SGX-listed companies StarHub Limited (SG:CC3) and PropNex Limited (SG:OYY) offer dividend yields that exceed the averages within their respective sectors. This makes them attractive for investors seeking stable dividend income within their investment portfolios. Analysts have assigned a Moderate Buy rating to StarHub, while PropNex has garnered a Strong Buy rating, reflecting a favorable outlook for both stocks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Selecting the appropriate dividend stocks has been made more accessible with the assistance of various tools offered by TipRanks. These resources, such as Top Dividend Stocks, Dividend Calculator, and Dividend Calendar, serve as perfect guides to aid investors in making well-informed stock choices.

Let’s take a look at these companies in detail.

StarHub Dividend History

StarHub is a telecommunications company based in Singapore, specializing in delivering high-quality communication, entertainment, and digital solutions.

StarHub has earned a reputation for its consistent dividend payments over an extended period, demonstrating resilience even during challenging times like the pandemic. The company boasts a robust dividend yield of 4.61%, which exceeds the industry average of 2.54%. In August, the company paid out S$0.03 in dividends for the first half of FY23, a figure consistent with the interim payment made in FY22.

22 days ago, analyst Arthur Pineda from Citi upgraded his rating on the stock from Hold to Buy. Pineda stated that the company’s dividend prospects and a positive earnings outlook were the driving forces behind this upgrade. He is confident in the company’s potential for profit growth, particularly following a phase of lower earnings impacted by costs associated with digital transformation in FY2022. Pineda forecasts an expected increase in dividends, rising from S$0.05 in FY23 to S$0.06, and subsequently to S$0.07 in FY24, followed by an anticipated further growth to S$0.08 in FY25. This projection suggests a positive outlook for dividend growth over the coming years.

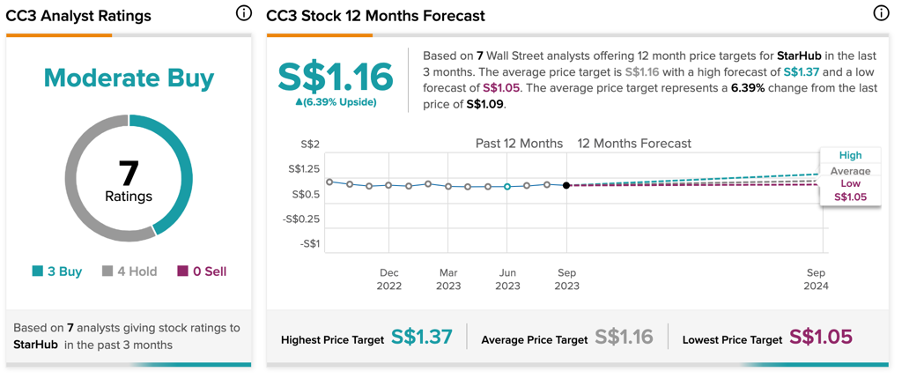

What is the Price Target for StarHub?

According to TipRanks’ rating consensus, CC3 stock has received a Moderate Buy rating based on recommendations from seven analysts. The StarHub share price target is S$1.16, which is 6.4% higher than the current price level.

PropNex Dividends

PropNex is a prominent real estate brokerage and consulting firm recognized for its comprehensive online real estate platform, which shows a diverse selection of residential and commercial properties.

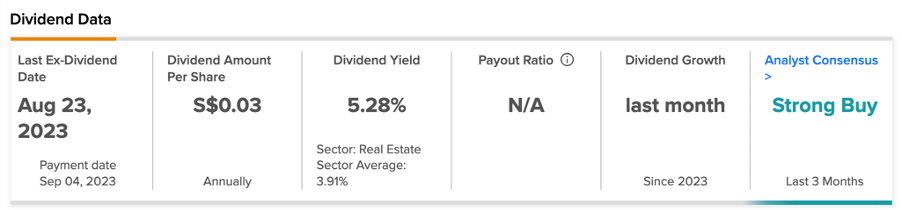

The company has a dividend yield of 5.28%, making it an attractive choice for income-focused investors. On September 4, the company paid an interim dividend for FY23 of S$0.03 to the shareholder registered until August 23, 2023. PropNex has maintained a consistent dividend payout pattern over the past three years, with a dividend payout ratio of 70% to 80%. The total dividends for FY22 amounted to S$0.135 per share, up from S$0.125 in FY21 and S$0.055 in FY20. This demonstrates the company’s commitment to rewarding its shareholders through dividend distributions.

Analysts hold an optimistic view regarding the company’s position in the Singapore residential market, citing its significant market share. Furthermore, the newly articulated strategies to venture into the commercial sector are anticipated to provide substantial medium-term support to the company’s earnings and dividends.

Is PropNex a Good Buy?

OYY stock has been assigned a Strong Buy rating on TipRanks, based on four Buy and one Hold recommendations. The PropNex share price target of S$1.15 suggests an upside of 28% on the current price.

Conclusion

In the current trading environment, consistent income through dividends holds significant importance for investors seeking stability. SGX-listed StarHub and PropNex present viable options to bolster investors’ portfolios and provide much-needed stability.