British retail giants Unilever PLC (GB:ULVR) and Reckitt Benckiser Group PLC (GB:RKT) will report their Q2 2023 earnings this week. The ULVR stock is rated Hold by analysts, indicating limited potential for significant gains. On the other hand, RKT stock has been given a Moderate Buy rating with a projected share price growth of over 20%.

The TipRanks Earnings Calendar serves as a helpful tool to identify companies scheduled to release their upcoming earnings reports. Investors can then conduct in-depth research on these stocks to enhance their decision-making process and make more informed choices.

Let’s explore further:

Unilever PLC

The leading British FMCG company, Unilever, is set to announce its half-year earnings on Tuesday, July 25. The market anticipates a minor easing compared to the robust performance witnessed in the first-quarter numbers, boosted by higher volumes and prices. Analysts expect a huge downfall in quarterly sales to £13.27 billion, as compared to sales of £26.27 billion in the last quarter. The forecasted EPS for Q2 is £1.11, higher than the EPS of £0.61 in the same quarter last year.

The projected underlying operating margin is anticipated to be a minimum of 16%, while analysts are expecting it to reach 16.2%, making it a crucial metric to monitor closely.

What is the forecast for Unilever PLC’s share price?

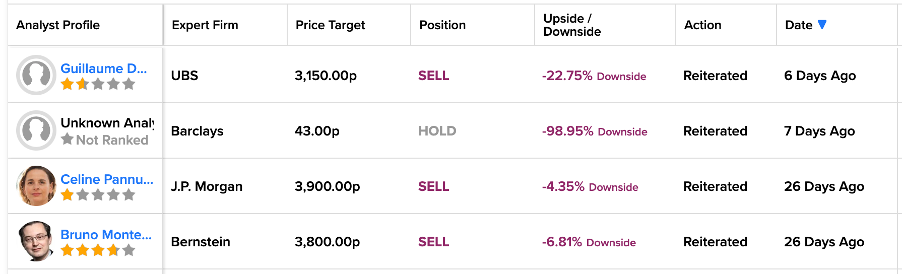

Ahead of earnings, analysts have reiterated a Sell rating on the stock and are predicting a downside in the share price.

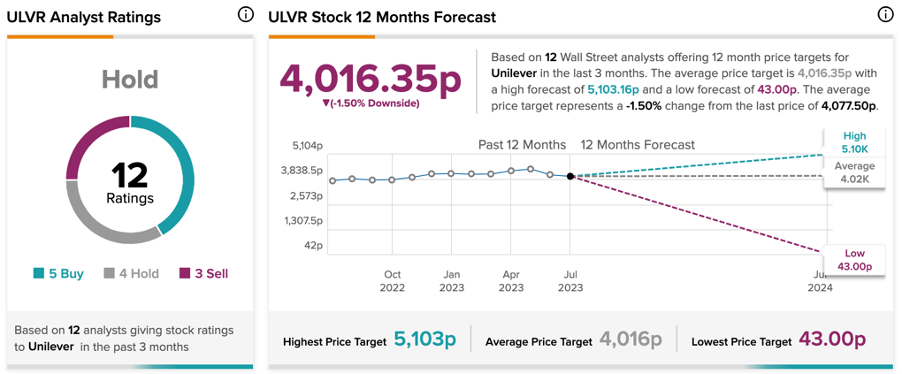

According to TipRanks’ analyst consensus, ULVR stock has a Hold rating. The stock has five Buy, four Hold, and three Sell recommendations.

The share price forecast is 4,016.35p, which is 1.5% lower than the current price level.

Reckitt Benckiser Group PLC (Reckitt)

Reckitt will report its half-yearly results one day after its competitor, Unilever, on July 26. According to TipRanks, the forecasted EPS for Q2 is £1.71 per share, slightly lower than the previous year’s reported EPS of £1.88 for the same period. The projected sales for the quarter are £3.56 billion.

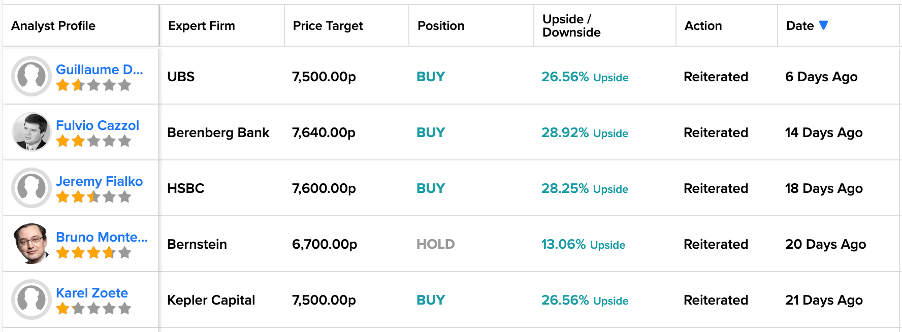

In contrast to Unilever, analysts are bullish on Reckitt’s numbers and its share price. Ahead of its earnings, many of them have confirmed their ratings on the stock, suggesting a good upside.

Is Reckitt a Buy or Sell?

RKT stock has a Moderate Buy rating on TipRanks, based on a total of 14 recommendations, of which nine are Buy.

The average target price is 7,180.0p, which implies an upside of 21% on the current trading price.