Unilever PLC (GB:ULVR) today reported its second-quarter and half-yearly earnings for 2023. The company posted positive numbers, driven by its growth across all segments. Post-announcement, the share price gained 4.7% at the time of writing. YTD, the stock has remained volatile at a loss of 2.45%.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Unilever is a leading FMCG company with brands like Dove, Knorr, Lifebuoy, Axe, Sunsilk, Lux, Vaseline, Pepsodent, etc. under its portfolio.

First-Half Performance

During the quarter, the company posted underlying sales growth of 9.1%, backed by a 9.4% hike in prices and a 0.2% decline in volumes. The sales growth exceeded the average analyst forecast of 6.4%. Among the segments, Personal Care was the highlight, with an increase of 10.8% in sales and 3.2% in volumes. This segment contributes 23% to the total group sales.

The total sales increased by 2.7% to €30.4 billion as the company witnessed a resurgence in consumer spending along with some signs of softening inflation. The operating profit grew by 3.3% to €5.2 billion, supported by a 10bps margin hike to 17.1%.

In terms of outlook, Unilever expects its full-year underlying sales growth to exceed 5%, surpassing its multi-year range. Additionally, Unilever stated that it foresees net material inflation for 2023 to be around €2 billion, with €400 million expected in the second half of 2023.

Analysts’ View

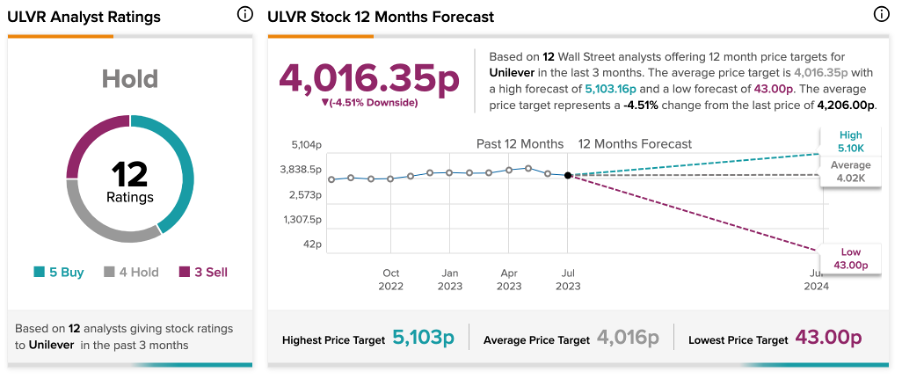

After the results, many analysts have confirmed their ratings on the stock. Analysts have a bearish outlook on the stock and are not expecting any significant growth in the share price in the near future.

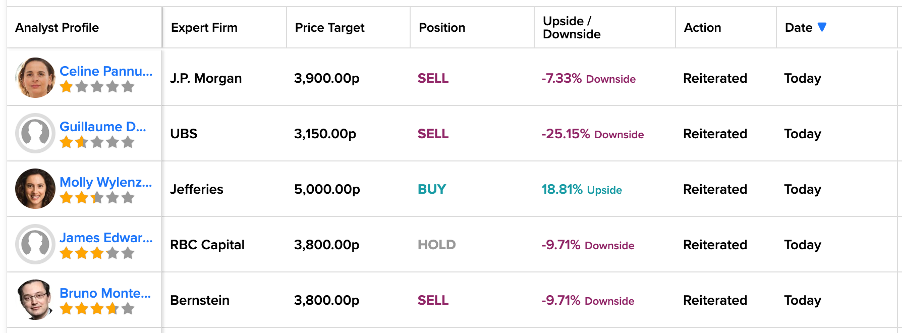

Today, J.P. Morgan analyst Celine Pannuti reiterated her Sell rating on the stock, predicting a decline of 7.3% in the share price.

Similarly, Guillaume Delmas from UBS also confirmed his Sell rating with a much higher predicted downside of 25% in the share price.

On the contrary, analyst Molly Wylenzek from Jefferies holds a Buy rating on the stock and forecasts 18.6% growth for investors.

Is Unilever a Good Stock to Buy?

On TipRanks, ULVR stock has a Hold rating based on a total of 12 recommendations. It includes five Buy, four Hold, and three Sell recommendations.

The average target price is 4,016.4p, which implies a downside of 4.5% on the current trading price.