SGX-listed stocks Sembcorp Marine (SG:S51) and Singapore Telecommunications Limited (SG:Z74) are today’s picks for investors. With Strong Buy ratings from analysts, these stocks could be a perfect fit for growth-oriented portfolios.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Moving forward, analysts also predict high upside potential for these stocks.

Let’s discuss these stocks in detail.

Sembcorp Marine Limited

Sembcorp Marine is an engineering company providing solutions to the offshore, marine, and energy sectors.

After two years of negotiations, the company recently closed its highly anticipated deal with Keppel Corporation (SG:BN4) to acquire Keppel Offshore & Marine.

The combined business will trade under Sembcorp Marine, and the deal is valued at S$4.5 billion. The merger will lead to huge synergies for both companies in terms of geographical expansion, improved operations, and upgraded potential.

Analysts remain bullish on the company’s prospects post-merger, considering the combined order value of S$18 billion to be delivered over the next three years. The deal will enable Sembcorp Marine to bid on bigger projects in the oil, gas, and renewables segments. Analysts predict the combined entity could post profits starting in 2023 if the order momentum continues.

Is Sembcorp Marine a Good Buy?

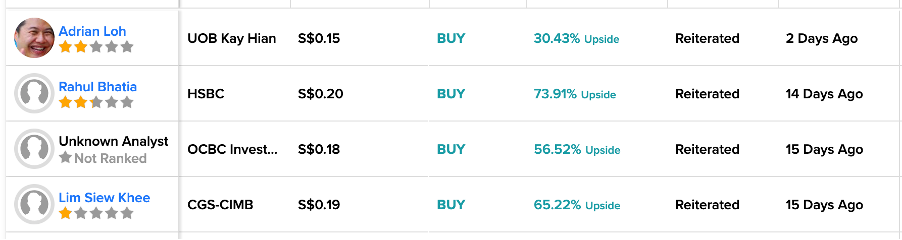

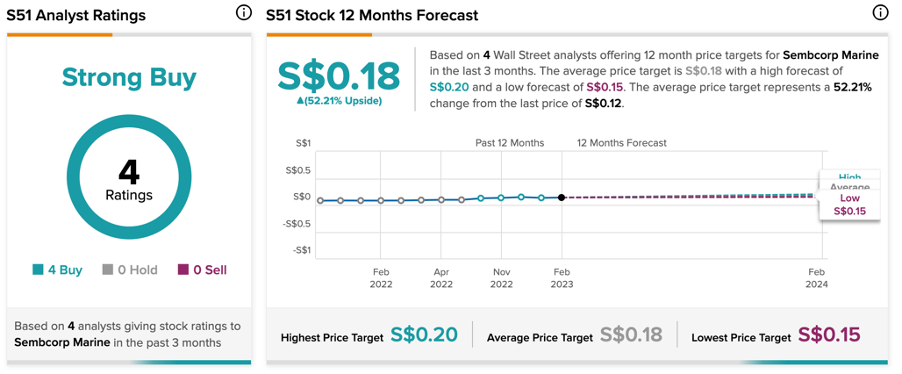

S51 stock has a Strong Buy rating on TipRanks based on all four Buy recommendations.

The price forecast is S$0.18, which implies a huge upside of more than 50% from the current price level.

Singapore Telecommunications Limited (Singtel)

Singtel is among the leading telecommunications companies in Singapore and provides a wide range of services such as fixed, mobile, data, internet, etc.

Last month, the company reported its numbers for the third quarter of fiscal 2023. The net profit in Q3 was up 18% to S$559 million, driven by a recovery in its roaming business in consumer and enterprise divisions. The mobile revenue business also showed 15% growth in Singapore due to improved travel and 5G services.

Analysts are optimistic about the stock considering its higher roaming revenues with the revival in travel in Singapore and Australia. Moreover, Singtel’s group company, NCS, an information technology provider, is expected to grow stronger on the back of a solid order book. The NCS project pipeline remains strong, and the company is targeting higher margins for the full year 2023.

Is Singtel Share a Buy?

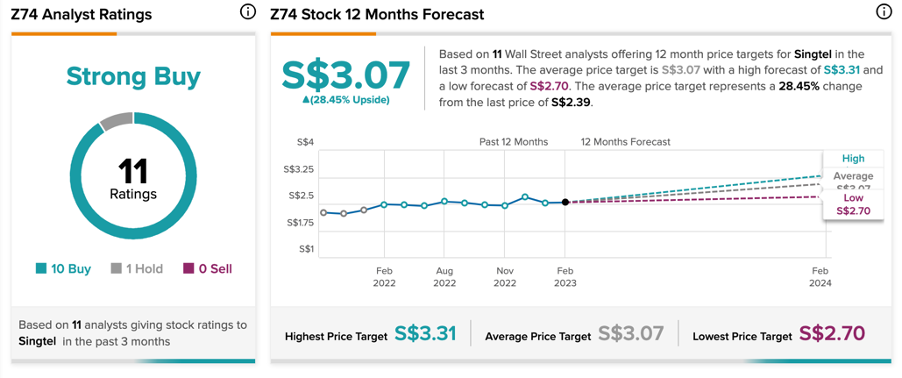

According to TipRanks, Singtel’s stock has a Strong Buy rating, based on 10 Buy and one Hold recommendations.

Z74 stock has a target price of S$3.07, which is 28.4% higher than the current trading price.

Closing Thoughts

With its recently closed merger deal with Keppel, Sembcorp Marine is sitting on a high-order book. Analysts are bullish on the company’s ship repair business, which is almost back to its pre-pandemic level, and the overall prospects after the merger.

As for Singtel, there are some near-term challenges for the company in terms of reduced growth in its subsidiary Optus and margin pressure for NCS. However, analysts are taking a long-term perspective and are bullish on the recovery of the company’s core business.