UK-based Aviva PPLC (GB:AV) and Legal & General Group PLC (GB:LGEN) will report their Q2 2023 earnings next week. Market experts anticipate that the positive trajectory in their figures will persist, capitalizing on the elevated interest rates within the economy as investment income plays a crucial role in shaping the profits of insurance companies. Nevertheless, the ongoing increase in costs will remain a hurdle for earnings.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Also, it would be interesting to see the dividend numbers, as they remain a key attraction for these companies.

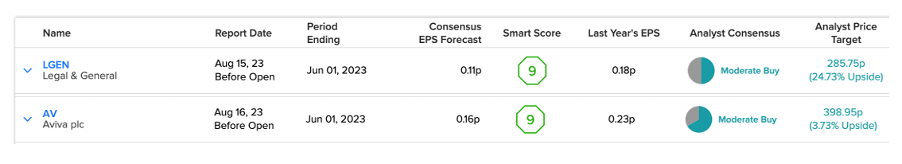

We have shortlisted these two FTSE 100 companies using the TipRanks Earnings Calendar for the UK market. The calendar provides updated information on UK companies regarding their earnings, including forecasted numbers about EPS and sales.

Let’s explore this further.

Is Legal and General Stock a Good Buy?

The leading financial services company from the UK, Legal & General Group, will publish its Q2 earnings for 2023 next week on August 15. According to TipRanks, the consensus EPS forecast is £0.11 per share, which is lower than the EPS of £0.18 reported in the same period last year. The projected revenue for the quarter is around £9.03 billion.

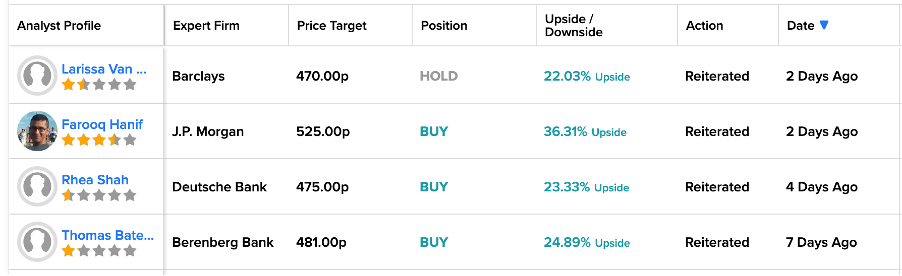

Ahead of its earnings, the stock has received rating confirmation from analysts. Four days ago, Barclays analyst Larissa Van Deventer confirmed her Buy rating on the stock, predicting 42.5% growth in the share price.

Similarly, analyst Farooq Hanif from J.P. Morgan reiterated his Buy rating at a price target of 315p, which implies an upside potential of 36%.

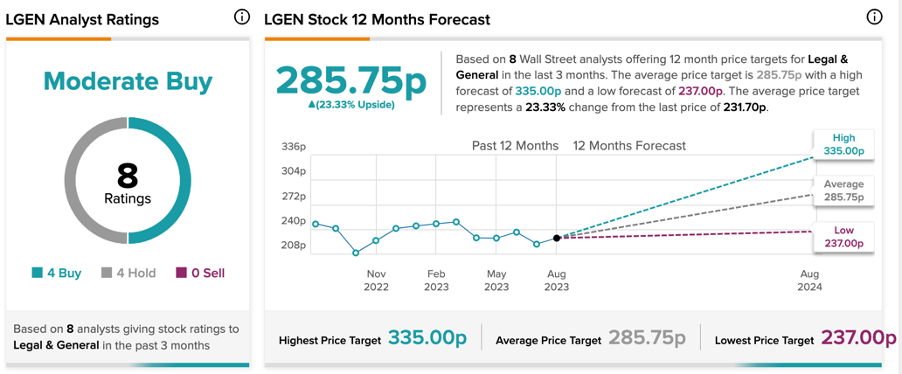

With a total of eight recommendations, LGEN stock has a Moderate Buy rating on TipRanks. It includes four Buy and four Hold ratings. The average price target of 285.75p signifies a 23.3% change from the current price level.

Are Aviva Shares a Good Buy?

Aviva is an insurance giant from the UK market that also provides wealth management and retirement services.

The company will announce its second-quarter earnings for 2023 on Wednesday, August 16. Analysts expect the company to deliver earnings of £0.16 per share, as compared to the earnings of £0.24 per share reported in Q2 2022. The sales forecast for the quarter is £22.85 billion.

Analysts are bullish on Aviva’s earnings and expect them to drive its share price higher. Hanif has also confirmed his Buy rating on AV stock and expects a 36.3% growth in the price. Over the last seven days, analysts from Deutsche Bank and Berenberg Bank also recommended buying this stock, forecasting an upside of 23% and 25%, respectively.

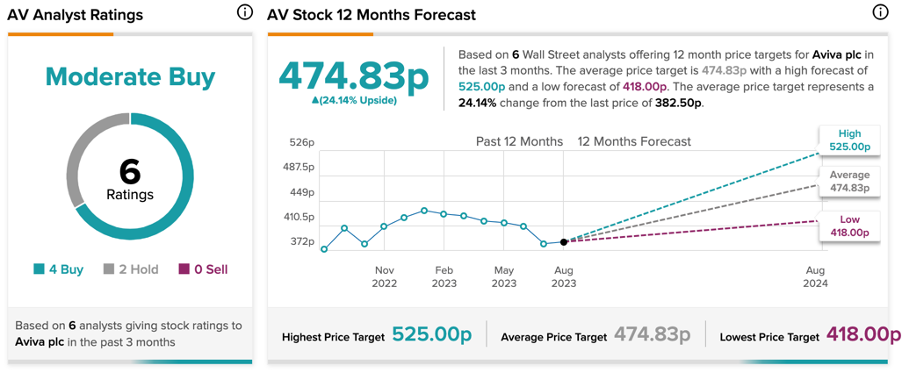

According to TipRanks consensus rating, AV stock has a Moderate Buy rating backed by four Buy and two Hold recommendations. The average price forecast for a 12-month period is 474.83p, which is 24.14% higher than the current price.

Conclusion

Analysts are optimistic about the earnings reports from Legal & General and Aviva in the upcoming week. While the anticipation of higher interest rates is expected to contribute to increased profits for these companies, analysts are concerned about the mounting cost pressures that could affect their ability to maintain competitive pricing.

Both stocks have received Moderate Buy ratings ahead of earnings announcements.