In major news on UK stocks, FTSE 100-listed International Consolidated Airlines Group, S.A. (GB:IAG) achieved record profits in FY23 and also signalled an upbeat outlook for FY24. In 2023, the company’s operating profits surged by over twofold to €3.5 billion, exceeding the prior record of €3.3 billion set in 2019. In terms of outlook, the company is optimistic about its leisure demand, with bookings standing at 92% for Q1 2024 and 62% for the first half.

IAG’s share price is currently trading down by 1.1%, possibly due to the absence of any dividend reinstatement news in the results.

IAG is a group company that manages the operations of major airlines in Ireland, Spain, and the UK. British Airways is the primary revenue contributor to the company.

Continued Surge in Post-Pandemic Travel

In 2023, IAG operated at 95% of its pre-pandemic capacity, with passenger revenue increasing by 33% year-on-year to €25.8 billion. The rise in passenger revenue was attributed to the reopening of markets, robust leisure demand, and higher ticket prices.

On the flip side, corporate travel demand was hit in the last quarter of 2023 due to the ongoing conflict in the Middle East region. However, the performance of the group’s premium leisure segment remained robust. Airlines have been benefitting from sustained travel demand, as customers are disregarding the higher prices.

What is the Prediction for IAG Stock?

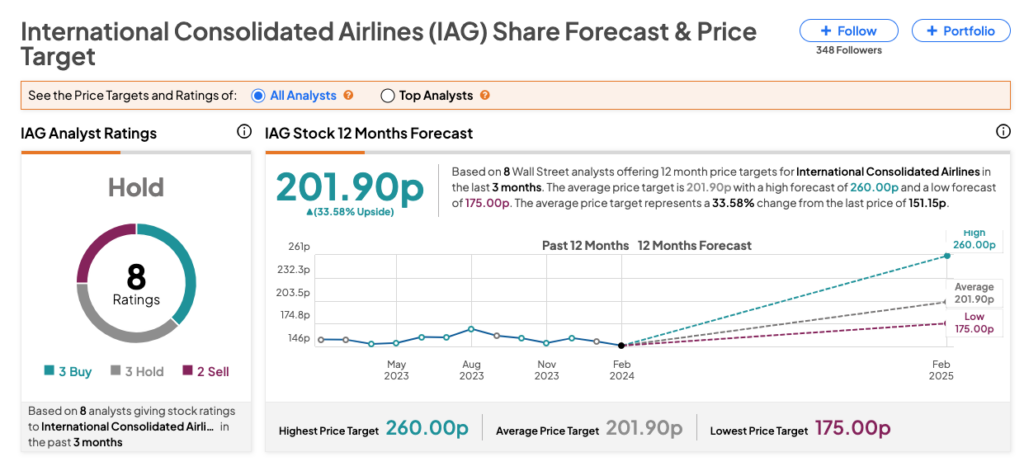

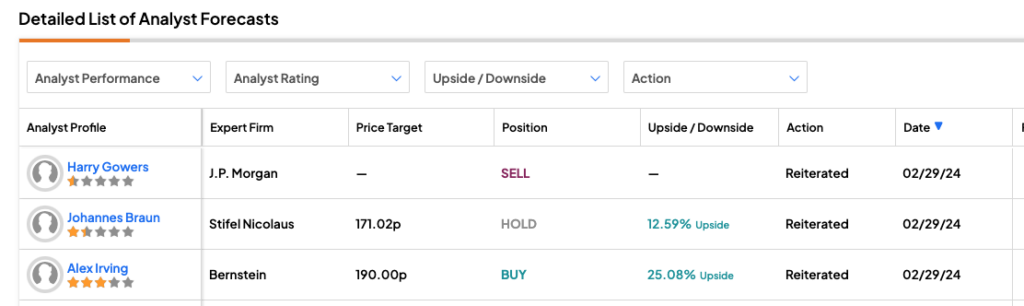

Post-results, analysts had mixed reactions to IAG stock. Alex Irving from Bernstein confirmed his Buy rating on the stock and predicts a growth rate of 25.5%.

Conversely, J.P. Morgan analyst Harry Gowers kept his Sell rating on the stock. Meanwhile, Johannes Braun from Stifel Nicolaus maintained his Hold rating, predicting an upside of 12.6%.

Overall, IAG stock has a Hold rating on TipRanks, backed by three Buy, three Hold, and two Sell recommendations. The IAG share price forecast is 201.9p, which is 33.6% higher than the current trading level.