ASX-listed companies Transurban Group Ltd. (AU:TCL), JB Hi-Fi Limited (AU:JBH), and Sonic Healthcare Limited (AU:SHL) are known for higher dividends. All three stocks have Hold ratings from analysts. Despite their less favorable share price growth, these companies remain dedicated to enhancing the returns for their shareholders.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Let’s take a look at these companies in detail.

Transurban Share Price Forecast

Based in Australia, Transurban Group is engaged in the development and operation of toll roads.

The company has a dividend yield of 3.72%, whereas the sector has an average of just 1.63%. Recently, the company paid a dividend of AU$0.265 for the first half of fiscal year 2023. The dividend forecast for the full year 2023 is AU$0.57, which is above the dividend of AU$0.41 paid in 2022. This could further increase to AU$0.62 in 2024 and AU$66.5 in 2025.

The company’s earnings growth is well supported by favorable macro conditions, record traffic levels, and the addition of new assets.

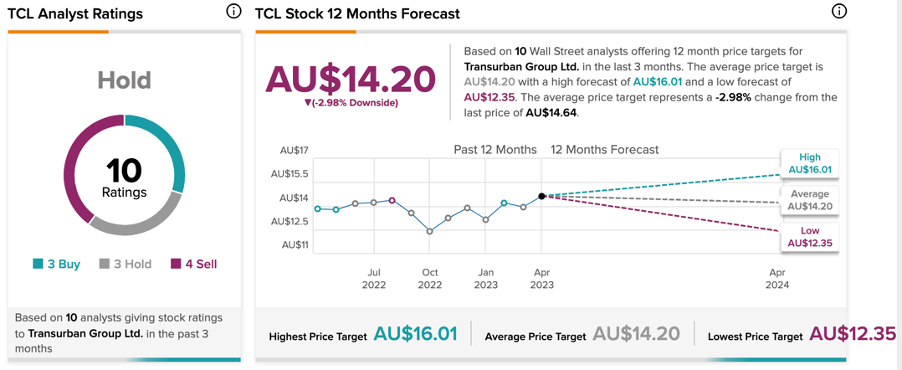

Overall, the TCL stock carries a Hold rating on TipRanks, backed by a total of 10 recommendations. The average price prediction is AU$14.2, which is 3% lower than the current share price.

Is JBH a Good Buy?

JB Hi-Fi is Australia’s largest home entertainment retailer that specializes in consumer electronics and home appliances.

The company has established a solid reputation as a consistent dividend provider on the ASX over numerous years. At a dividend yield of 7.58%, it looks like an appealing option for investors. In March, the company paid an interim dividend of AU$1.97, up from AU$1.63 a year ago.

According to TipRanks, JBH stock also has a Hold Buy rating based on two Buy, four Hold, and four Sell recommendations. The target price of AU$44.38 is 3.5% lower than the current price level.

Is Sonic Healthcare a Good Investment?

Sonic Healthcare is a globally recognized healthcare company that specializes in laboratory, pathology, and radiology services.

The company paid a periodic dividend of AU$0.42 per share, which reflected a growth of 5% as compared to the corresponding payment made last year (A$0.40). The current dividend yield stands at around 3%.

Sonic Healthcare has implemented a progressive dividend policy, which indicates its intention to increase the dividend payout to investors every year. Over the long term, analysts anticipate that the business will reap the advantages of a return to a normalized level of testing after COVID-19 for its core operations and more acquisitions.

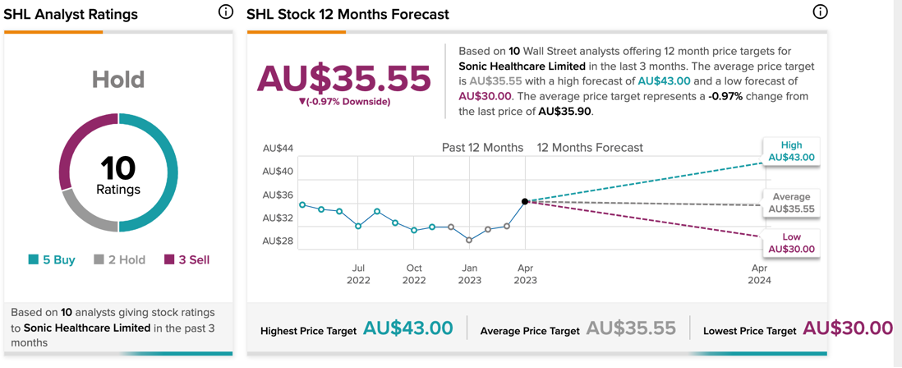

SHL stock has a Hold rating on TipRanks at an average price forecast of AU$35.55 for a 12-month period. This is almost similar to the current trading levels, and analysts do not anticipate any significant upside potential.

Conclusion

Analysts suggest that the share prices of these two ASX companies may not have significant upside potential. Nevertheless, their dividend outlook remains steady, making them a viable choice for income-oriented investors.