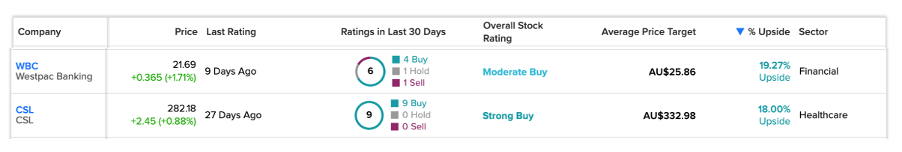

Biotechnology company CSL Ltd. (AU:CSL) and banking giant Westpac Banking (AU:WBC) have received favorable ratings from analysts in the last 30 days. Both CSL and WBC have Buy ratings on TipRanks, with an upside potential of more than 15% on their stock prices.

The TipRanks Trending Stocks tool in Australia is a perfect way to choose stocks recommended by analysts. Using the tool gives investors a safety assurance of investing in the right stocks, as backed by experts. This tool comprises the companies recently rated by analysts along with other parameters.

Let’s discuss these companies in detail.

Westpac Banking Corporation

Westpac is one of the oldest banks in Australia, providing a wide range of financial services to personal and business customers.

The bank’s stock has benefited from the rising interest rates in the economy and gained more than 50% in the last three years. However, the stock is trading down by 4.5% YTD.

Overall, the banking sector could remain under pressure after the collapse of SVB Financial Group. Investors are worried about more fallout among the global banks.

However, analysts believe this could be the right entry point for the stock as further rate hikes are expected by the Reserve Bank of Australia (RBA). This will increase the bank’s net interest margins, which will support its lending profits in 2023 and 2024.

The bank is also working to improve its return on equity (ROE) as compared to its competition. This includes growing the loan portfolio, improving profitability, taking cost control measures, and taking advantage of higher interest rates.

Analysts also see higher dividends for shareholders over the next two years. The expected fully franked dividend for 2023 is $1.38 per share and $1.47 per share in 2024. For 2022, Westpac’s total dividend was $1.25 per share.

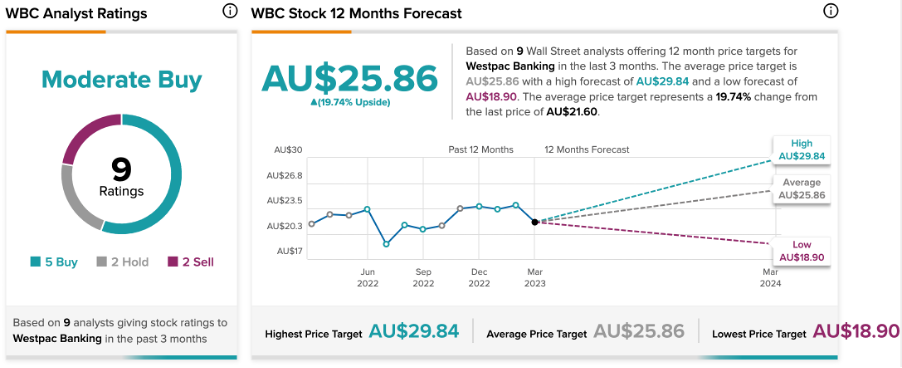

Westpac Share Price Forecast

According to TipRanks, WBC stock has a Moderate Buy rating, based on a total of nine recommendations.

The average target price is AU$25.86, which is almost 20% higher than the current price level.

CSL Limited

CSL is a multinational biotechnology company developing medicines for serious and rare diseases.

Last month, the company reported its first-half results for the fiscal year 2023, beating analysts’ expectations. The company’s revenues increased by 19% to $7.18 billion, compared to the same period last year. The company’s numbers were well supported by higher sales and margins.

Analysts remain bullish on the stock given the company’s R&D pipeline and its upcoming products in the markets. The company got its approval for a gene therapy drug for hemophilia B patients, HEMGENIX, in the U.S. The drug will be launched in the U.S. market in the second half of 2023. This will be one of the most important drugs to drive the company’s earnings starting in 2023. The company expects revenue growth of 29% for the full year of 2023.

Moreover, the company’s grip on the influenza markets and a strong recovery growth in its plasma collections are the other potential drivers for future growth.

What is the Target Price for CSL Shares?

CSL stock has a Strong Buy rating on TipRanks based on nine Buy and two Hold recommendations.

The average target price is AU$334.7, which represents a growth of 18% on the current price level.

Conclusion

Analysts are confident in Westpac’s stocks mainly due to the rising interest rate environment, its growing ROE, and higher dividends.

For CSL, the interim results made analysts bullish on the stock, along with its strong drug pipeline, which boosted the top-line growth of the company.