Among the famous UK stocks, FTSE 100-listed Rolls-Royce Holdings PLC (GB:RR) has emerged as a standout performer with a gain of over 190% in 2023. The increase in global air travel post-COVID-19 and a rise in defence expenditures amid geopolitical tensions have greatly benefitted the company’s operations and drove strong numbers in 2023. Shares have risen nearly 31% year-to-date and analysts maintain a bullish stance on RR stock, citing its strong performance across various business segments and an effective turnaround strategy.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Rolls-Royce specializes in designing engines and power systems for the aerospace and defence industries. Based in London, it has a global footprint spanning the U.S., Asia, Europe, the Middle East, and Africa.

Let’s take a look at the details.

Upbeat Results and a Promising Outlook

Last month, Rolls-Royce reported its annual results for 2023, achieving a record performance. The company’s 2023 revenue grew over 21% and surpassed £15 billion, with more than half of the top-line growth driven by its Civil Aerospace segment. This segment also witnessed a substantial increase in its operating margin, climbing to 11.6% in 2023 from 2.5% in the previous year.

Additionally, the company’s underlying operating profit increased £938 million to £1.6 billion in 2023. The group also announced a record free cash flow of £1.3 billion, supported by the growth of its long-term service agreement (LTSA) book.

In 2024, Rolls-Royce anticipates continued progress, with underlying operating profit expectations ranging from £1.7 billion to £2.0 billion and free cash flow between £1.7 billion and £1.9 billion. Moreover, the company forecasts a notable increase in its large EFHs (engine flying hours) within the Civil Aerospace segment, expecting the metric to reach 100-110% of the 2019 level. In 2023, EFHs rebounded to 88% of the 2019 level.

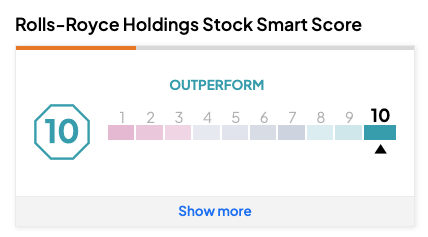

“Perfect 10” on the TipRanks’ Smart Score List

Rolls-Royce earns a “Perfect 10” on the TipRanks Smart Score Tool, suggesting a higher probability of the stock outperforming market averages. The Smart Score tool rates stocks on a scale of one to ten, offering insights into their potential to outperform the overall market. The ratings are based on eight key factors, including hedge fund activity, fundamental analysis, and analyst ratings, among others.

What is the Target for Rolls-Royce Share Price?

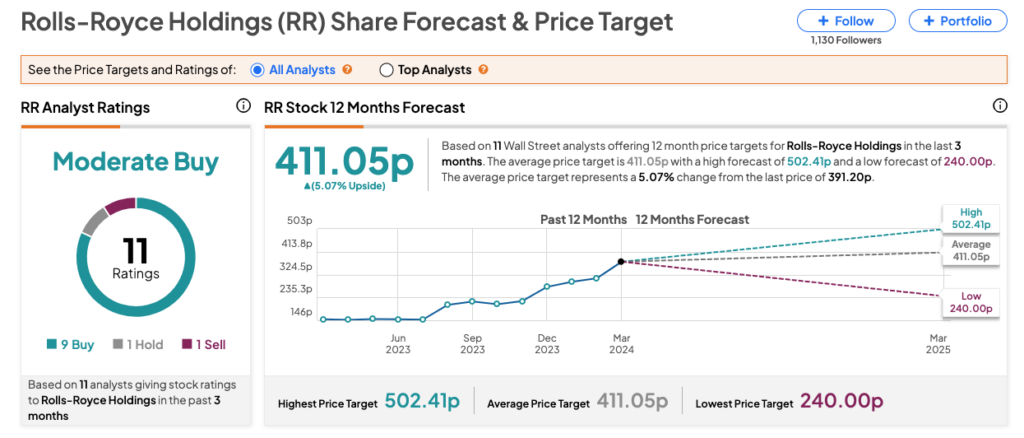

According to TipRanks, RR stock has received a Moderate Buy consenus rating based on a total of 11 recommendations, of which nine are Buys. The Rolls-Royce share price forecast is 411.05p, which is 5% higher than the current trading level.