Currently, like every other big economy, Australia is also looking at an upcoming recession in 2023. The Reserve Bank of Australia, Australia’s central bank, has raised interest rates eight times in 2022 and is currently at 3.1% in December.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

In this situation, the banking stocks have found some peace from rising interest rates. Australian banking stocks are among investors’ favorites because of their stable earnings and reliable dividend game. The top four banks in Australia have a dividend yield in the range of 3.5% -6.5%, offering a regular income flow to investors.

Australia and New Zealand Banking Group Limited (AU:ANZ) has a dividend yield of 6.5%, and the Commonwealth Bank of Australia (AU:CBA) has a yield of 3.65%. The highlight of these dividends is that they are fully franked, which means the tax on them is already paid by the company.

Let’s see these two banks in detail.

Commonwealth Bank of Australia

Commonwealth Bank, or CommBank, is among the four largest banking institutions in Australia. The bank serves almost 16 million customers worldwide, with the majority in Australia.

The last six months have been happy for the investors, with the stock gaining 20%. This upward trend is driven by the increasing interest rates set by the government to tame inflation. In the last year, the stock has given a return of 14.3%.

The stock’s performance is also supported by the fact that it delivered a solid performance in its annual results for 2022. CommBank posted an increase of 11% in cash net profit of AU$9.6 billion. The bank’s retail banking segment contributed more than 50% to the profits. The bank has also started 2023 on a strong note and posted a cash net profit of AU$2.5 billion in its first quarter.

Known for its dividends, CommBank rewarded its shareholders with a final dividend of AU$2.1 per share, leading it to a full-year dividend of AU$3.85 per share fully franked in 2022. The full-year dividend shows an increase of 10% to 2021’s payout.

Analysts expect an annual dividend of AU$4.10 per share in the fiscal year 2023.

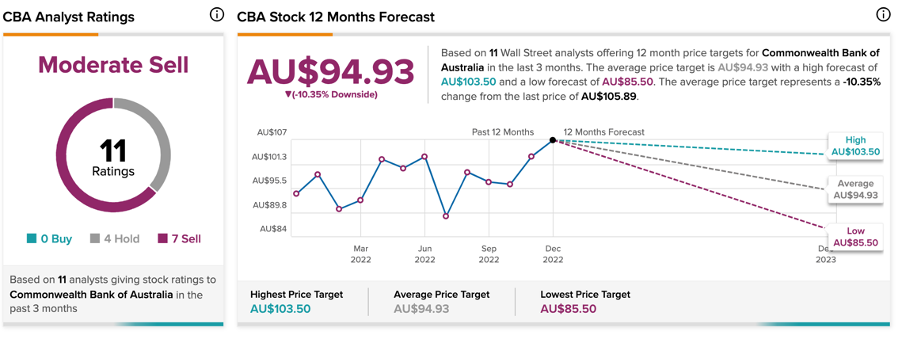

Commonwealth Bank Stock Forecast

According to TipRanks, CommBank stock has a Moderate Sell rating based on four Hold and seven Sell recommendations.

The CBA target price is AU$94.93, with a high forecast of AU$103.5 and a low forecast of AU$85.5. The average target price is 10.3% lower than the current price level.

Australia and New Zealand Banking Group Limited

Australia and New Zealand Banking Group (ANZ) is another big bank in Australia, that offers personal, business, and institutional banking services.

Just like its other banking peers, ANZ’s stock has also rallied in the last six months and is trading up by 16%, having fallen by 6% in the last year.

ANZ posted a 5% increase in cash profits of AU$6.5 billion and a 16% increase in statutory profits of AU$7.1 billion in its annual results for 2022. The bank’s overall earnings were boosted by its net interest income, which climbed by 5% to AU$14.8 billion in 2022.

Considering such promising performance, the board declared a final dividend of AU$0.74 per share and a total dividend of AU$1.46 per share in 2022.

Analysts predict that dividend payouts will increase further in the coming years as interest rates rise, providing a cushion for the bank’s profits and margins.

Citigroup analyst Brendan Sproules expects a dividend of AU$1.66 per share in 2023 and AU$1.76 per share in 2024. Sproules has a Buy rating on the stock with a target price of AU$29.2, giving an upside potential of 24%.

Is it Good to Invest in ANZ Shares?

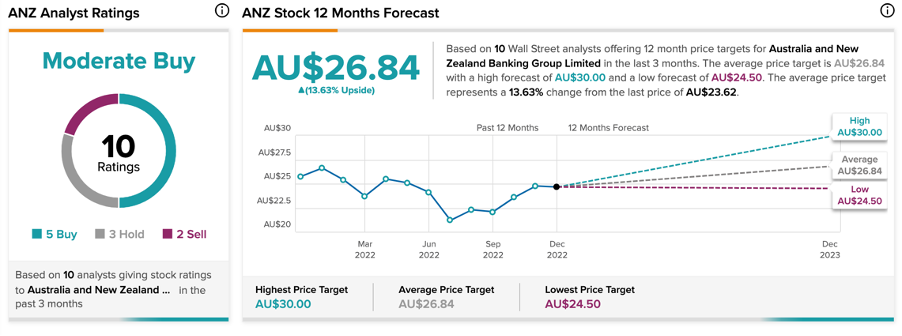

According to TipRanks, ANZ stock has a Moderate Buy rating with five Buy recommendations.

The average ANZ target price is AU$26.84, which has an upside of 14% on the current price level.

The Ending Notes

Higher interest rates will undoubtedly increase interest income for banks, but they may also increase the risk of increased bad debts. However, these big banks are surely well-positioned to handle such situations with their healthy balance sheets.

Moving ahead, the banks expect a higher cost of living pressure on households, which can affect the volumes of transactions. But the banks remain committed to continued investment in their core products and maintaining a healthy stream of earnings.