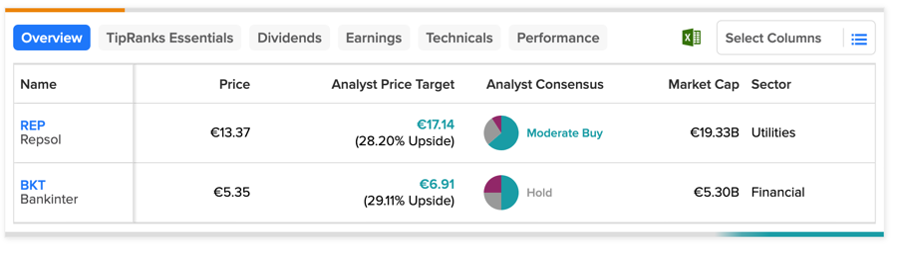

The share prices of these Spanish companies, Repsol (ES:REP) and Bankinter (ES:BKT) are expected to grow by more than 25%, according to forecasts. Repsol is rated as Moderate Buy while BKT has a Hold rating.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

We have used the Stock Screener tool from TipRanks to select stocks based on our high-growth criteria and then utilized the Stock Comparison tool for Spain to compare these stocks on various parameters. These tools provide investors with detailed analysis and up-to-date information on different companies, making their investment decision-making process easier.

Let’s take a look at some details.

Repsol S.A.

Repsol is a company operating in the energy sector, involved in crude oil and natural gas production as well as the refining of petroleum. Additionally, it offers various products and services across diverse industries.

YTD, the stock has been trading down by 10.3%, making it a more attractive option to buy, according to analysts.

Last week, the company reported its first-quarter earnings for 2023. The company’s net profit for the period fell to €1.1 billion, as compared to €1.39 billion in the same period last year. The company also experienced a decline in sales for the quarter, from €17.25 billion to €15.30 billion, which can be attributed to a decrease in crude oil prices by approximately 20%.

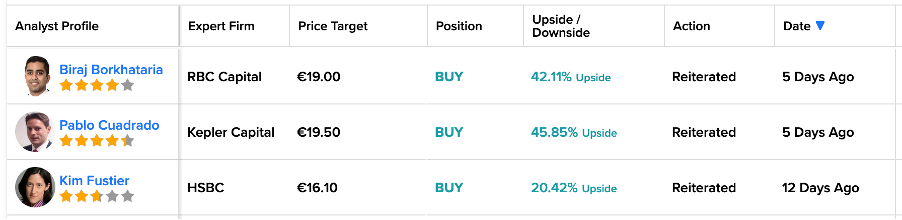

Despite a dull performance in the recent results, analysts have maintained a bullish outlook on the stock and higher upside potential. Among the recent actions on the stock, analyst Pable Cuadrado from Kepler Capital has the highest price target on the stock and predicts an upside of around 45% in the share price.

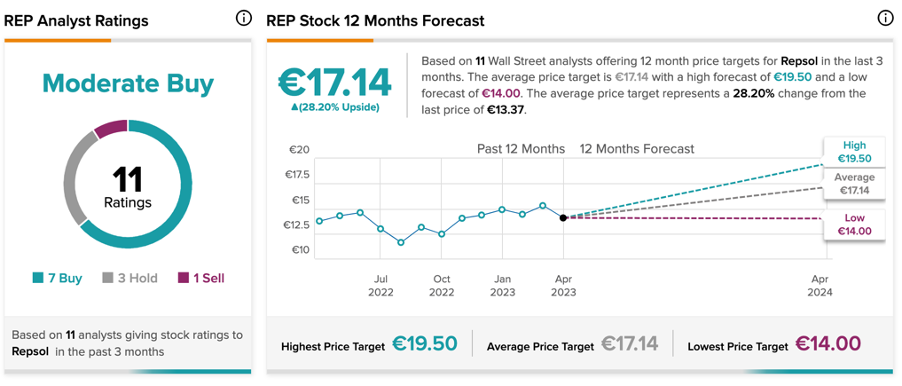

Repsol Share Price Forecast

According to TipRanks’ analyst consensus, REP stock has a Moderate Buy rating based on a total of 11 recommendations.

The average price target is €17.14, which suggests a growth of 28.2% from the current trading level.

Bankinter SA

Bankinter SA is a Spanish bank that offers a range of financial services, including retail banking, corporate banking, asset management, financial planning, treasury, and international banking.

Similar to Repsol, BKT stock has also experienced a decline of 15% YTD. According to analysts, the decrease in its stock price makes it a more appealing choice to purchase.

In April, the company reported its first-quarter results for 2023, depicting a promising beginning to the new year. Bankinter’s net income in the first quarter increased by 20% to €185.0 million. The revenues were up by 16% to €514 million on a year-over-year basis. The bank’s net interest income jumped by 63% to €522 million. The bank witnessed a strong quarter of improved commercial activity along with 5% growth in its loan book.

Analysts remain bullish on the bank’s ROE (return on equity) of 14% and cost-to-income of 36%, which are considered the best in class for the European banking sector.

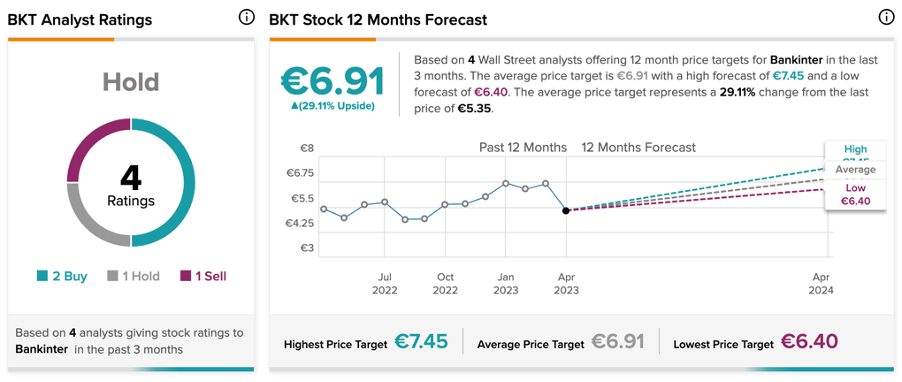

Bankinter Stock Forecast

BKT stock has a Hold rating on TipRanks, backed by two Buy, one Hold, and one Sell recommendations.

The average price target is €6.91, which is around 30% higher than the current trading levels.

Conclusion

Repsol’s Q1 results have been lackluster compared to Bankinter’s strong quarter, but analysts are optimistic about both companies. They forecast a potential increase of more than 25% in their respective share prices.