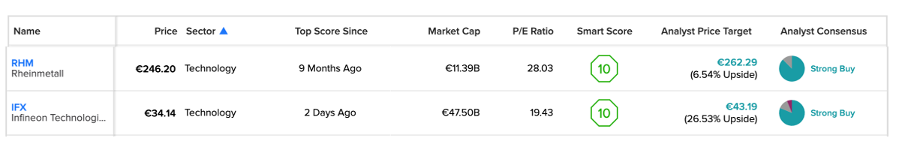

Using the TipRanks Smart Score tool, we have shortlisted two German shares with a “Perfect 10.” Both Rheinmetall (DE:RHM) and Infineon Technologies (DE:IFX) have Strong Buy ratings from analysts, making them attractive options in the German market.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The TipRanks Smart Score tool assigns a score between one and ten to every stock after analyzing it on eight different factors. These include analyst ratings, hedge fund activity, and other fundamental and technical factors. The stocks with a score of eight and above have more potential to surpass the overall market returns. During the current challenging times, this tool gives an investor confidence in choosing the right stock.

Let’s have a look at what’s working for these two companies.

Rheinmetall AG

Rheinmetall is a manufacturing company providing automotive and defense equipment worldwide.

The company’s stock has been soaring, with a gain of 66% in the last six months. The share price has grown more than 2.5 times since the onset of the Russia-Ukraine war. Recently, the company also announced that it would join the DAX 40 index, which is the blue-chip index of Germany.

The company has received a Smart Score of 10 for the last nine months, reflecting the higher defense budgets of governments globally. Moving forward, the company is expecting a huge demand for its products and is planning to set up a battle tank factory in Ukraine for €200 million. This factory will have the capacity to produce around 400 tanks annually.

The company will report its 2022 annual results on March 16.

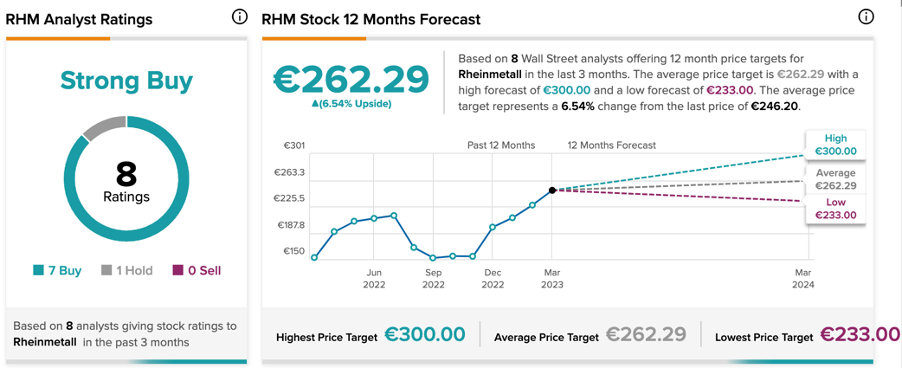

Is Rheinmetall a Good Stock to Buy?

Overall, analysts remain bullish on the stock, but the stock price upside is limited.

According to TipRanks, RHM stock has a Strong Buy rating, with seven Buy and one Hold recommendation.

The average target price is €262.3, which represents a 6.5% change from the current price level. The price has a low and high forecast of €233 and €300, respectively.

Infineon Technologies AG

Infineon Technologies is a semiconductor manufacturing company catering to various sectors like automotive, industrial, telecom, security, etc.

Last month, the company reported its earnings for the first quarter of 2023 on profitable terms. The group’s revenues of €3.9 billion were 5% lower than the previous quarter’s numbers. But the gross margins of the company increased to 47.2% from 44.4% in the last quarter.

The company is off to a good start and is targeting a revenue of €15.5 billion in 2023, up from €14.2 billion in 2022. The higher order values and pricing policy will drive earnings for the company. In terms of its clients and its geographical presence, the company is well diversified, providing stability to its revenues.

Based on these numbers and analysts’ confidence, the stock has received a score of 10 on the Smart Score tool very recently.

Infineon Share Price Forecast

IFX stock has a wide coverage from analysts, with a total of 16 ratings on TipRanks. The stock has a Strong Buy rating.

The average target price of €43.19 shows an upside of 26.5% from the current trading level.

Conclusion

Both RHM and IFX have Strong Buy ratings from analysts. These companies are currently witnessing heavy demand for their products. Moreover, the well-diversified product range across different markets makes them safer options for long-term growth.

Both companies have a “Perfect 10” on the TipRanks Smart Score tool.