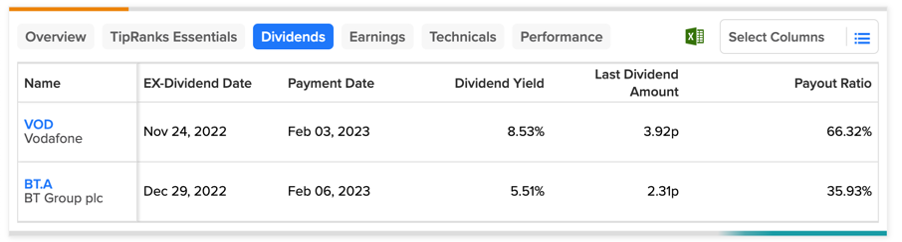

The FTSE 100 index is a base for many high dividend payers. Today, we have shortlisted two telecom giants, Vodafone Group (GB:VOD) and BT Group (GB:BT.A), from the UK market. Even though the telecom sector is currently struggling with higher costs, these two companies are able to manage stable dividends for their shareholders.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Choosing the correct dividend stock is a tedious task. It is important to consider the dividend yield, total amount, and also the stability of these payments in the future. Well, the TipRanks Top Dividend Shares tool surely makes it easy. With this tool, users can look at all the top companies with high dividends and all the major pointers in one go.

Let’s have a look at the details.

BT Group PLC

BT Group is among the world’s leading telecommunications companies, providing fixed-line, mobile, and broadband services in the UK and other countries globally.

The company’s stock saw some rough times during the second half of 2022. The stock was mainly hit after the company reported lower profits in the first half of its fiscal year 2023 while struggling with higher inflation costs. The stock has been trading down by 21% in the last year.

The recently announced trading update for Q3 2023 showed slight improvements, despite a tough operating environment. The adjusted EBITDA was up 3% to £5.9 billion, supported by higher cost control measures. The group’s revenues decreased by 1% to £15.6 billion.

Speaking of dividends, the stock is popular among income investors in the UK. During its half-yearly results, the company announced an interim dividend of 2.31p per share, which was similar to 2021’s interim dividend. Analysts forecast a total dividend of 7.8p per share for 2023 and 2024.

What is BT Group Price Target?

BT.A stock has a Moderate Buy rating on TipRanks based on a total of nine recommendations.

The average share price target is 177.8p, which has an upside of 27% from the current price level.

Vodafone Group

Based in the UK, Vodafone is the leading provider of telecommunications services in Europe and Africa.

In February, the company provided its trading update for the third quarter of its fiscal year 2023. The company’s service revenue growth of 1.8% was lower than the previous quarter’s growth of 2.5%. The lower numbers were due to a decline in business activities in Germany, Italy, and Spain. This was offset by strong performances in the UK, Africa, and other parts of Europe.

In terms of dividends, the company’s yield is impressive at 8.53%. In addition, the stock has been trading down 21% in the last year, which makes it an attractive entry point for income investors.

Analysts are bullish on the company’s growth in UK operations, higher market share for M-Pesa (its mobile payments network in Africa), and its performance in other international markets like Turkey, Egypt, and Ghana. This makes analysts confident in the future cash flows supporting the higher dividend payments for its shareholders.

However, the German market remains a threat to the near-term outlook of the company. The company’s highest margin market, Germany, saw huge customer losses due to new sector regulation, which could also hit free cash flow.

Is Vodafone Group PLC a Good Stock to Buy?

According to TipRanks, VOD stock has a Hold rating, based on five Buy, five Hold, and two Sell recommendations.

The average target price is 112.82p, which is 27.5% higher than the current price.

Let’s Wrap Up

Both Vodafone and BT Group remain solid options on the FTSE 100 for income investors.

Both companies are going through short-term challenges in terms of higher inflation costs, regulations, underperformance in some markets, etc. However, analysts feel that while it could take some time to see improvements in the business trends, the companies are attracting shareholders with their dividends.