In key news on UK stocks, Shell (GB:SHEL) has reportedly been mulling its exit from the London Stock Exchange (LSE) and plans to move its listing to New York. According to Bloomberg, Shell’s CEO, Wael Sawan, stated that the company is considering several options in order to ensure the right valuation for its shares. He added that if the valuation gap continues till the middle of 2025, the company will consider all possibilities, including the potential relocation of the listing to New York.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Shell shares gained 1.47% in the trading session on Monday.

Shell is a leading oil and gas company, providing a wide range of energy products, including fuels, oil, liquefied petroleum gas (LPG), lubricants, etc.

Shell’s Exit: A Major Threat to LSE’s Stability

Shell’s possible exit from London comes as a major threat to the exchange’s stability. In recent times, London has been concerned about its shrinking role in global finance. Those concerns were notably evident in the London Stock Exchange’s inability to secure 2023’s largest IPO, that of Arm Holdings PLC, (NASDAQ:ARM), especially given that it is a British company.

If Shell’s exit happens, its departure would exert immense pressure on other energy giants like BP PLC (GB:BP), Glencore (GB:GLEN). These companies are already grappling with waning interest from European investors due to mounting environmental apprehensions surrounding fossil fuels.

Interestingly, these energy companies also play a vital role within the UK equity market as solid dividend payers. They remain a preferred option for income investors. In 2023, Shell’s shareholder distributions totalled $23 billion, comprising $8 billion in cash dividends and $15 billion in share buybacks. The total dividend for 2023 was $1.29 per share, reflecting a 25% increase from the $1.04 per share paid in 2022.

The company maintained dividend growth despite its adjusted earnings declining by 29% to $28.25 billion in 2023, compared to the previous year’s record profit of $39.9 billion.

Is Shell Stock a Good Buy?

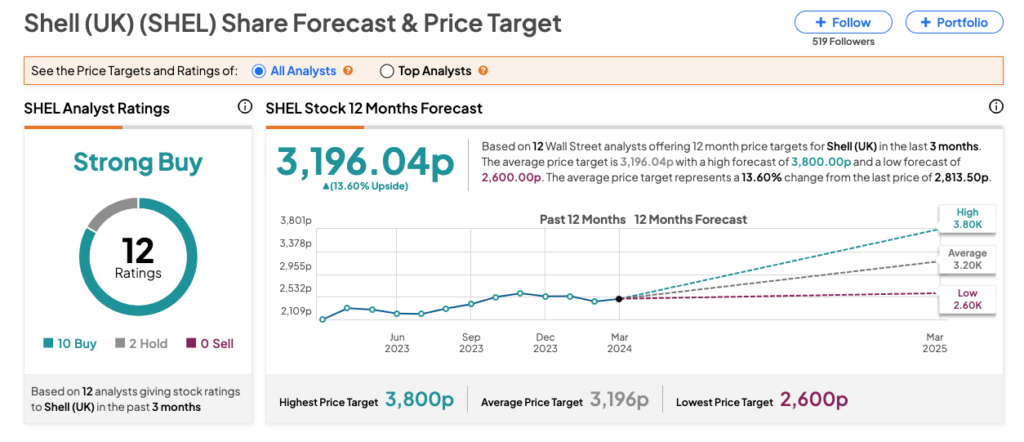

Overall, analysts have a bullish stance on SHEL stock, as reflected in the Strong Buy consensus rating on TipRanks. This is based on 10 Buy and two Hold recommendations. The Shell share price target of 3,196.04p implies a 14% increase on the current price level.