In key news on UK stocks, BP PLC (GB:BP) raised its oil and gas production outlook for the first quarter of FY24 in its trading update released on Tuesday. However, the company cautioned of potential financial headwinds in its Oil Production and Operations and the Gas and Low Carbon Energy segments, citing decreases in natural gas market prices, the devaluation of the Egyptian pound, and pricing delays in BP’s production regions. Following the update, BP shares gained 1.7% today as of writing. Year-to-date, the stock has gained almost 10%.

The company will announce its first-quarter results on May 7.

BP is a multinational energy company that explores, produces, and distributes oil and natural gas.

More Details from BP’s Update

According to the update, BP expects increased upstream production in Q1 2024 compared to the previous quarter, with higher output in both the Oil Production and Operations and the Gas and Low Carbon Energy segments. In the fourth quarter of 2023, the output of the company’s core Oil Production and Operations unit increased by almost 9% to reach 1.42 million boe/d (barrels of oil equivalent per day).

On the flip side, the segment will be impacted with reduced realizations in the range of $0.3-$0.6 billion in the quarter. This is mainly due to price lags in the oil production from the Gulf of Mexico and the UAE.

Speaking of the Gas and Low Carbon Energy segment, BP foresees slightly higher levels of production compared to the last quarter. Here, realizations are expected to decline by $0.2-$0.4 billion, hit by a decline in non-Henry Hub natural gas marker prices. Moreover, there is an estimated additional impact of around $0.2 billion due to the devaluation of the Egyptian pound.

Meanwhile, the Customers and Products segment is projected to gain from enhanced refining margins, which are anticipated to add an extra $100-$200 million to the company’s earnings. Overall, the outlook for oil trading remains positive, rebounding from a weaker performance in Q4 2023. However, fuel margins are anticipated to be weaker.

Is BP a Good Share to Buy?

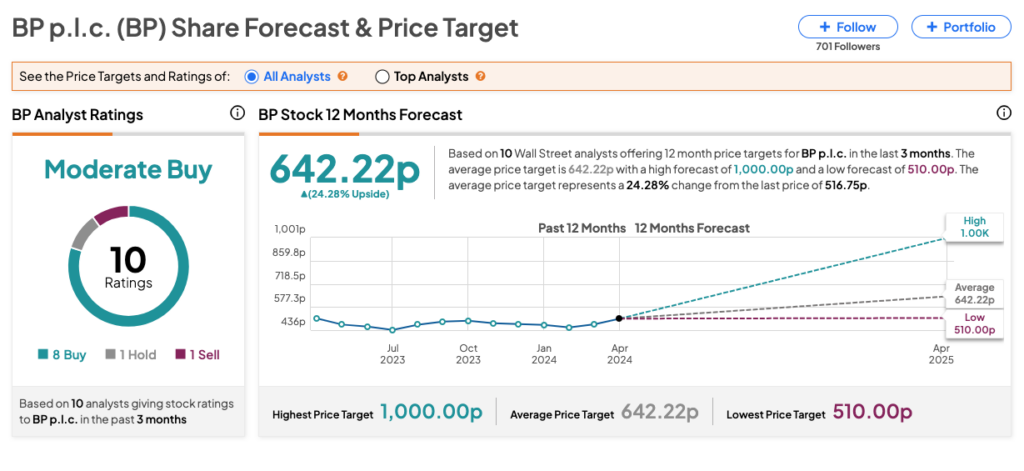

According to TipRanks consensus, BP stock has received a Moderate Buy rating based on eight Buys, one Hold, and one Sell recommendation from analysts. The BP share price forecast is 642.22p, which implies 24.3% upside potential from the current trading level.