In today’s article, we have shortlisted the shares of Singapore Telecommunications, or Singtel (SG:Z74), and ComfortDelGro (SG:C52) from SGX, which are backed by Strong Buy ratings from analysts. These stocks received significant attention from analysts recently and are worth monitoring in September 2023. In terms of share price growth, Singtel presents a potential upside of 20%, whereas ComfortDelGro’s stock growth is estimated at 12%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let’s take a look at some of the details.

Singapore Telecommunications Limited (Singtel)

Singtel is a leading telecommunications service provider in Singapore, providing a diverse range of services like fixed, mobile, internet, TV, etc.

The company recently conducted its Investor Day, during which it laid the groundwork and outlined significant business objectives for the next three years. The company mentioned improved roaming revenues and business digitization as tailwinds for its revenue growth. The company is targeting to enhance its return on invested capital to a low double-digit percentage by FY2026, up from the 8% reported for FY23. To achieve this, Singtel is boosting its cost synergies through improved management of its 5G deployment and more judicious expenditure.

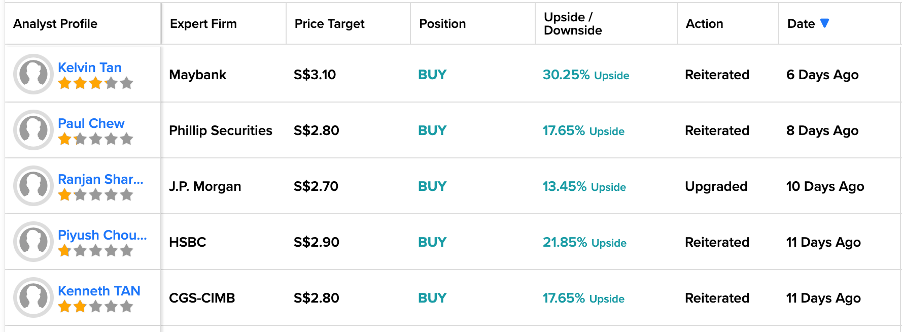

Analysts at Maybank, HSBC, CGS-CIMB, J.P. Morgan, UOB Kay Hian, etc. have rated the shares as Buy. Most recently, Kelvin Tan from Maybank confirmed his Buy rating on the stock and predicted a 30% growth in the share price.

Is Singtel a Good Buy Now?

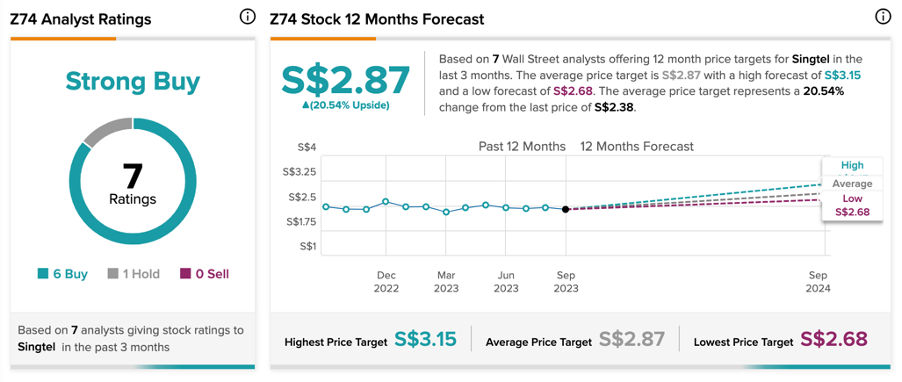

According to TipRanks’ consensus forecast, Z74 stock has a Strong Buy rating, based on six Buy and one Hold recommendations. The Singtel share price target is S$2.87, suggesting an upside of 20.5% on the current trading price.

ComfortDelGro Corporation Limited

Based in Singapore, ComfortDelGro is a global transportation company with an extensive fleet that includes buses, taxis, and a variety of rental vehicles. The company operates on an international scale, spanning seven countries.

The ComfortDelGro share price reached a 10-month peak in August 2023, driven by a bullish trend that started in June and its Q2 earnings announcement. The numbers were primarily propelled by the company’s public transport division and enhanced margins within its taxi segment. This led to an impressive surge in the company’s operating profit, which exceeded 100% and reached S$26 million. In the future, the company will implement a platform fee of S$0.70 for bookings made via its Zig app. This strategic step is anticipated to contribute approximately S$11 million in additional revenue during the second half.

After the earnings report, analysts are optimistic about the stock, supported by several positive factors like dividend expansion, increasing earnings momentum, and a robust balance sheet.

Is ComfortDelGro a Good Stock to Buy?

Based on seven buy ratings, C52 stock has a Strong Buy rating on TipRanks. The ComfortDelGro share price forecast is S$1.43, implying a change of 13% from the current price level.

Conclusion

Analysts hold a positive outlook on both Singtel and ComfortDelGro, supported by an impressive earnings report and the ongoing growth momentum expected to persist in the coming quarters.