Shares of tinyBuild (GB:TBLD) cratered 51% in regular trade on December 5 after the video game publisher and developer provided a slew of disappointing updates. The London-listed company noted that trading has been “unusually weak” in October, dragging down revenues for Fiscal 2023. Moreover, the continued underperformance of game publisher Versus Evil, owned by tinyBuild, and the delay in the launch of three out of four titles into 2024 has impacted the overall business.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

tinyBuild’s Unfavorable Updates

Furthermore, tinyBuild decided to settle the ongoing litigation with the founder of Versus Evil, which it acquired in 2021. Under the Global Settlement Agreement, tinyBuild will pay $3.5 million in claims in addition to legal costs. Also, CEO and founder Alex Nichiporchik informed that the company is mulling a future round of equity fundraising of up to $10 million, subject to shareholders’ approval.

Citing further deterioration in the games market, the company said that it now expects to earn revenues in the range of $40 to $50 million for the full year 2023. Also, TBLD said the cash position at the end of 2023 will be in the low single-digit millions instead of the earlier forecast of between $10 to $20 million. The cash position will be affected by the $1.5 million upfront payment concerning the legal settlement.

The company also mentioned one-time severance charges that will be borne in the second half of 2023 results, implying that tinyBuild has laid off employees. As of November end, tinyBuild had $5.7 million in cash on its balance sheet.

What is the Share Price Prediction for tinyBuild?

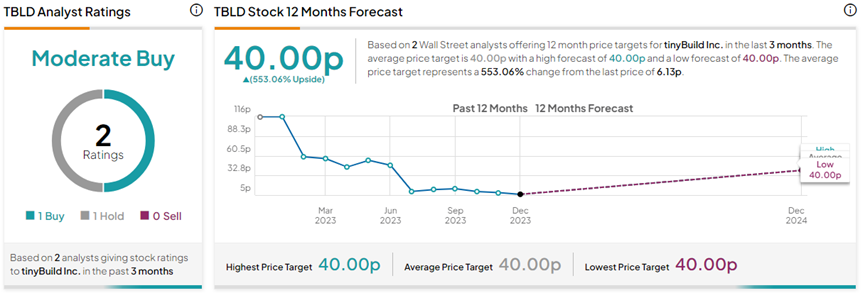

On TipRanks, TBLD stock has a Moderate Buy consensus rating based on one Buy versus one Hold rating. The tinyBuild share price prediction of 40.00p implies a massive 553.1% upside potential from current levels. Year-to-date, TBLD shares have lost 94.4%.