The stocks of the banking group Commonwealth Bank of Australia (AU:CBA) and biotechnology company CSL Ltd. (AU:CSL) have shown good growth since the beginning of 2023. Both these stocks have hit their 52-week high point in January 2023.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Here, we have used TipRanks tools like Stock Screener and Stock Comparison for the Australian market. These tools are a perfect way to screen and compare the stocks in a particular market to make the right choice.

Let’s have a closer look at them.

CSL Ltd.

CSL is a biotechnology company that develops products in different areas, including rare and serious diseases, influenza vaccines, iron deficiency, and nephrology.

Since January 2023, CSL stock has gained around 8% and also touched its 52-week high point. In the last year, the stock price has increased by 17%.

As CSL is set to release its Q2 earnings for the fiscal year 2023, analysts have an encouraging view of the company. Australian broking firm Morgans believes this year could be a “break out” year for the company as it recovers from the COVID slowdown.

Morgans expect double-digit growth in the company’s earnings, driven by higher plasma collections, HEMGENIX approval, and its hold on the influenza vaccine market. As one of the leading influenza vaccine providers in the world, the company’s grip on this market is strong and makes a strong investment case for the stock.

The company’s recent approval of HEMGENIX, a gene therapy drug, will strengthen its position in the haemophilia treatment market. Moreover, it is among the premium drugs of the company, which could have a long-term impact on the earnings.

What is the Price Target for CSL Share?

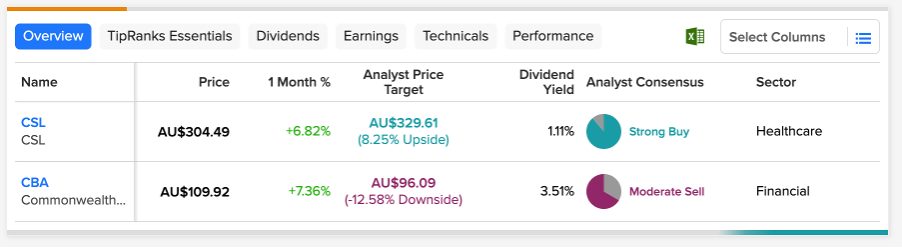

According to TipRanks’ rating consensus, CSL stock has a Strong Buy rating, based on eight Buy and one Hold recommendations.

The average target price is AU$333.88, which shows a growth of 9.6% on the current price level.

Commonwealth Bank of Australia (CommBank)

CommBank is one of the leading banks in Australia, serving around 16 million customers globally.

The stock has benefited from the various rounds of interest rate hikes by the government in 2022, supporting the net interest margins of the bank. The stock has gained almost 21% in the last year and touched a record high in 2023.

On the flip side, analysts are concerned about the recessionary pressures in the economy, which could lead to more bad debts for the bank.

Even though analysts don’t forecast any upside in the share price, the stock is a must for value investors. CommBank is known as a stable dividend stock with a yield of 3.51%. In 2022, the bank paid a dividend of AU$3.85 per share, and Morgan Stanley predicts a 17% increase to $4.5 per share in 2023.

What is the Forecast for the Commonwealth Bank of Australia Share Price?

According to TipRanks’ analyst consensus, CommBank stock has a Moderate Sell rating.

The average price target is AU$96.09, which is 12.5% lower than the current price level.

Conclusion

The shareholders are currently enjoying the stock ride with higher returns.

On one hand, CSL stock is poised for more growth with its market-leading vaccines and new drugs. On the other hand, analysts prefer CommBank for its dividend payments and don’t expect any further growth in its share price.