UK-based Jet2 PLC (GB:JET2) and Volex PLC (GB:VLX) yesterday reported their first-half results, including Q2 numbers for FY24. Both companies reported better numbers in their interim results and also remained upbeat about achieving their full-year forecasts. The Jet2 share price was down by 0.88% by the end of the day on Thursday, while Volex’s stock gained over 5% after the results announcement.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Following the release of results, analysts have reconfirmed their Buy ratings on JET2 stock, projecting over 60% growth in the share price. In contrast, Volex’s stock holds a Moderate Buy rating on TipRanks, with analysts yet to provide reactions to the recent financial numbers.

The TipRanks Earnings Calendar is a useful tool for identifying companies that have recently released their earnings and those with upcoming announcements. Investors can delve into additional research on these stocks to enhance their decision-making process. The tool is now available across 10 different markets on TipRanks.

Let’s take a look at the details.

Jet2 PLC: Recovery on Track, Raises Dividend

Jet2 is a leisure travel group that provides budget-friendly flights and holiday packages.

The company’s first-half numbers reflected its continued journey through the recovery of operations, driven by strong demand for holiday travel. It posted a jump of 24% in its revenues to £4.4 billion in the first half. The operating profit increased by 19% to £617 million during the same period. The company further stated that it remains on track to hit its annual targets and confirmed the guidance for profit before tax to be in the range of £480 million to £520 million.

As a reward to its shareholders, Jet2 announced an interim dividend of 4p per share, 33% higher than last year’s payment of 3p.

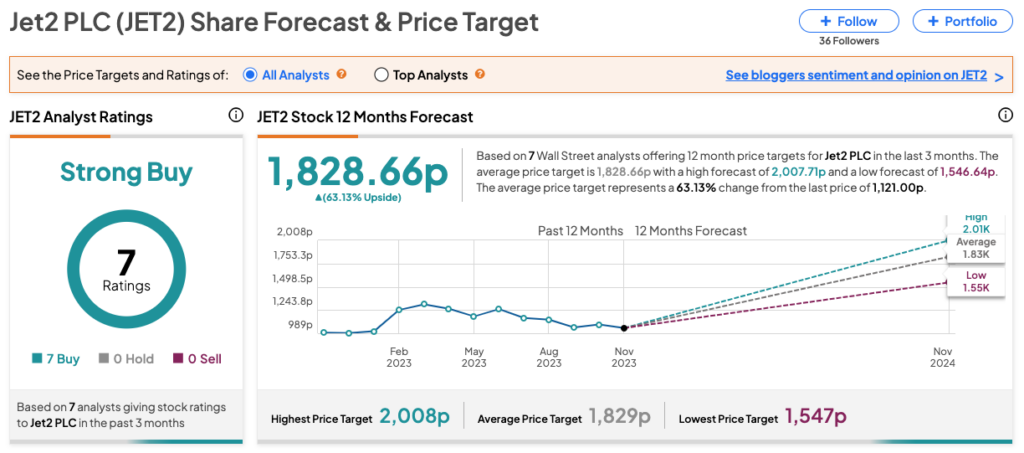

Are Jet2 shares a good buy now?

According to TipRanks’ analyst consensus, JET2 stock has received a Strong Buy rating backed by all Buy recommendations from seven analysts. The Jet2 share price forecast is 1,828.6p, which is 63% higher than the current price level.

Volex PLC: Higher Revenues and Profits

Volex is a leading provider of power products and electronic components, including power cords, fiber optic cables, high-speed copper cables, etc.

Volex reported 11.2% growth in its half-yearly revenues of $397.5 million. The underlying operating profit demonstrated a growth of 16.5%, reaching $37.4 million. This improvement was attributed to its efficient cost management and sales mix, resulting in the strengthening of the underlying operating margin to 9.4%. Moving forward, Volex expressed confidence in achieving its long-term objectives and meeting market expectations for the full year.

The company announced an interim dividend of 1.4p, marking a 7.7% increase from the previous year. Since Volex resumed dividend distributions in 2020, it has consistently increased its payments, demonstrating a cumulative increase of 40% during that period.

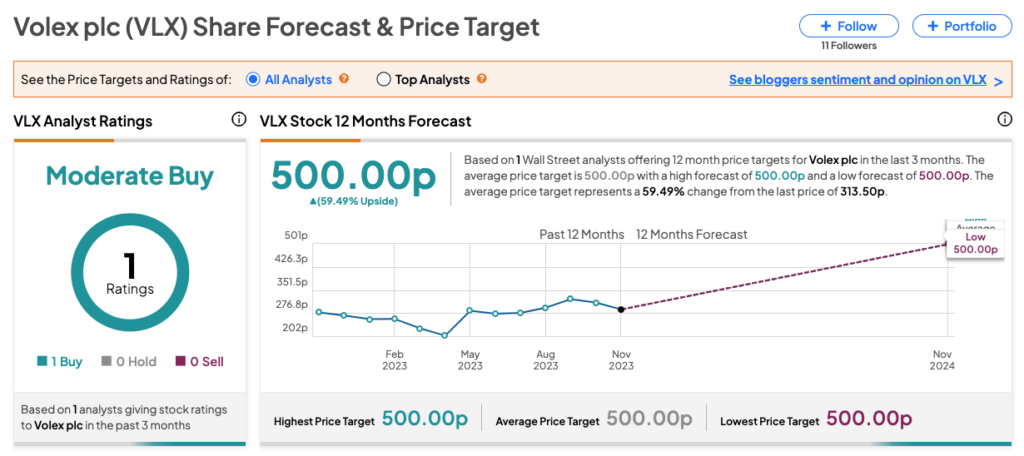

What is the Target Price for Volex Shares?

VLX stock has received a Moderate Buy rating on TipRanks, based on one Buy recommendation from HSBC analyst Stephan Klepp. The Volex target share price is 500p, which implies an upside of almost 60% on the current trading price.