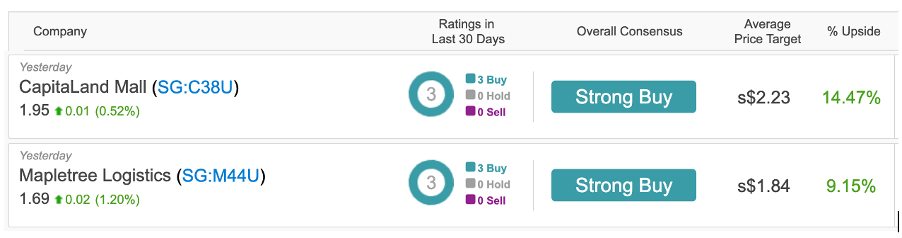

SGX-listed REITs Mapletree Logistics (SG:M44U) and CapitaLand Mall (SG:C38U) have “Strong Buy” ratings from analysts. The analysts are highly bullish on these companies, based on the strong performance in their recently announced results and their strong portfolios in the Asian markets.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

According to the TipRanks Trending Stocks tool, a few analysts have recently reiterated their Buy ratings on these stocks.

This tool lists the stocks that have been on the radar of analysts in the last few days. It gives investors an opportunity to consider these stocks for further research. This tool is available for the stocks of seven different markets on TipRanks.

Let’s discuss these stocks in detail.

CapitaLand Integrated Commercial Trust (CICT)

CICT, previously known as CapitaLand Mall Trust, is a real estate investment trust that owns and invests in commercial properties across Singapore. The trust also owns a few properties in Germany and Australia.

Recently, the company reported its numbers for the second half of 2022, with its performance driven by new acquisitions and operational efficiency. It delivered an increase of 4.8% year-over-year in its distributable income of S$355.1 million. The gross revenues increased by 14.4% to S$754.1 million for the second half and by 10% to S$1.4 billion for the full year 2022.

The property income was also higher at S$541.7 million in H2, due to higher rental income from its Singapore assets. The numbers were slightly offset by increased operating expenses and its divestment of a shopping center, JCube.

Post-results, analysts have gained more confidence in the company and reiterated their Buy rating on the stock. With a portfolio occupancy of 95.8% and the signing of new leases and renewals, the stock makes a strong case for investment.

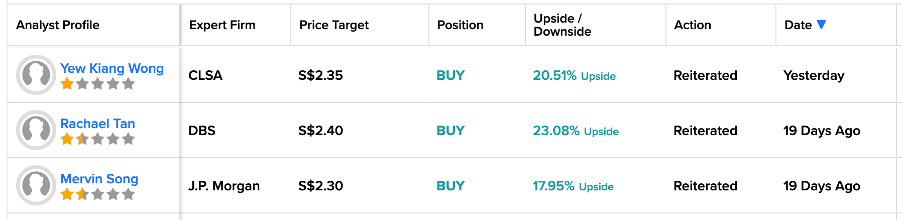

CapitaLand Integrated Share Price Forecast

According to TipRanks’ rating consensus, C38U stock has a Strong Buy rating.

The average target price is S$2.23, which suggests an upside potential of 14.5% on the current trading levels.

Mapletree Logistics Trust Management Limited (MLT)

MLT is a real estate investment trust focused on logistics properties in Asia. The company’s strength is portfolio stability, with higher occupancy and a long lease period of more than three years.

The company’s distributable income increased by 10.8% to S$107.1 million in its third-quarter results for the fiscal year 2023. The gross revenues jumped by 8% in the quarter, driven by its higher occupancy rate of 96.9%. The company also made efforts to offload some properties in Singapore and Malaysia to revive its portfolio. On the flip side, the property expenses also increased by 12.6% during the quarter to S$23 million.

Moving ahead, management will remain focused on achieving a stable occupancy rate and effective cost control to further strengthen its position. The company’s financial management is also on par with its operations. The company’s 83% of debt is hedged at fixed rates, and almost 80% of its income is hedged in Singapore dollars. This negates the impact of rising lending costs and fluctuating currencies.

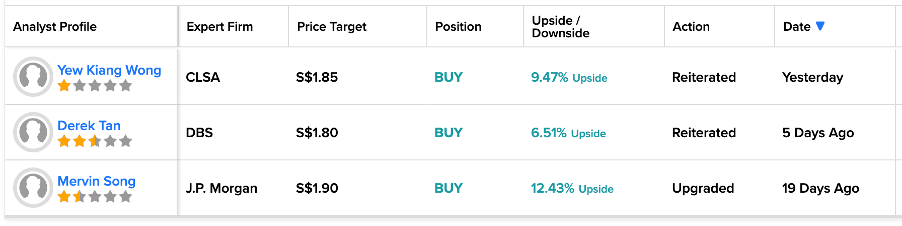

Is Mapletree Logistics a Good Buy?

Mapletree’s stock has a Strong Buy rating on TipRanks, based on three Buy recommendations.

The M44U price forecast is S$1.85, which indicates an upside of 9.19% on the current price level.

Conclusion

Both CICT and Mapletree have delivered great performances in their recent results. The companies remain committed to maintaining their higher occupancy rates and timely divestments of unsuccessful properties.

Overall, the stocks have “Strong Buy” ratings from analysts and upside potential for further share price growth.