British homebuilder Barratt Developments PLC (GB:BDEV) and cybersecurity company Darktrace PLC (GB:DARK) reported their Fiscal Year 2023 earnings today. While Barratt stated that housing demand was impacted by the challenging conditions in the UK market, Darktrace reported increased revenue driven by higher demand for cyber security solutions.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

According to analysts’ assessments on TipRanks, BDEV and DARK have received Moderate Buy and Strong Buy ratings, respectively.

Here, we have used the TipRanks Earnings Calendar for the UK market to find these companies with the latest earnings reports. This tool offers a valuable means of identifying companies that have recently disclosed their earnings results along with the upcoming announcements from companies.

Let’s take a look at the numbers in detail.

Barratt Developments PLC

Barratt Developments is a UK-based residential property builder engaged in various activities such as land acquisition, property design, and construction.

The company announced its full-year earnings, including the fourth quarter numbers for FY23, today. During the year that ended on June 30, the company completed 17,206 homes, which was almost 4% lower compared to last year. Despite this, the company was able to deliver a 10% growth in profits to £705 million, thanks to its cost-cutting initiatives. This helped Barratt to improve its gross profit margin by 120 bps to 18.3%.

Moving forward, the company has cautioned that the housing industry will face ongoing challenges in the near future as prospective buyers grapple with the increasing cost of mortgages.

What is the Price Target for Barratt Developments?

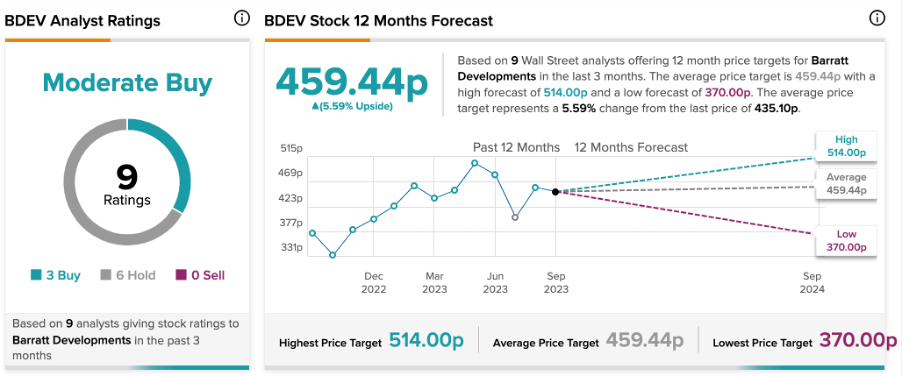

According to TipRanks’ analyst consensus, BDEV stock has received a Moderate Buy rating, based on three Buy and six Hold recommendations. However, these ratings were assigned ahead of its earnings and are subject to change. The Barratt share price forecast is 459.44p, which is 5.59% higher than the current price level.

Post-results, the shares were trading down by 1.85% today at the time of writing.

Darktrace PLC

Darktrace operates as a cyber security company, specializing in AI-powered solutions for a range of threats, including ransomware and cloud attacks.

The company delivered revenue of $545.3 million in its full-year earnings report that ended on June 30, equating to a 31.3% growth rate. The higher revenues were achieved by an 18% growth in its customer base. The net profits jumped to $58.9 million this year, as compared to $1.4 million last year.

The company cut its core earnings growth for FY24 to 17-19%, down from the earlier projected number of 22-25.5%. This was mainly due to the company’s decision to provide a 100% upfront payment for sales commissions, departing from the previous practice of paying 50% upfront.

Is Darktrace a Buy or Sell?

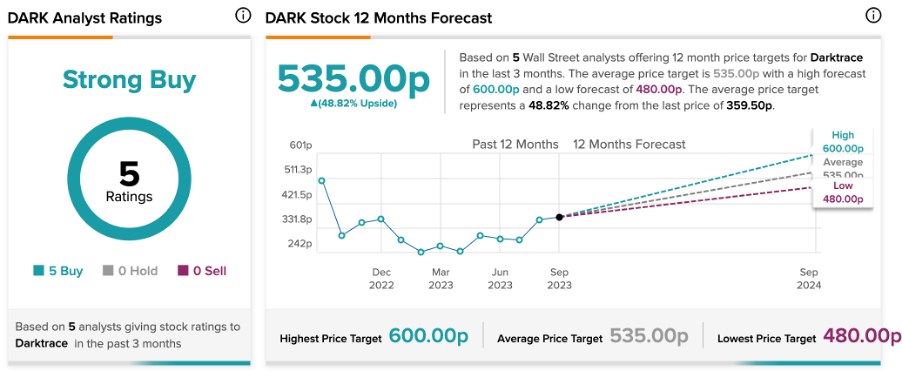

DARK stock has a Strong Buy rating on TipRanks, based on five Buy recommendations. Post-results, analysts Robert Chantry from Berenberg Bank and Alex Hoa Nguyen from Jefferies confirmed their Buy ratings on the stock today.

The Darktrace share price target is 535p, which implies an upside potential of 49% from the current trading price.