In the last year, Singapore’s market has performed better as compared to other developed nations. While the analysts believe that in 2023, the market will see the impact of a recession and higher inflation, they also believe Singapore stocks are a safe haven due to their strong earnings growth.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

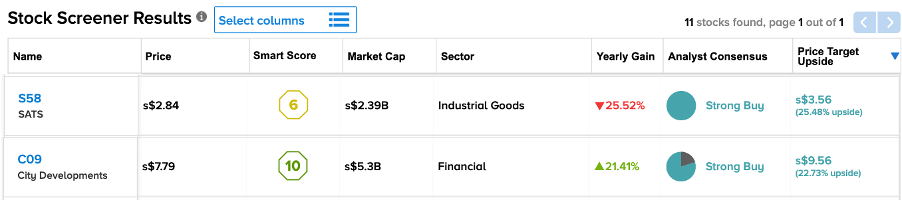

Based on this, we have used the TipRanks Stock Screener tool to shortlist two such companies from the Singapore market, City Developments (SG:C09) and SATS (SG:S58). These stocks have ‘Strong Buy’ ratings from analysts, along with more than 20% of potential upside in their share prices.

City Developments Limited (CDL)

City Developments is a real estate company in Singapore with assets spread across 29 locations globally. The company has a diverse portfolio of properties, including residences, hotels, offices, malls, etc.

The company’s stock is on the mend after it fell during the COVID-19 outbreak. The stock gained almost 20% last year after having fallen by 25% in the last three years.

The analysts are bullish on the stock mainly due to its sturdy earnings. CDL reported record numbers in its half-year results for 2022. The company posted a net profit after tax of $1.1 billion, which reversed the loss of S$32.1 million in the first half of 2021. The revenues also increased by 23.5% to S$1.5 billion.

The company’s liquidity position also remains strong, with cash reserves of S$2.2 billion as of June 2022. The company’s timely divestments throughout the year have provided it with enough scope to focus on portfolio growth and navigate the economic challenges in a better way.

City Developments Share Price Target

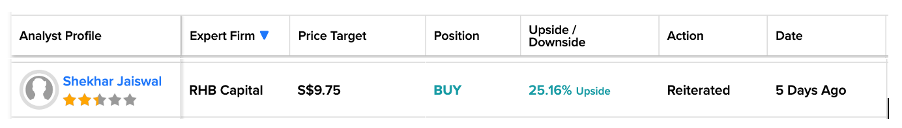

City Developments’ stock has a Strong Buy rating on TipRanks, with four Buy and one Hold recommendations.

The average target price is S$9.58, which is 23% higher than the current price level.

RHB Capital analyst Shekhar Jaiswal is also bullish on the stock and recently reiterated his Buy rating.

Jaiswal is highly positive on the overall Singapore market, and he feels the STI (Straits Times Index) is currently trading at an “inexpensive” valuation.

SATS Limited

SATS is a leading food solutions and gateway services company in Singapore. Its main services include commercial, aviation, and institutional catering, aviation security, warehousing, passenger services, etc.

With the recovery in the aviation sector, the company’s revenues of S$804.5 million increased by 41.3% on a year-on-year basis in the first half of the fiscal year 2023. In terms of operations, the flights and passengers handled were at 62% and 56%, respectively, of pre-pandemic numbers, and the food served was at 75%. The company is still operating in the red, but its losses were significantly reduced to S$9.9 million from S$22.5 million in the previous quarter.

The analysts are expecting a positive turnaround in the company because of a strong rebound in the travel sector. The company is positive about a solid winter travel season in 2023, for which it is boosting its capacity to meet the increasing demand.

Is SATS a Good Buy?

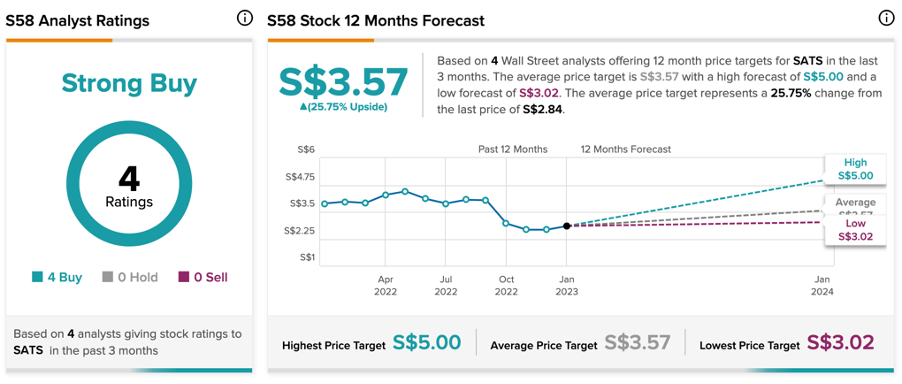

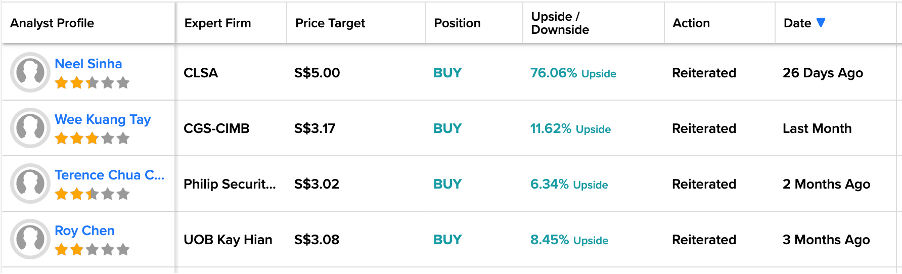

Based on four buy ratings, SATS’ stock has a Strong Buy rating on TipRanks. The target price is S$3.57, representing a 25.7% change from the current price level.

In the last year, the stock has traded down by 27%.

Conclusion

Analysts are bullish on these two stocks, backed by their strong results and an equally solid outlook. Considering their target prices, which show a good upside, these stocks could be a good addition to an investor’s portfolio in 2023.