The China-based global conglomerate Tencent Holdings Limited (HK:0700) (TCEHY) reported record revenues in its Q3 earnings report for 2023. The growth was mainly driven by its games business recovering from regulatory challenges in the country’s tech sector, along with robust advertising sales. For Q3, Tencent reported a 10% year-over-year growth in its revenues of CNY 154.6 billion ($21.4 billion), in line with market estimates. This also marked the third consecutive quarter of revenue growth for the company.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The year 2023 has been a turnaround for the company, as the gaming industry experienced a resurgence after the regulators resumed issuing game licenses. Last year was one of the most challenging periods for the company due to an eight-month freeze on licenses for new games and other restrictions. As a consequence, Tencent reported an annual revenue decline, marking the first time in its history.

Tencent Holdings is a technology company that provides digital entertainment and internet value-added services to more than 1 billion customers. The company owns revolutionary products such as WeChat and QQ in its portfolio and is also a leading video game company in the world.

Q3 Earnings Roundup

Among its segments, the games and social network gross profit grew by 12% to CNY 42.04 billion. The improvement was fuelled by a strong 14% increase in international game revenue, coupled with a 5% rise in domestic game earnings. The company games, like Lost Ark and Valorant, delivered exceptional performances during the quarter. The company also mentioned its upcoming strong pipeline of games to be released, including Honor of Kings World, Valorant Mobile, and Assassin’s Creed Mobile, among others.

In its online advertising business, the company witnessed a remarkable 35% surge in gross profit, reaching CNY 13.45 billion. This substantial increase is credited to the increased demand for video advertisements and the use of generative AI tools in crafting ad visuals. And lastly, the fintech and business services sectors also experienced an impressive 43% increase in gross profit, reaching CNY 21.31 billion. This was due to a rise in commercial payment activities and the expansion of wealth management services provided by Tencent.

Is Tencent Holding a Buy?

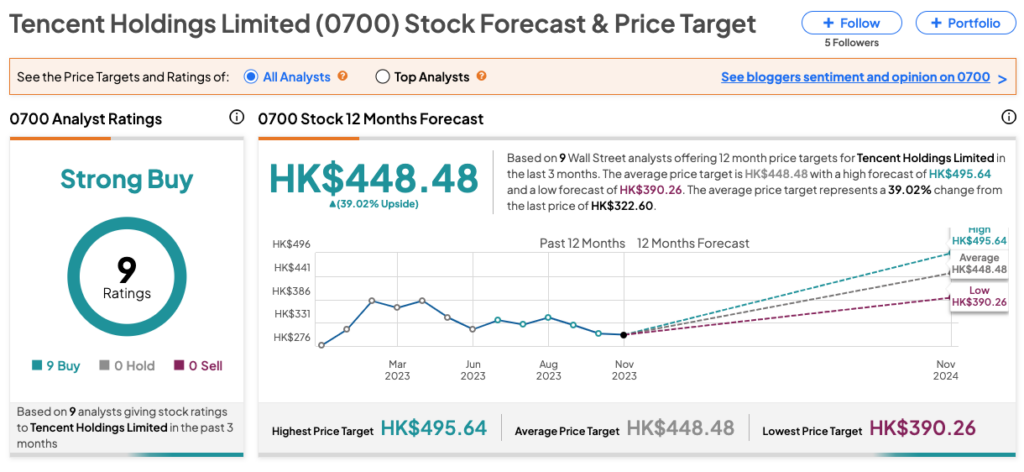

According to TipRanks’ rating consensus, 0700 stock has received a Strong Buy rating, backed by all Buy recommendations from nine analysts. The Tencent share price forecast is HK$448.48, which implies an upside of almost 40% on the current trading level.