CAC 40-listed bank Societe Generale, or SocGen (FR:GLE), returned to profits in Q3 despite the challenges in its home market. The bank reported a net income of €900 million, surpassing analysts’ expectations and representing a significant improvement from the 1.5 billion euro loss reported in the second quarter of 2022. Nonetheless, revenues in French retail banking saw a decline of 13.6% compared to the previous year, primarily due to lower net interest margins.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In its Q3 2023 earnings report, revenues decreased by 6.2% to €6.2 billion. Among its segments, banking division revenues saw a decline of 7.3%, mainly due to reduced volumes and volatility. FIC (fixed income and currencies) also experienced a downfall of 18.4%, attributed to less favorable market conditions resulting from weaker interest rates and currency volatility.

The bank’s operating expenses increased by 2.7% to €4.4 billion, as compared to last year. At the end of this quarter, the bank’s CET 1 ratio, which serves as a measure of solvency, reached 13.3%, surpassing the regulatory requirements by 350 basis points.

Following in the footsteps of its competitors, the bank launched a share buyback program for €440 million.

Societe Generale is a leading financial institution in Europe, catering to approximately 25 million customers. The group offers a wide range of services, including banking, insurance, investment banking, and various other financial services.

The Share Price Performance

Following Q3 results, the shares traded up by 1.04% today at the time of writing. Last month, the stock witnessed its most substantial decrease since March 2023. Investors demonstrated their dissatisfaction with the newly set goals by the company, which was reflected in the decline of the company’s share price. According to a new three-year plan, the bank intends to focus more on safeguarding its capital reserves while preserving its profitability and implementing cost-cutting measures. Analysts gave mixed responses to the new plan and are awaiting additional details on it.

Is Societe Generale a Buy?

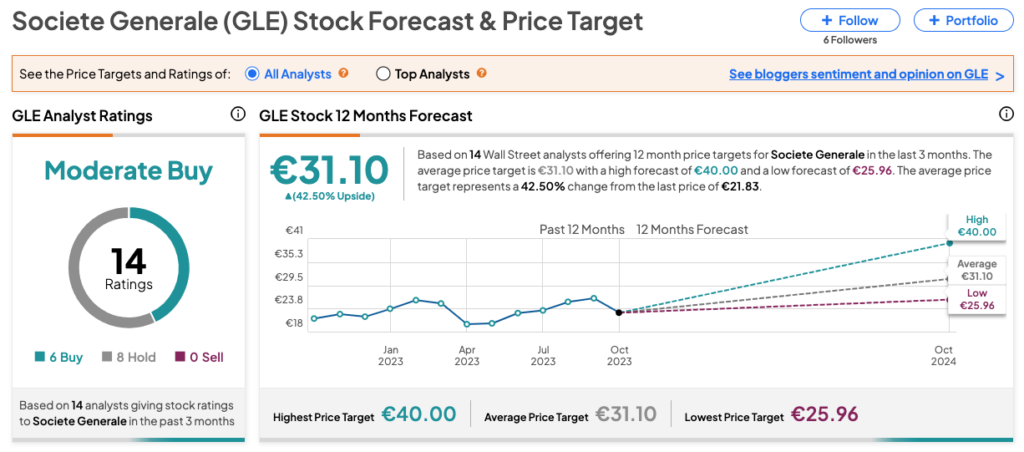

Overall, on TipRanks, GLE stock has received a Moderate Buy rating based on six Buy and eight Hold recommendations. The Societe Generale share price forecast of €31.10 implies an upside potential of more than 40% on the current trading price.