Using the technical analysis on TipRanks, we have identified two Spanish companies, Solaria Energia y Medio Ambiente (ES:SLR) and Acerinox (ES:ACX), for investors. According to the technical indicators, these stocks have bullish signals for the time period of one month.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

TipRanks’ newly introduced technical analysis for companies guides investors on stocks based on technical indicators. These include moving averages, oscillators, pivot points, RSI, and more. These indicators could be combined with other research tools on TipRanks, such as Smart Score, and Analyst ratings to make an informed decision.

Let’s have a look at more details on these Spanish stocks.

Solaria Energia y Medio Ambiente, SA

Solaria is a leading name in the solar energy sector in Spain and Europe. The company manufactures and manages solar panels and plants.

The company’s stock has generated a huge gain of 85% in the last three years for its shareholders. This growth was mainly due to its profitability, which was driven by the growing solar sector in Europe.

Moving on to the technical analysis for Solaria’s stock, the overall summary signal is Buy. This signal combines various technical indicators to provide a stock’s overall technical strength.

In the time frame of one month, the company’s Moving Averages Convergence Divergence (MACD) indicator is 0.98, which indicates it as a Buy stock. MACD is among the most commonly used indicators in technical analysis, which compares the moving averages of different time frames. The Moving Average signal for the stock is Strong Buy.

The stock’s 100-day exponential moving average is 10.23, which is lower than the stock’s current price of €17.96, suggesting a Buy signal.

Solaria Energia Stock Price Target

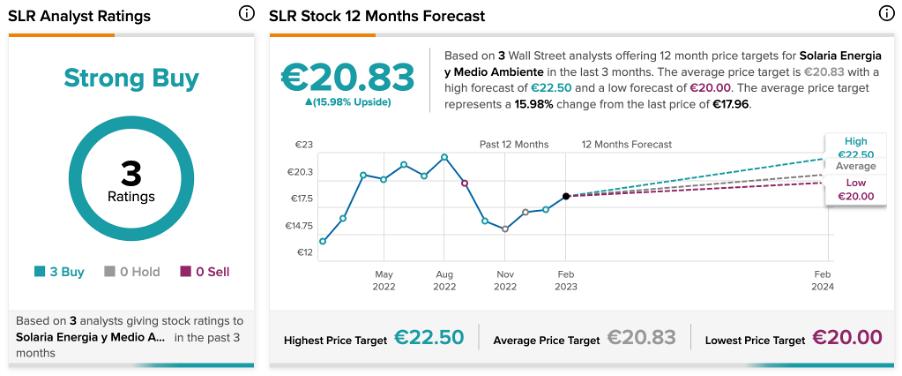

SLR stock enjoys a Strong Buy rating on TipRanks, based on three Buy recommendations.

The average target price is €20.83, which is almost 16% higher than the current price.

Acerinox SA

Acerinox is among the leading manufacturers of stainless steel in the world, with a presence on five continents.

The company’s stock has been volatile in the last year and has lost almost 10%. The steel industry is currently facing issues like a slowdown in demand and higher costs, which are impacting the manufacturers.

In the time period of one month, the summary signal for Acerinox stock is Strong Buy. This signal brings other technical indicators into a summary form, which provides a complete overview of the stock’s technical analysis.

The stock’s Moving Averages Convergence Divergence (MACD) indicator is 0.16, which implies a Buy signal. The stock’s 100-Day exponential moving average is 8.44, as compared to the current stock price of €9.8, suggesting a Buy.

The Relative Strength Index (RSI) value for the stock is 53.19, which indicates Neutral action. The RSI value indicates whether the stock is overbought or oversold. A higher value means the stock is overbought.

Acerinox Share Price Forecast

According to TipRanks’ analyst consensus, Acerinox stock has a Strong Buy rating.

The average price forecast is €12.45, which shows an upside of 27% from the current price level. The target price has a high forecast of €16 and a low forecast of €10.10.

Conclusion

While technical analysis could be of great help for stock trading, it is important to consider a wholesome view of the stock before making an investment. A perfect combination of fundamental and technical tools is the best way to make the right decision.