Based in France, TotalEnergies SE (FR:TTE) is a global energy company engaged in producing and marketing oils, biofuels, natural gas, renewable energies, and more. The company is offering an attractive dividend yield of 5.3% to investors, making it a suitable option for income investors.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

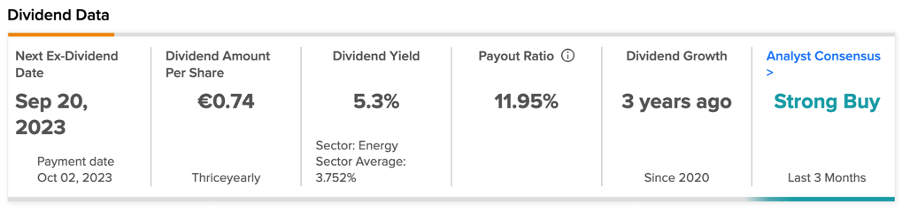

Apart from its dividends, TotalEnergies’ stock has garnered a Strong Buy rating from analysts, suggesting the potential for additional growth opportunities.

TotalEnergies Dividend 2023

In 2023, the company declared an initial interim dividend of €0.74 per share, reflecting a rise of 7.25% in comparison to 2022. The company pays its dividends quarterly, and the yield is expected to grow by 5% annually.

Over the past 10 years, the company has maintained an average gross annual dividend yield of 6%. TotalEnergies generously rewarded its shareholders in 2022 due to higher oil and gas prices. Although prices have softened, the returns to shareholders are expected to remain significant in FY23.

Additionally, the company announced significant buyback plans to enhance the attractiveness of the proposition for investors. In the first half of 2023, the company declared buybacks worth $4 billion.

Is TotalEnergies a Buy?

According to TipRanks, TTE stock has a Strong Buy rating based on a total of 13 recommendations. It includes 10 Buy versus three Hold recommendations.

The average price forecast is €66.8, with a high forecast of €75 and a low forecast of €59.8. The price target implies an upside of almost 30% on the current trading levels.

Conclusion

As an investor, if you’re not investing in dividend stocks, you may be missing out on a valuable opportunity. The French company, TotalEnergies, offers a combination of stable dividends and an upside potential of 30% in its share price.

The dividend yield of 5.3% looks decent, considering future growth potential and buybacks.