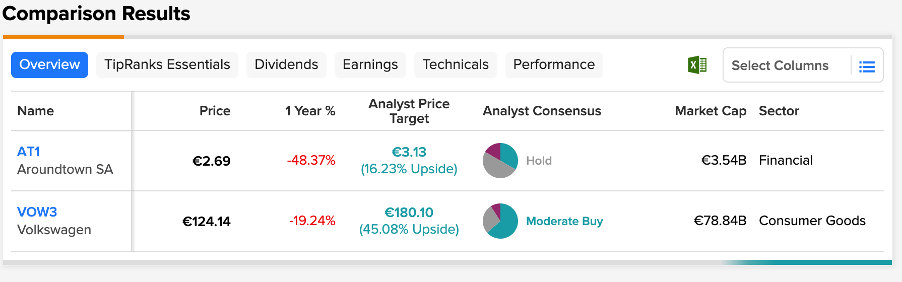

Investing in stocks that offer balanced growth in terms of dividends and capital gains is a perfect choice for investors. Two German companies, Aroundtown SA (DE:AT1) and Volkswagen AG (DE:VOW3), both have high upside potential in their share prices and also pay high dividends.

While focusing on any particular market, investors can use the TipRanks Trending Stocks tool to identify companies that are on analysts’ radar. This tool lists the stocks that are recently rated by analysts, in seven different markets. Investors can pick the stocks from this list for further research to make safe and informed decisions.

Let’s have a look at these companies in detail.

Volkswagen AG (VW)

VW is a premium car maker and owner of well-known brands like Volkswagen, Skoda, Audi, Bentley, Ducati, Lamborghini, and more.

Analysts are bullish on the stock, considering its progress in the elective vehicle (EV) space. In 2022, the company delivered 5,72,100 EVs, which is 25% more than in 2021. This gives VW a dominant position in this space in Europe. The company is targeting a complete EV portfolio in Europe by 2033. With the changing landscape of the automobile industry, success in the EV domain will determine the next phase of growth for the companies.

During the first nine months of 2022, overall vehicle deliveries were down by 12.9% to 6.1 million vehicles, due to supply issues after the COVID-19 pandemic followed by the Russia-Ukraine war.

RBC Capital’s analyst Tom Narayan has recently reiterated his Buy rating on the stock. Although he has reduced his target price from €281 to €237, that still implies a huge upside of 90% from the current price level. He believes the company’s models will gain “more traction in China,” which is the fastest-growing market for EVs.

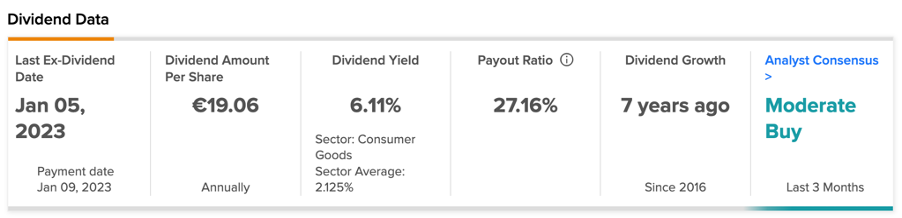

VW is among the leading dividend-paying companies in Germany. Against the sector average of 2.12%, the company has a dividend yield of 6.11%. The company has announced a special dividend of €19.06 in 2022.

Will Volkswagen Stock Go Up?

According to TipRanks’ rating consensus, VW’s stock has a Moderate Buy rating.

The VOW3 target price of €180.1 has an upside potential of 45% on the current trading levels. The target price ranges from a low of €115 to a high of €250.

Aroundtown SA

Aroundtown is a real estate company with a portfolio of residential and commercial properties across Germany and the Netherlands. The company has its office properties (44% of the total) in top-notch locations in cities like Berlin, Frankfurt, and Amsterdam. This gives a prime location advantage to the company, boosting its rental income.

The company’s stock has been trading down by 45% in the last year. However, it gained momentum and gained 40% in the last three months, driven by a strong set of results for its third quarter of 2022.

During the first nine months of 2022, the company’s revenues grew by 28% to €1.2 billion, and its rental income increased by 19% to €917 million. The company also disposed of its non-core and mature assets during the year so far, which has boosted its liquidity position and reduced its debt levels. As of September 2022, the signed disposal agreements for 2022 are worth €1.1 billion YTD.

The liquidity position safeguards dividend payments for the shareholders. The company’s dividend yield of 8.55% is much higher than its sector average of 2.1%. For the full year 2022, the company expects its dividend to be in the range of €0.23-€0.25 per share.

Aroundtown Stock Price Target

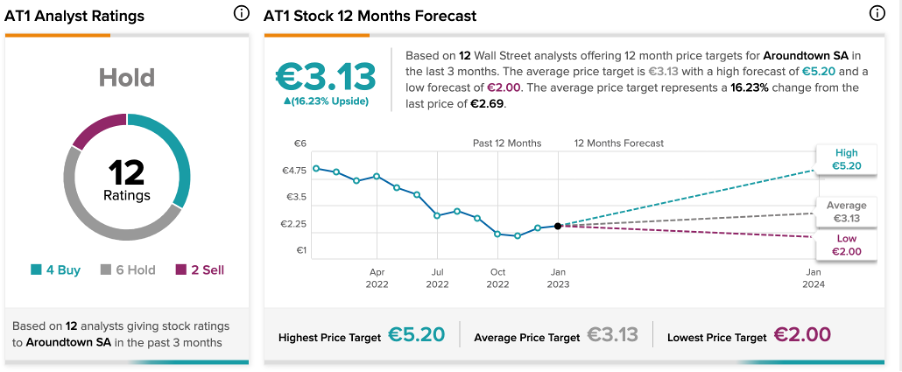

The stock has a wide coverage from analysts on TipRanks, with a total of 12 recommendations. It includes four Buy, six Hold, and two Sell ratings.

Overall, Aroundtown’s stock has a Hold rating on TipRanks. The AT1 average target price is €3.13, which is 16.23% higher than the current level.

Conclusion

During a period of volatility in the stock markets, stocks that can offer both capital gains and dividend income are a blessing for investors.

These two German companies fit the bill perfectly – they have the advantage of holding the leading position in their respective industries. The consistent dividend payments and analyst recommendations just make them more attractive.

Join our Webinar to learn how TipRanks promotes Wall Street transparency