The share price of the UK-based THG PLC (GB:THG) crashed by 21% on Thursday after the company posted £100 million in operating losses in its H1 2023 earnings report. Moreover, the company expects its annual sales to be flat or decline by 5% in 2023, down from the previous forecast of low-mid-single digit growth. The company kept its adjusted EBITDA guidance unchanged.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

After the results announcement, investors’ concerns mounted, which led to over a 21% drop in the stock yesterday. This decline came as a bigger jolt to investors, surpassing the one in May when the shares dipped by 10% following the unsuccessful takeover discussions with Apollo. The stock’s value has plummeted by 86% since its IPO in 2020.

THG is a technology and consumer brand company that sells its own brands under the beauty and nutrition categories. The company also offers third-party brands on its e-commerce platform.

Interim Results 2023

The company’s first-half revenue declined 9.3% to £969.3 million compared to the same period last year. Within its segments, THG Beauty saw a 10.4% decline in revenues, while the technology division, IHG Ingenuity, experienced a 14.9% drop. The decline in overall revenue was primarily linked to the strategic sale of unprofitable and discontinued product categories, along with manufacturing delays within THG Beauty.

The company’s operating loss increased to about £100 million from £89.2 million, and its net loss expanded to £133.1 million from £106.4 million. The divestment of non-core assets resulted in a one-time non-cash expense of £26.2 million, contributing to the rise in operating loss.

On a positive note, the company celebrated a milestone with a record revenue of £340.7 million in the THG Nutrition segment for the first half, showing a 2.6% increase. Moreover, underlying earnings (EBITDA) reached £50.1 million, reflecting a 22.9% increase compared to the previous year’s £40.8 million. THG upheld its projection for full-year adjusted EBITDA of approximately £119 million.

Positive Reaction

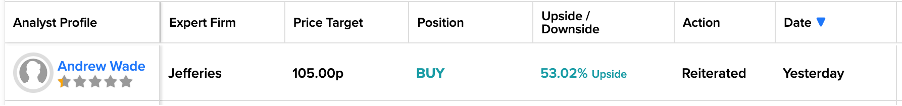

Following the release of the results, Jefferies analyst Andrew Wade expressed his optimism about the stock and confirmed his Buy rating yesterday. His price target of 105p implies an upside potential of 53% in the shares. Wade believes significant challenges that led to downgrades are now reversing, and he sees “considerable value and growth potential in the market-leading strategic assets” of the company.

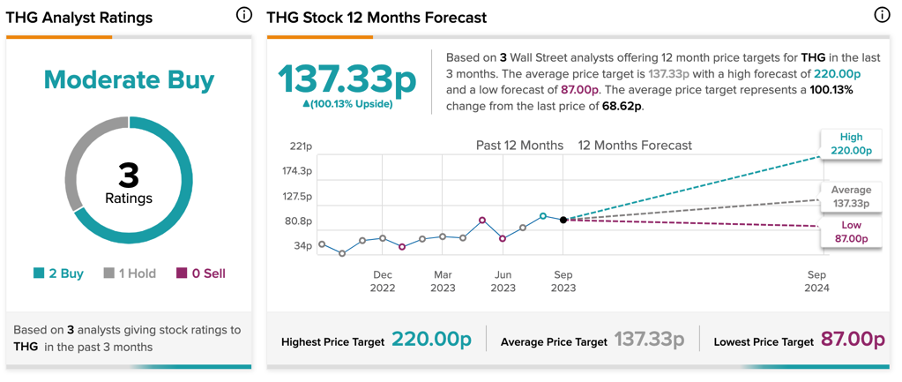

What is the Price Target for THG?

THG stock has received a Moderate Buy rating on TipRanks, backed by two Buy and one Hold recommendations. The THG share price forecast is 137.3p, which implies a huge potential for a 100% increase from the current price of 68.6p.