Observing the insider’s transactions on any stock can tell so much about the company’s outlook. Among the different activities, informative buying is the one that stands out for investors, as it directly shows insider confidence in the company’s share price. Based on any valid piece of information, when an insider buys a stock, it means they are bullish about the company’s prospects, and investors can use this to their advantage.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

TipRanks makes this easy for investors with its Daily Insider Transactions list for different markets. This list comprises date-wise transactions by corporate insiders for a particular company, clubbed with other details.

With TipRanks’ insider trading data, investors get systematic and timely information on who is buying and selling the company’s stock from within.

Let’s have a look at two companies from the Singapore market and see their recent insider activities.

Wilmar International (SG:F34)

Based in Singapore, Wilmar International has a global presence with around 500 manufacturing plants across the world. The company is engaged in agribusiness, including plantations, oil cultivation, refining, sugar and rice milling, the manufacturing of fertilizers, biodiesel, and more.

The company’s stock has recently gained some momentum and has been trading up by 8% in the last three months. The long-term growth of the stock is also impressive, with 52% returns for the shareholders. The company has a diversified portfolio, including some premium brands, which acts as a cushion during periods of slow demand.

According to TipRanks’ insider trading activity, the confidence signal is positive for the company.

The corporate insiders have bought shares worth $29.9 million in the last three months. The company’s chairman and chief executive officer, Khoon Hong Kuok, made seven informative buy transactions in December 2022. Recently, he bought around 5,800 shares at S$4.09 per share, worth S$23.7k.

Last month, Kuok also bought shares worth S$8.8 million for S$4.10. Transactions of this magnitude from the head of the company indicate a brighter future for the company.

He has a success rate of 84% on Wilmar’s stock and an average return of almost 12%.

Is Wilmar International a Good Buy?

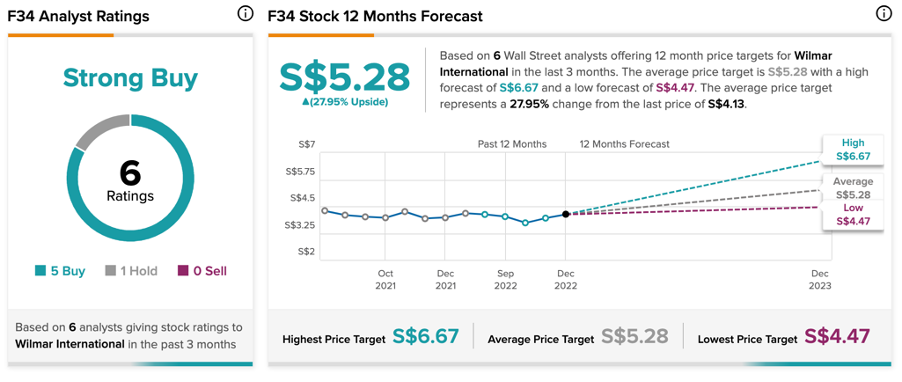

According to TipRanks’ analyst consensus, Wilmar’s stock has a Strong Buy rating.

The average target price is S$5.28, which represents a 28% change in the price from the current level.

United Overseas Bank (Singapore) (SG:U11)

UOB is a banking institution with operations in around 19 countries worldwide. The bank has a network of 500 branches globally.

After strong third-quarter results in 2022, the bank’s stock soared and gained almost 20% in the last six months. The bank posted a 34% growth in profits, which touched a record of S$1.4 billion. Profits increased due to higher net interest income and its treasury portfolio.

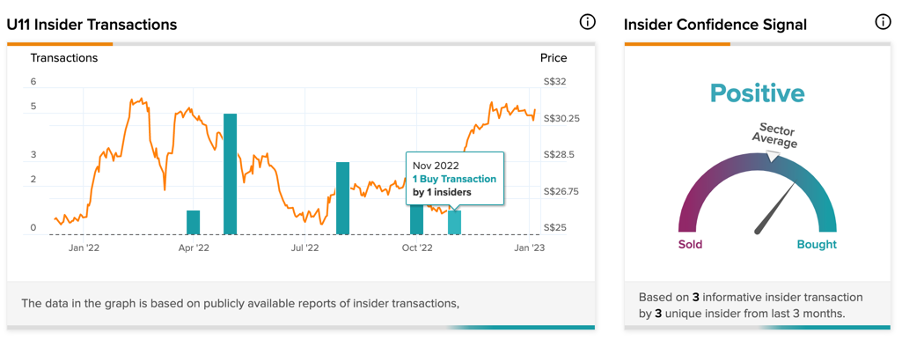

The company’s insider trading page on TipRanks shows the insider confidence signal as positive. In the last three months, the insider’s transactions were worth $233,000.

Kan Seng Wong, a director of the company, has had three informative buy transactions in the last three months. Wong has increased his holding in the company multiple times in the last year. This is an encouraging sign for investors who are looking to invest in UOB.

Next on the list was the bank’s deputy chairman and chief executive officer, Ee Cheong Wee, who bought shares in August 2022. His two transactions for 1,00,000 shares were the biggest purchases by an insider in the last year.

He believes that the bank’s presence in the South Asian markets will help it navigate smoothly through the recessionary period.

What is UOB Target Price?

According to TipRanks’ analyst consensus, UOB stock has a Strong Buy rating, with a full majority of five Buy recommendations.

The average target price is S$34.37, which has an upside potential of 11% on the current price level.

Conclusion

Before selecting a stock for investment, investors have numerous data points to check. What makes a real difference is how an investor quickly uses that information to make an informed decision. Corporate insider transactions are such data points, which, if used properly and on time, can lead to higher returns for investors.