The ASX-listed lithium mining company Sayona Mining Limited (AU:SYA) has witnessed a 54% decrease in its share price over the past six months. Most recently, the share price went further into the red zone despite the company receiving its initial cash proceeds from the North American Lithium (NAL) operation in Quebec, Canada.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

YTD, the Sayona share price has shown significant fluctuations, primarily linked to the broader downturn witnessed in the lithium sector in Australia. This pattern is likewise observable among other industry participants like Core Lithium Limited (AU:CXO), which is down 62% YTD.

Sayona Mining Limited is an Australian lithium producer that manages projects in both Quebec, Canada, and Western Australia. The company is poised to become a prominent supplier of lithium for the electrification of North America.

Recent Developments

Last week, the company reported another major milestone of cash generation from NAL in Canada after delivering its first shipment of 20,500 wmt (wet metric tonnes) of lithium oxide concentrate. Sayona owns a majority stake of 75% in NAL, and the remaining 25% is owned by Piedmont Lithium Limited (AU:PLL).

Looking ahead, the company has an inventory of roughly 30,000 wmt of concentrate at the port, ready for upcoming shipments in late September or October 2023. Both partners have received an initial cash payment, which amounts to 90% of the cargo’s total value. Sayona had $257 million in cash and cash equivalents as of August 31.

The milestone proves that the company not only possesses lithium deposits but is also actively monetizing them within the initial two years following the project acquisition. It underscores Sayona’s ability to meet the growing global demand for lithium and play a role in the ongoing energy transition.

Is Sayona a Good Stock to Buy?

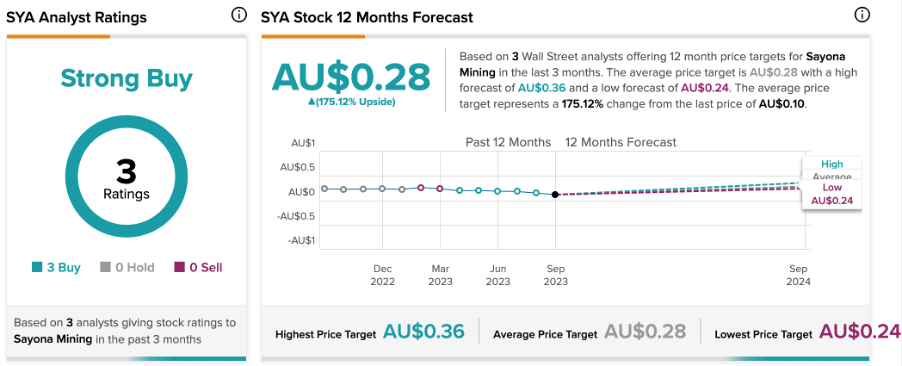

On TipRanks, SYA stock has been rated Strong Buy by analysts, backed by three Buy recommendations. The Sayona share price target is AU$0.28, which implies a huge upside of 175.12% from the current trading levels.

In particular, 12 days ago, analyst Frederic Tremblay from Desjardins reiterated a Buy rating on SYA stock, predicting a 144% jump in the share price.

Ending Notes

The drop in Sayona’s stock value reflects investor apprehensions about the small players in the overall lithium sector during a period of declining prices. However, Sayona Mining’s NAL project is strategically positioned to thrive amid the increasing demand for lithium.

Analysts anticipate a potential increase of around 175% in the stock and see the downward trend as a good opportunity for investors to build a position.