In major news on UK stocks, Entain PLC (GB:ENT) fell on Thursday after the company forecasted reduced profit this year in its 2023 annual results. The company expects its EBITDA (earnings before interest, tax, depreciation, and amortization) to decline by £40 million in 2024, hit by regulatory changes in the UK and Netherlands. The company emphasized that, despite short-term disruptions for players, these regulatory changes will yield positive outcomes in the long run. After the announcement, ENT shares were down by over 9% in early trading hours but recovered later in the day.

Entain is a gaming and sports betting company that owns games such as Bwin, Ladbrokes, Partypoker, PartyCasino, and others.

2023 Results Meet Expectations

In 2023, Entain reported 11% growth in its NGR (net gaming revenue) on a constant currency basis. Revenue also grew by 11% to £4.8 billion. The company’s joint venture, BetMGM, achieved 36% year-over-year growth in its NGR of $1.96 billion, which was at the top end of its guidance.

The company’s EBITDA, excluding its New Zealand partner TAB, decreased by 2% to £974 million compared to the previous year, aligning with expectations. Reported EBITDA increased by 1% to £1 billion.

Speaking of shareholders’ returns, Entain declared a second interim dividend of 8.9p per share, bringing the total dividend for the year to £17.8 per share.

Is Entain a Good Stock to Buy?

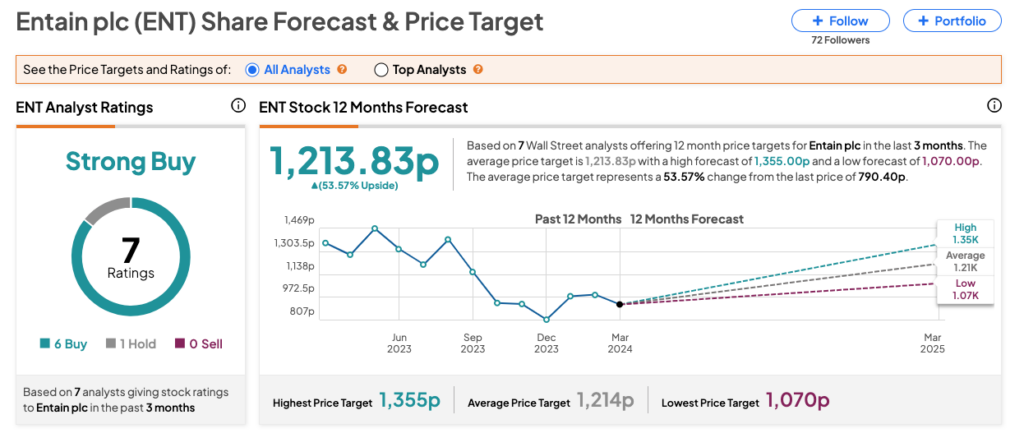

Post-results, analyst James Wheatcroft from Jefferies reiterated his Buy rating on the stock, predicting an upside of 53.7%. Wheatcroft is bullish on the stock due to confidence in the new management and the company’s robust track record in the gambling industry. Additionally, he believes that the stock’s low valuation and ongoing market noise regarding a potential MGM takeover will further drive the shares.

According to TipRanks consensus, ENT stock has received a Strong Buy rating, backed by six Buys and one Hold recommendation. The Entain share price prediction is 1,213.83p, which is 53.6% higher than the current trading levels.