German companies Deutsche Post (DE:DPW) and TeamViewer AG (DE:TMV) will announce their first-quarter earnings for 2023 this week on May 3.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Analysts have assigned Moderate Buy ratings to both stocks, but their upside potential for the future is limited because of their healthy share price performance over the past few months.

Let’s take a look at the details.

Deutsche Post DHL Group

Deutsche Post is a leading logistics company that provides postal and logistical solutions in Germany and across the globe.

The company is scheduled to declare its Q1 2023 results on May 3 with a consensus EPS forecast of €0.72p. Analysts expect revenue and earnings to fall this quarter due to a decline in volumes.

According to analysts, the Q1 sales forecast is €20.5 billion, down from €22.59 billion in the corresponding period last year. The EBIT is expected to be around €1.46 billion, lower than €2.16 billion in Q1 2022.

In a note, J.P. Morgan analyst Sam Bland stated, “Weak first-quarter results have been well signaled by the company, so they expect investors to focus on any comments about whether there has been any significant volume improvement.” Bland has a Sell rating on the stock and expects a decline of 13% in the share price.

On the plus side, few analysts believe that the company will renew its full-year outlook, considering that there are indications of the volume decline stabilizing and the company’s most profitable quarter is yet to come.

Deutsche Post Stock Forecast

DPW stock has a Moderate Buy rating on TipRanks backed by a total of nine recommendations, of which five are Buy.

The average price target is €44.88, which is 2.89% higher than the current price.

TeamViewer AG

TeamViewer AG, headquartered in Germany, is a software development company primarily specializing in cloud-based technologies that facilitate online remote support and collaboration on a global scale.

The company will also report its Q1 2023 earnings on May 3. The consensus estimate for EPS is €0.17 per share for the quarter, which is higher than last year’s EPS of €0.07 in the same quarter. The Q1 sales forecast is €149.65 million, slightly down from €150.5 million in the previous quarter.

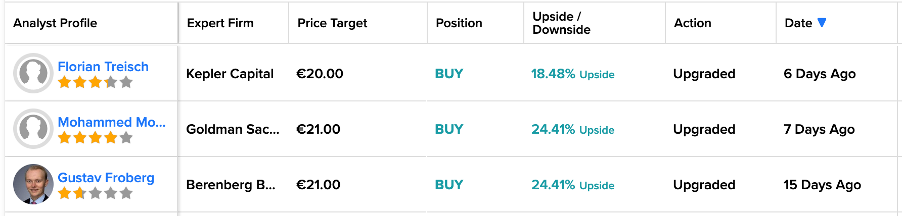

Ahead of the results, three analysts have upgraded their ratings to Buy on the stock. Berenberg Bank analyst Gustav Froberg is bullish on the results, as he expects a positive turnaround at the company after experiencing two difficult years. He believes medium- and small-sized companies will drive the recovery at the company, and the investors are currently failing to recognize this potential.

Froberg also raised his price target on the stock to €21.0, which implies an upside of 24.4%.

Is TeamViewer Stock a Buy?

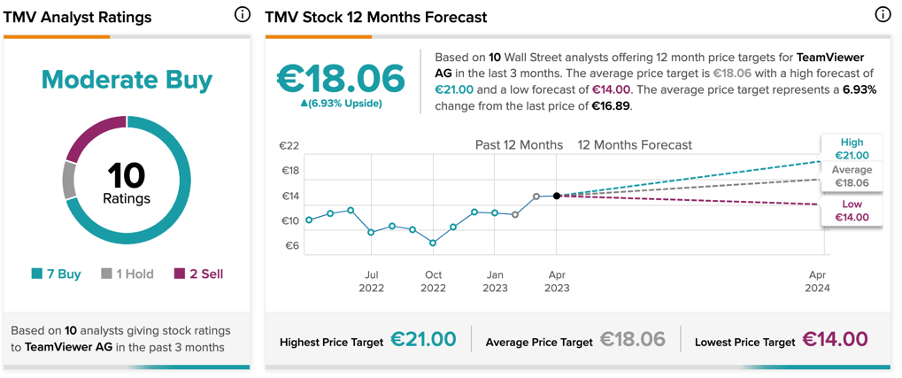

On TipRanks, TMV stock has a Moderate Buy rating, which includes seven Buy, one Hold, and two Sell recommendations.

The stock price forecast is €18.06, which is almost 7% higher than the current trading levels.

Conclusion

Analysts have assigned Deutsche Post and TeamViewer a Moderate Buy rating. As for their expected results, analysts anticipate a decline in revenues and earnings for Deutsche Post for the quarter, whereas they predict a positive turnaround in the numbers for TeamViewer.