ASX-listed companies Telstra Corporation Limited (AU:TLS) and Cooper Energy Limited (AU:COE) have been rated a Strong Buy by analysts.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Amongst these companies, COE stands out with significant upside potential, exceeding 90% in its share price. While Telstra presents a more moderate growth prospect, with a projected increase of 10% in its share price.

Now, let’s delve into some of the particulars.

What is the Prediction for Telstra Shares?

Telstra, an Australian telecommunications company, offers a wide range of communication and technology services to cater to diverse customer needs.

Analysts are bullish on the stock as they believe the company is in a favorable position within the industry’s growth, benefiting from higher mobile revenues and effective cost-saving programs. The Australian telecommunications sector experienced higher revenues in the first half of FY 2023 after a long, dull period.

Recently, four days ago, Neale Anderson from HSBC maintained his Buy rating on the stock and expects it to grow by almost 20%.

Overall, TLS stock has a Strong Buy rating on TipRanks with five Buy versus one Hold recommendations. At an average price forecast of AU$4.81, analysts predict another 10% hike in the share price for the next 12-month period.

Is Cooper Energy a Good Investment?

Cooper Energy is an ASX-listed energy company, operating through two segments: Cooper Basin and South-East Australia.

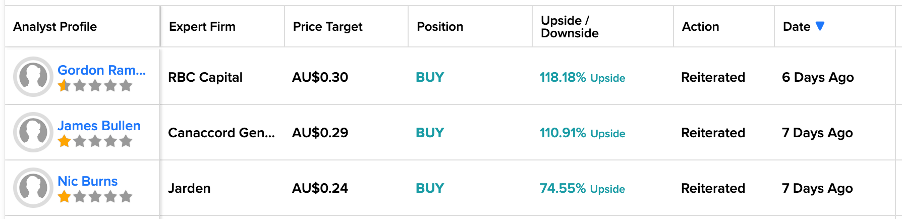

Over the last year, the stock has been trading down by 50%. However, analysts remain bullish on the stock and expect it to recover in the medium term. Over the last seven days, analysts from RBC Capital, Canaccord Genuity, and Jarden have confirmed their Buy ratings on the stock.

Six days ago, Gordon Ramsay from RBC Capital reiterated his Buy rating on the stock, predicting an upside of more than 115% in the share price.

Similarly, just one week ago, Canaccord Genuity analyst James Bullen predicted a remarkable growth rate of 110%. Additionally, Nic Burns from Jarden envisions a potential increase of 75% in the share price.

Based on all four Buy recommendations, COE Stock has a Strong Buy rating on TipRanks. The average price forecast of AU$0.27 implies an upside of 94% from the current price level.

Conclusion

Analysts have expressed positive sentiment towards these two ASX shares, expecting continued growth in their respective share prices.