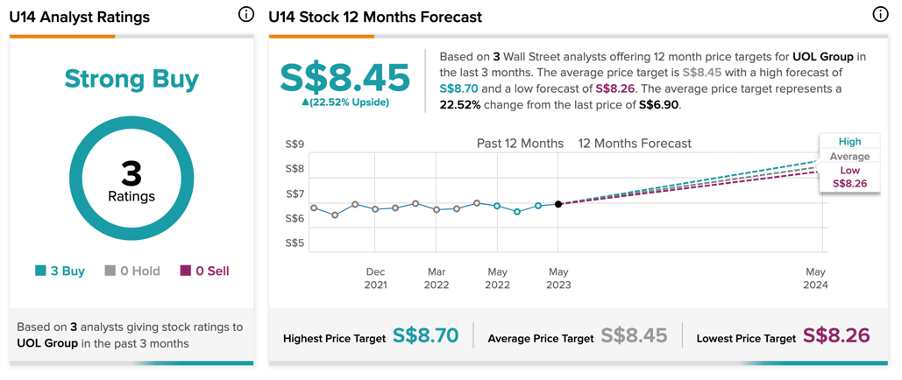

According to TipRanks’ rating consensus, U14 stock has a Strong Buy rating backed by three Buy recommendations.

The average price target is S$8.45, which has an upside potential of 22.5% from the current price level.

Keppel Corporation Limited

Keppel is a conglomerate that operates in various sectors, including marine, infrastructure, energy, asset management, and urban development, through its subsidiaries.

The company carries a dividend yield of 5.17%, significantly higher than its sector’s average of 1.63%. In 2022, Keppel maintained its total dividend payout of S$0.33 per share despite a challenging year for its operations. The company’s net profits of S$926.7 million in 2022 saw a year-over-year decrease of 9%.

Analysts are bullish on the fact that the company managed the odds in 2022 and reported a good set of results.

Within the past 10 days, analysts from UOB Kay Hian and CGS-CIMB have reiterated their Buy ratings for the stock. UOB analyst Adrian Loh anticipates a 41.3% growth in the share price, while Lim Siew Khee from CGS sees a potential increase of 35.3%.

What is the Target Price for Keppel Corp.?

BN4 stock has a Moderate Buy rating on TipRanks, based on five Buy and one Sell recommendations.

The average target price of S$7.75 suggests an upside of almost 20.5% from the current price level.

Final Thoughts

In summary, UOL Group and Keppel Corp. have been consistent dividend payers. Backed by their earnings growth, their future prospects for dividend income and share price appreciation are also promising.