The German energy company Siemens Energy AG’s (DE:ENR) share price dropped sharply following Investor Day, which failed to meet expectations, particularly regarding the turnaround plan for its wind turbine unit. The company cautioned that the recovery process for Siemens Gamesa, its wind business, would be challenging. However, it reassured investors with a comprehensive plan to steer it back on course within the next three years. The company’s wind business has encountered significant challenges, including quality concerns in the onshore segment.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

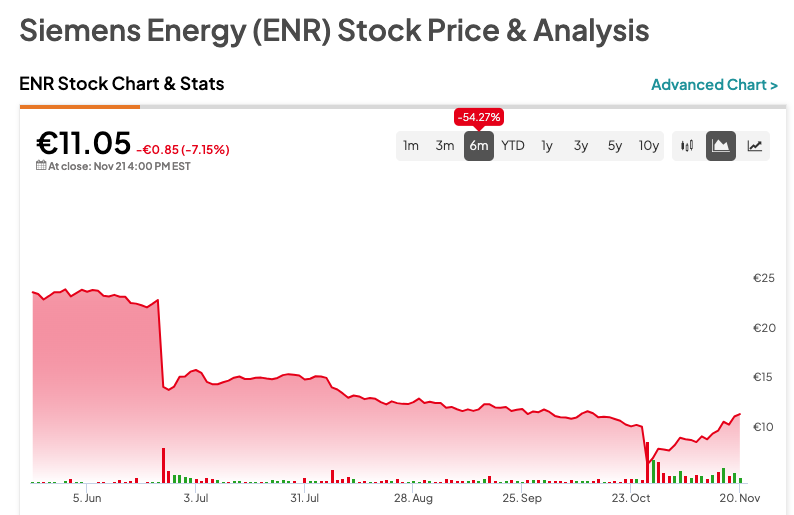

The company’s stock ended the day at a loss of almost 8% in trading yesterday. The company experienced a decline in investor confidence as it struggled to resolve issues within its wind business.

Consequently, the stock has depreciated by over 50% in value over the past six months. Nevertheless, the shares have rebounded by 80% since their big fall in October, when the company sought government support to bail out its troubled wind business.

Siemens Energy is a global energy company engaged in the design and operation of a range of energy systems, including wind turbines, gas turbines, gas engines, steam turbines, and other power distribution systems.

The Turnaround Plan

On its Capital Markets Day yesterday, the company outlined a plan for its struggling wind turbine unit to achieve breakeven status by FY26. It also highlighted the goal of returning to profitability and achieving solid financial strength thereafter. Additionally, it announced its plan to achieve €400 million in cost reductions for its challenged wind turbine business.

Last week, the company released its Q4 and FY23 results, where the outstanding performance of most of its energy businesses was dominated by the challenges within Siemens Gamesa. For the full year, the company posted a net loss of €4.58 billion. The losses prompted the company to secure a €15 billion government-backed bailout last week.

Is Siemens Energy a Good Buy?

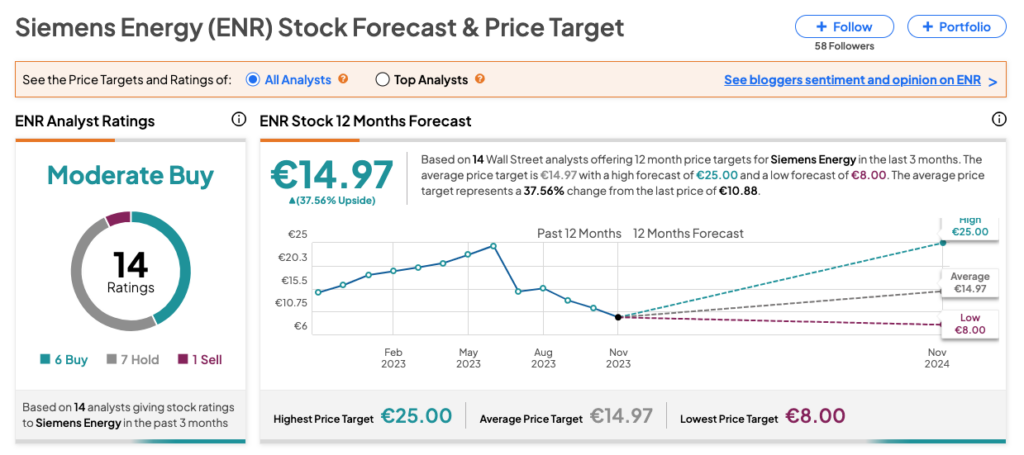

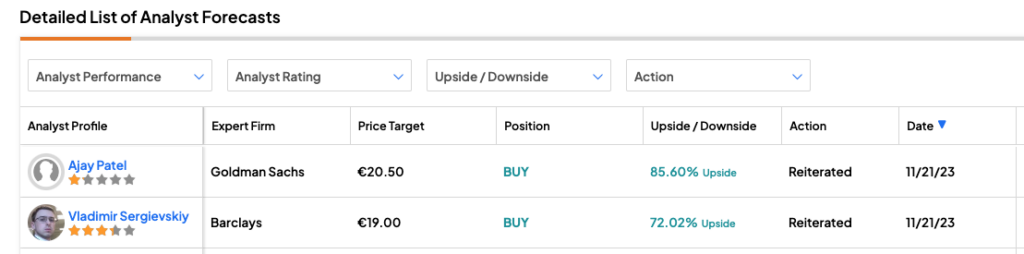

Despite the negative reaction from the market, analysts remain bullish about the company’s prospects and the share price growth. Yesterday, analyst Ajay Patel from Goldman Sachs reiterated his Buy rating on the stock, predicting a huge growth rate of 85%.

Similarly, Barclays analyst Vladimir Sergievskiy also maintained his Buy rating with a forecast of over 70% upside potential in the share price.

On TipRanks, ENR stock has a Moderate Buy rating backed by a total of 14 recommendations, of which six are Buy. The Siemens Energy share price forecast is €14.97, which implies a growth of 37.5% from the current trading level.