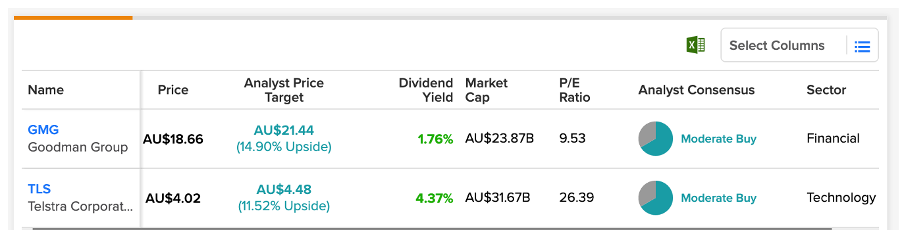

The benchmark index for Australia, the ASX 200, includes the top 200 listed companies in the country. For our analysis today, we have picked up real estate company Goodman Group (ASX:GMG) and telecommunications company Telstra Corporation Limited (ASX:TLS) from the index.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The analysts have confidence in these stocks and see a growth of more than 10% in their share prices.

Investors can use the TipRanks Trending Stocks tool to find analyst-rated stocks in Australia. This tool contains a list of stocks that have recently received high ratings from analysts. It is a great way to identify what the analysts are going after.

Let’s have a closer look at these stocks.

Goodman Group

The Goodman Group is a commercial and industrial real estate firm. The company has industrial properties in major cities around the world.

The company is one of the blue-chip companies in Australia and is highly popular among investors. Its strategy to tap strategic locations for its property has led to a profitable business for many years now. This has also helped the company navigate smoothly through market volatility. The analyst expects this strategy to work in the future as well, delivering solid growth.

The company finished 2022 on a high note, with an operating profit increase of 25% to AU$1.5 billion. The company witnessed a strong demand for industrial property along with an increase in rental income. Goodman Group’s total AUM (assets under management) was AU$73 billion, a 26% increase from 2021.

Recently, the company issued its first-quarter update for the fiscal year 2023 and saw similar trends. The company’s occupancy rates remain high at 100% in its completed projects. As of September 2022, the company’s rental income is AU$527 million per annum. Moving forward, the company is focusing on its increasing rents, higher occupancy, and cash flow growth to offset the high cap rates in its portfolio.

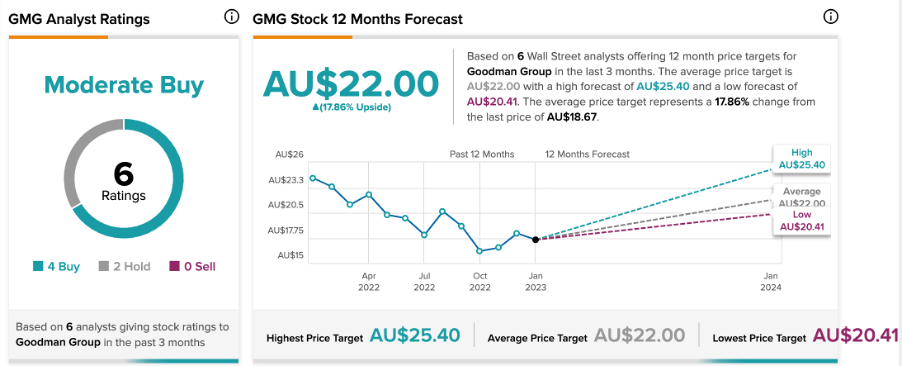

Is Goodman Group a Good Buy?

According to TipRanks’ rating consensus, Goodman stock has a Moderate Buy rating, based on six Buy and three Hold recommendations.

The target price is AU$22.0, which shows an upside of 18% on the current price of AU$18.6. The stock price is down by 21% in the last year.

Telstra Corporation Limited

Telstra provides a complete range of telecommunications services, including fixed, mobile, and internet, in Australia.

The company is known for its stable dividends, with a yield of 4.37%. The final dividend for 2022 was AU$0.165 per share. J.P. Morgan analyst Mark Busuttil expects that the company will continue to pay AU$0.165 as fully franked dividends for its fiscal years 2023 and 2024. Busuttil has a Buy rating on the stock and forecasts an upside of 21% in the share price.

Just like Busuttil, many other analysts were impressed by the results of the company’s T22 strategy, launched in 2018. This strategy included simplifying the company’s operations, restructuring, and reducing costs.

In its annual results for 2022, the company announced a similar strategy, T25, to focus on growth over the next two years. As part of this strategy, the next focus areas are customer service, developing network and technology solutions, enhancing shareholder returns, and creating a great work environment. With the foundation created by the T22 strategy, the company is now confident in its ability to build on it for financial and operational growth.

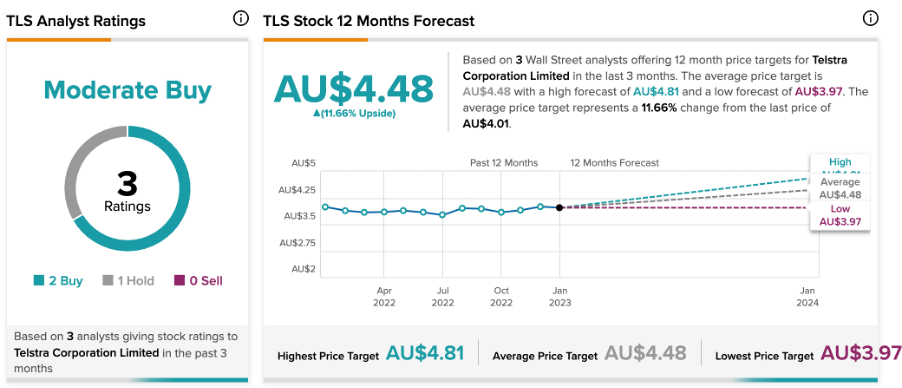

Telstra Share Price Target

On TipRanks, Telstra stock has a Moderate Buy rating, based on two Buy and one Hold recommendations.

It has an average target price of AU$4.48, which shows a change of 11.6% from the current price level. The target price has a high forecast of AU$4.81 and a low forecast of AU$3.97.

Conclusion

Both Goodman and Telstra have a long-term vision, which will drive their earnings growth and unlock more value for shareholders. The analysts’ Buy ratings and the target price make their whole story more believable.