German companies Siemens AG (DE:SIE), Allianz SE (DE:ALV), and Rheinmetall AG (DE:RHM) are lined up this week to report their next set of quarterly earnings for 2023. We have identified these three companies using the TipRanks Earnings Calendar for the German market. Ahead of their earnings announcements, all of these companies have Buy ratings from analysts.

The TipRanks earnings calendar serves as a useful resource, offering up-to-date information about the upcoming earnings reports from various companies. It also provides essential data such as dates, estimated EPS, actual EPS, and more. Users can delve deeper into researching these stocks to enrich their decision-making process.

Let’s take a look at the numbers.

Are Siemens Shares a Good Buy?

The German manufacturing company Siemens will announce its third-quarter earnings for 2023 on August 10. According to TipRanks, the consensus EPS forecast is €2.19 per share, significantly higher than the negative EPS of €2.06 per share reported last year. The expected sales for the quarter are €19.41 billion. The company’s order growth is expected to be flat in this quarter at an order value of €22.19 billion.

Analysts also anticipate the company to post a profit of €1.41 billion, in contrast to the previous year, when it reported a net loss of €1.66 billion due to charges linked to Russia.

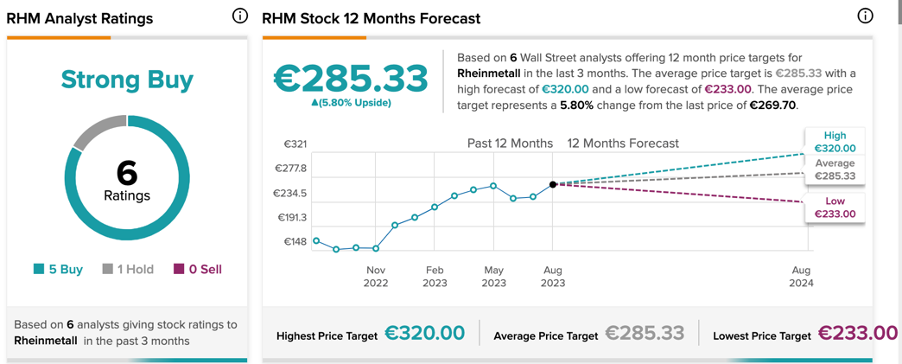

With a strong base of all 12 analysts’ recommendations, SIE stock has a Moderate Buy rating on TipRanks. The average price target of €185 signifies a 24.8% change from the current trading levels.

Is Allianz Stock a Good Investment?

Based in Germany, Allianz is a global financial services company with operations in over 70 countries.

Analysts are expecting earnings of €5.65 per share in the second-quarter earnings for the company due this week on Thursday. The EPS reported in the second quarter of last year was €3.85 per share. The sales forecast for the period is €37.89 billion, up from the previous quarter’s sales of €25.22 billion.

According to TipRanks consensus rating, ALV stock has a Strong Buy rating backed by seven Buy and two Hold recommendations. The average price forecast for a 12-month period is €254.25, which is 18.26% higher than the current price.

Is Rheinmetall a Good Stock to Buy?

Rheinmetall is a German manufacturing company, focused on designing arms and automation goods for international markets.

The company will publish its half-yearly earnings report, including the second-quarter numbers, on August 10. The forecasted EPS for Q2 is €0.94 per share, down from the EPS of €1.21 reported a year ago. The revenue expectations are set at €1.51 billion, as compared to €1.36 billion in the last quarter.

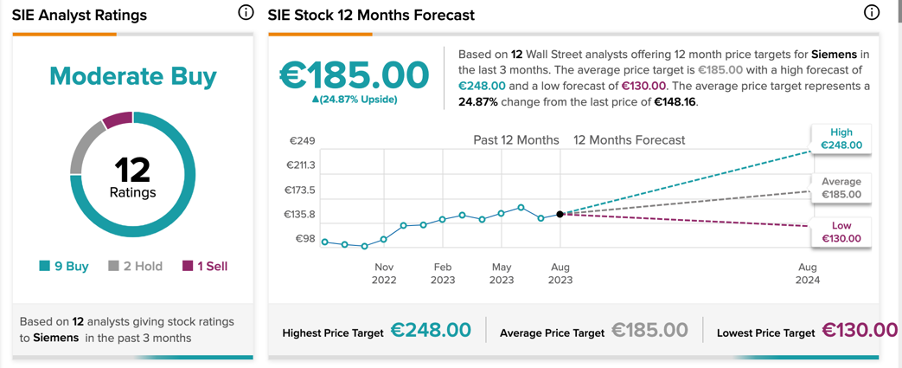

RHM stock carries a Strong Buy rating on TipRanks based on a total of six recommendations, of which five are Buy. Analysts expect growth of 5.8% on the current share price with a price target of €285.3. YTD, the stock has experienced growth of almost 40%.