ASX-listed companies Telstra Corporation Limited (AU:TLS) and Computershare Limited (AU:CPU) have a perfect score on the TipRanks Smart Score tool. Analysts are bullish on the long-term aspects of these companies and have rated them as Strong Buys.

Choosing the right stocks can be a tedious task for investors. In such situations, the TipRanks Smart Score tool comes in handy. This tool assigns a score between one and ten to every stock, measuring its potential to outperform the market. The stocks with scores of eight, nine, and ten have higher chances of surpassing the market returns.

Let’s have a closer look at these companies.

Telstra Corporation Limited

Telstra provides telecommunications and information services to its customers in Australia and globally. The company is a leading player with the largest mobile network in the country.

Last month, the company achieved a score of 10 on TipRanks. Telstra also announced its first-half earnings for 2023 at the same time. The company’s revenues grew 7.6% to AU$11.3 billion in H1 2023, as compared to the corresponding period of the previous year. The profit for the period grew by 25% to AU$934 million.

On the dividend front, the company announced an interim payment of AU$0.09 per share. The stable income model of the company makes it a perfect dividend stock on the ASX.

Telstra’s dominant position in the industry gives it pricing leverage, which could enhance total revenues. The company is also targeting to cut its costs by $500 million over the next two years, leading to better margins.

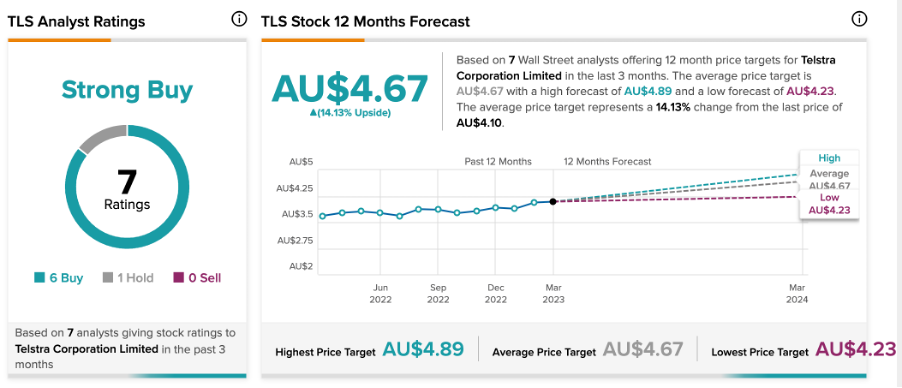

Telstra Share Price Forecast

Based on six Buy and one Hold recommendations, TLS stock has a Strong Buy rating on TipRanks.

The average target price is AU$4.67, which shows a change of almost 14% from the current price level.

Computershare Limited

Computershare is a service company in Australia that helps organizations maintain their relationships with their stakeholders. The services include governance and proxies, employee equity plans, mortgage servicing, communications consulting, and more.

The company’s stock has been on a downward journey with a loss of 16.6% YTD. However, according to the TipRanks Smart Score tool, the stock has a score of “Perfect 10,” indicating a long-term potential to beat the market. The stock also outperformed the returns of the ASX All Technology Index in 2022.

In February, the company reported its half-yearly results for 2023, with record growth of 466% in its margin income of $352 million. This huge growth was driven by higher interest rates in all its markets, which also mitigated the impact of higher inflation costs.

Analysts remain confident in the stock based on its business model of recurring business, a large client base, and growing margin income. The company expects its margin income to reach $810 million in 2023.

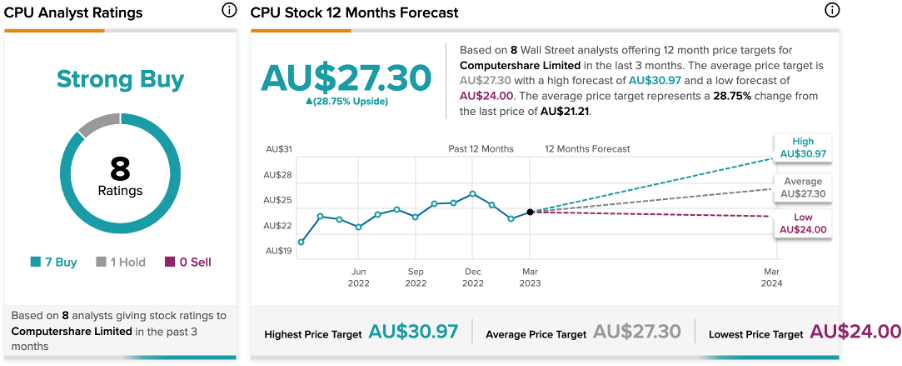

Is Computershare a Buy?

According to TipRanks, CPU stock has a Strong Buy rating, based on a total of eight recommendations.

The average target price is AU$27.3, which suggests an upside of 28.7% from the current price.

Conclusion

These two perfectly scored stocks could be good additions for the long term, backed by their Strong Buy ratings from analysts.

Telstra’s stock is famous for its dividends, and analysts favor the stock based on the company’s capability to deliver higher earnings supported by strong cash flows.

Computershare, on the other hand, has more upside potential in terms of share price growth. Based on its earnings growth, the falling share price makes for a more attractive entry point.