Singapore Technologies Engineering (SG:S63) and United Overseas Bank (SG:U11) will report their fourth-quarter earnings for 2022 next month.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Singapore Technologies has a favorable outlook from analysts based on the recovery in air travel and its closed acquisitions in 2022. While United Overseas Bank will be slightly impacted by the slow economic growth, it will also benefit from the growth in its net interest income.

The TipRanks Earnings Calendar lets you track the upcoming earnings dates of the companies in seven different markets. Using this tool, investors can look at the forecasted EPS and compare it with the previous year’s numbers as well.

Let’s have a look at these companies in detail.

Singapore Technologies Engineering (ST Engineering)

ST Engineering provides technology and engineering services to various sectors like aerospace, defense, public health, digital tech, etc.

The company will report its annual results for 2022 on February 24, 2023, before the Singapore market opens. For Q4 2022, the forecasted EPS is S$0.09 per share, similar to the same quarter a year ago.

Analysts expect the company’s revenue for H2 2022 to be around S$4.7 billion, driven by its acquisition of TransCore and the recovery in the aerospace sector. The second-half profits are expected to be S$271 million. But the earnings growth could be impacted by higher interest expenses.

Analysts are also bullish on the fact that China has reopened its economy, which will benefit the company’s MRO (maintenance, repair, and overhaul) business. This effect will be visible in the earnings for H22023.

What is the Target Price for ST Engineering Share?

TipRanks rates ST Engineering as a Strong Buy, with seven Buy and one Sell recommendations.

The average target price is S$4.07, suggesting an upside of 11.5% on the current trading level.

United Overseas Bank (UOB)

UOB is a banking institution that provides its services across many Asian markets. The bank has a strong grip on the credit card and home loan businesses in Singapore.

The bank will report its fourth-quarter and full-year results for 2022 on February 23. According to TipRanks, the forecasted EPS will increase from S$0.59 per share in Q4 2022 to S$0.72 per share in the same quarter this year.

Overall, analysts have a neutral view of the Singapore banking sector’s results for 2022. CGS-CIMB analysts feel the earnings will remain flat due to a shrinking net interest margin (NIM) and a slowdown in economic growth.

Analyst Andrea Choong from CGS-CIMB forecast a net profit of S$1.38 billion for Q4 of 2022, which is 35% higher on a year-over-year basis. The bank is likely to benefit from the acquisition of Citibank’s consumer business due to its strong retail grip in the market.

The NIM is expected to increase by 24 bps in the fourth quarter.

The expected dividend for the quarter is 90 cents per share, which is 50% higher than the previous year.

What is UOB Target Price?

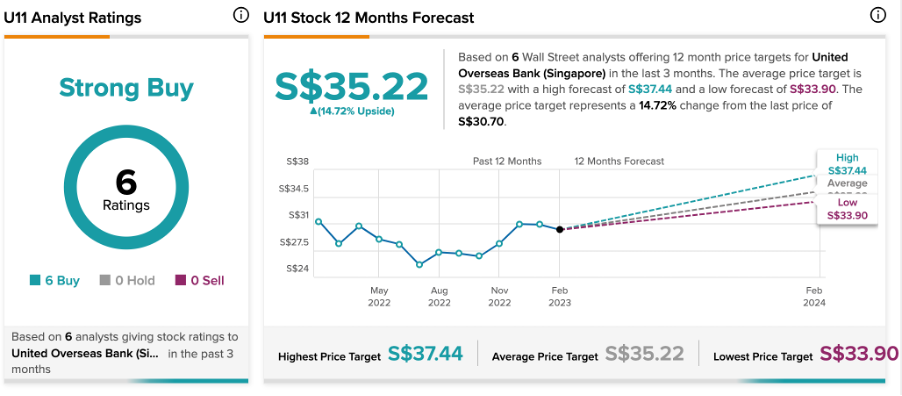

According to TipRanks, UOB stock has a Strong Buy rating, based on six Buy recommendations.

The target price for UOB is S$35.22, which is 14.7% higher than the current price level. The target price ranges from a low of S$33.9 to a high of S$37.4.

Conclusion

Analysts remain bullish on these companies’ upcoming earnings and have reiterated their Buy ratings ahead of their announcements.