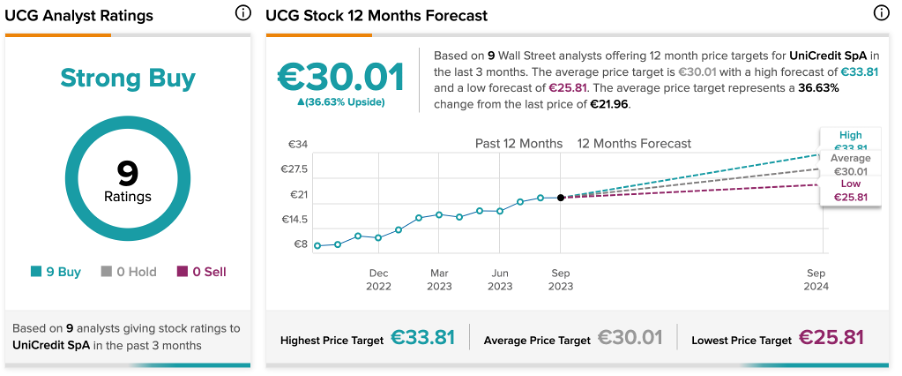

Italy’s leading banking group, UniCredit S.p.A. (IT:UCG), has recently gained favorable analyst ratings, indicating further upside potential in the share price. Over the last five days, the stock has received three Buy ratings from analysts, with their price targets indicating growth ranging between 36% and 54%. Overall, the stock has a Strong Buy consensus rating from analysts on TipRanks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Within the last 12 months, the company’s stock has seen a significant upswing, with a growth rate of 110%, out of which 71% has been realized YTD. In August, the share price was slightly hit after the government decided to impose a windfall tax on banks, sending ripples across the Italian banking sector. However, the bank’s guidance remains on track, and it is confident of delivering higher profits for the full fiscal year 2023.

UniCredit is an Italian banking conglomerate offering a comprehensive range of services throughout Europe. The bank serves approximately 15 million customers on a global scale.

What Are Analysts Predicting?

The stock has garnered Buy ratings from numerous analysts ever since the bank disclosed its Q2 2023 earnings report in July. It has recently received three additional Buy ratings, further bolstering the investment outlook.

Analysts are impressed by the Q2 numbers and believe in the core fundamentals of the bank. Moving forward, analysts expect the company to secure profits in the range of €3.2 to €3.3 billion during the second half of 2023, even when factoring in extra provisions for non-performing assets and windfall tax.

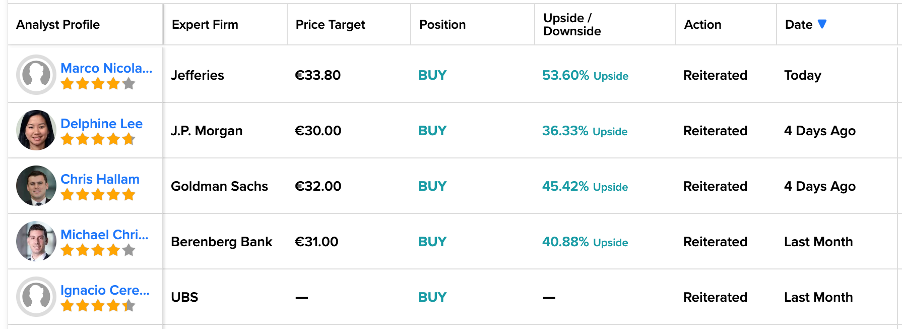

Today, Jefferies analyst Marco Nicolai confirmed his Buy rating on the stock, predicting a 54% growth rate in the share price.

Four days ago, the stock garnered two Buy ratings from analysts. Analyst Delphine Lee from J.P. Morgan reiterated her Buy rating on the stock with a price target of €30. Lee is a five-star-rated analyst on TipRanks and mainly covers financial stocks in the European market.

On the same day, Goldman Sachs analyst Chris Hallam also maintained his Buy rating, suggesting a 45% growth in the share price. He reduced his price target from €33.5 to €32.0. Hallam is also rated as a five-star analyst according to the TipRanks Star Ranking system.

UniCredit Share Price Target

According to the TipRanks consensus, UCG stock has received a Strong Buy rating backed by Buy recommendations from all nine analysts covering it. The UniCredit share price target is €30.01, which represents a positive change of around 37% in the share price.