In key news on UK stocks, Pearson PLC (GB:PSON) shares fell despite the company releasing its Q1 update in line with its expectations. The company reported sales growth of 2% for the first quarter. Investors responded unfavourably to the news, as they seemed to have anticipated much higher sales growth. Nonetheless, Pearson confirmed its guidance for the full year 2024, as it expects higher sales momentum in the second half.

PSON shares traded down by over 1% as of writing, making its place among the top 5 fallers on the FTSE 100 index.

Pearson PLC is an education and publishing corporation offering educational solutions, courses, and digital content in approximately 200 countries worldwide.

Insights from Pearson’s Q1 Update

Among its businesses, the primary driver of Pearson’s Q1 revenue growth was the 22% surge in the English Language Learning division’s sales. This growth was mainly driven by inflationary pricing in Argentina. However, moving ahead, this gain is expected to diminish as comparative foreign exchange rates return to normal.

Workforce Skills sales experienced 9% growth, consistent with the company’s projections. On the other hand, the Higher Education and Virtual Learning divisions witnessed a decline of 4% each.

The company’s digital registrations grew by 3% compared to last year. Pearson has been incorporating artificial intelligence (AI) into its range of educational products as part of its modernization efforts. The company expressed satisfaction with the level of engagement it is witnessing from both students and faculty regarding its AI study tools.

Additionally, Pearson successfully concluded the £300 million share buyback program initiated last year. It has also initiated the previously announced £200 million buyback extension, with £88 million already repurchased as of April 24, 2024.

Is Pearson Stock a Good Buy?

Before the pandemic, Pearson faced challenges in keeping up with the evolving technology landscape, which affected its share price. However, the ongoing transformation appears to be generating favorable outcomes, evidenced by the shares rebounding in recent years. In the last 12 months, Pearson stock gained around 14%.

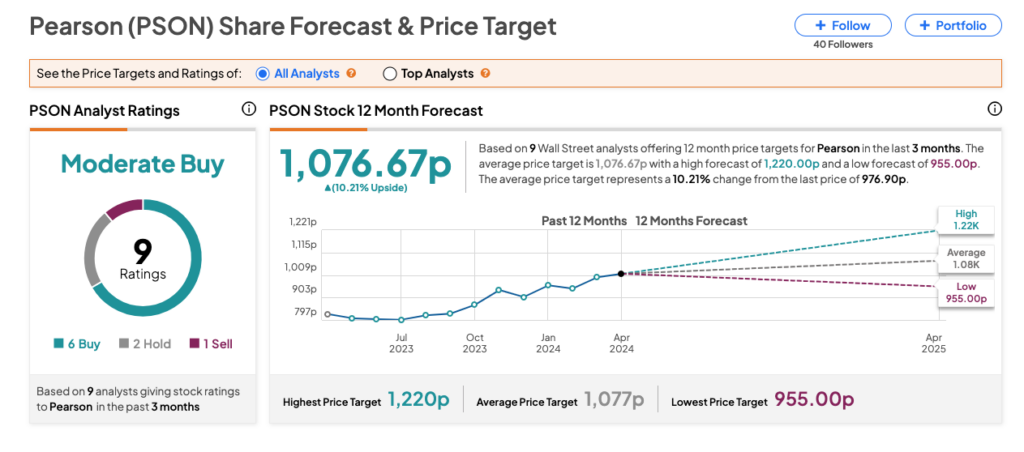

Overall, analysts are moderately bullish on PSON stock based on six Buys, two Holds, and one Sell recommendation. The Pearson share price forecast is 1,076.67p, which represents a growth of 10% from the current level.