Investing in large-cap stocks comes with its own benefits. These companies have been around for many years and have a strong hold on the market. Therefore, they are considered to be safer investments, as these companies are well-prepared for any uncertainty.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Even though the stock price growth will not be as fast as that of small or mid-cap stocks, they are ideal for stable and long-term growth.

Here, we have used the TipRanks Trending Stocks tool for the German market to identify two such companies, Siemens AG (DE:SIE) and Merck KGaA (DE:MRK). This tool lists the recently rated stocks by analysts in any particular market. It makes it easy for the investor to pick stocks that are constantly on the radar of analysts and can be trusted.

Let’s have a look at these companies in detail.

Siemens AG

Siemens is one of the largest engineering and manufacturing companies in Europe, operating in energy, financing, healthcare, mobility, automation, consumer products, etc.

In the last three months, the share price jumped by almost 30%, driven by its solid performance in the fourth quarter of 2022. The revenue in the quarter increased by 18% year-on-year to €20.6 billion. The highlight of the results was its industrial businesses, in which the profit jumped by 38% to €3.2 billion with a margin of 16.2%. The full-year profit for industrial businesses touched a record high of €10.3 billion.

The company’s order growth and larger contract win reflected its continued strong demand for its products and services. In 2022, the new orders were worth €89 billion, which was 25% higher than in 2021, pushing the total order backlog to €102 billion.

Analysts are bullish on the stock as the strong order backlog provides clarity about future earnings. Gael De-Bray from Deutsche Bank found the numbers very “encouraging” and is bullish on the company’s “resilience capabilities and strong strategic positioning.” He has a Buy rating on the stock.

Is Siemens AG a Good Investment?

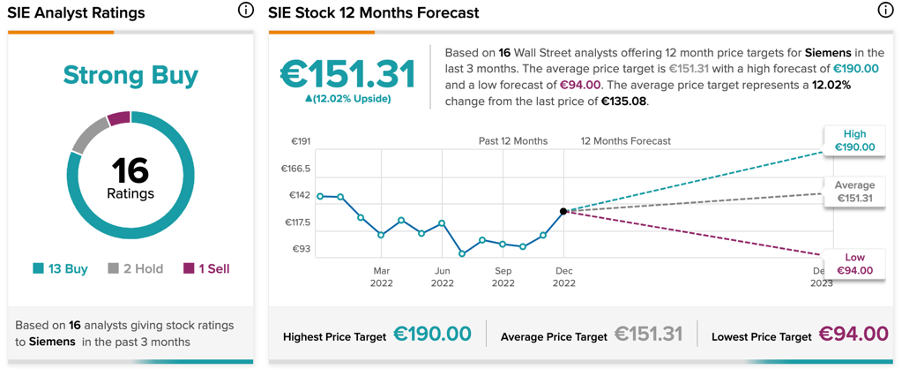

TipRanks rates Siemens’ stock as a Strong Buy, with a solid 13 Buy recommendations.

The average target price is €151.3, with an upside potential of 12%.

Merck KGaA

Based in Germany, Merck is a science and technology company catering to the life sciences, healthcare, and electronics sectors.

In the last three years, the stock has made its shareholders very happy with 81% returns. They are now waiting for the next growth catalyst, which could further push the price up.

Analysts feel the next growth driver for the company will be upcoming acquisitions. As the company has reduced a significant amount of debt in 2022, it is looking forward to some larger deals in 2023. The company also confirmed its target of achieving sales of €25 billion by 2025.

Based on such factors, Bank of America has recently added Merck’s shares to its “Europe 1” recommended list. Sachin Jain of Bank of America considers it a “top pick” in Europe’s pharma sector.

Merck KGaA Stock Forecast

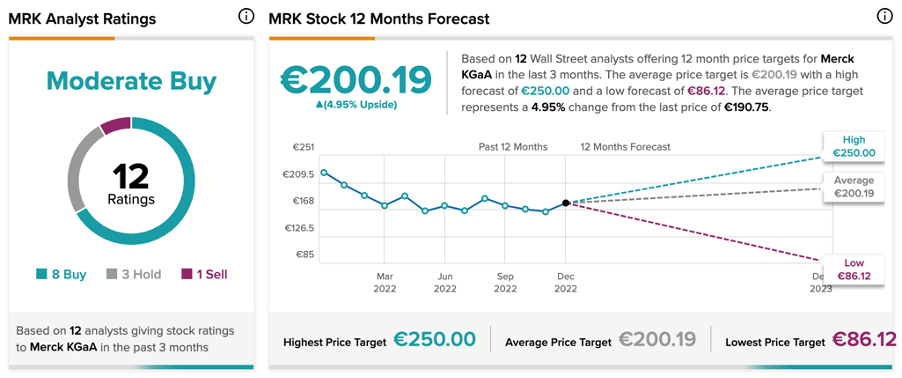

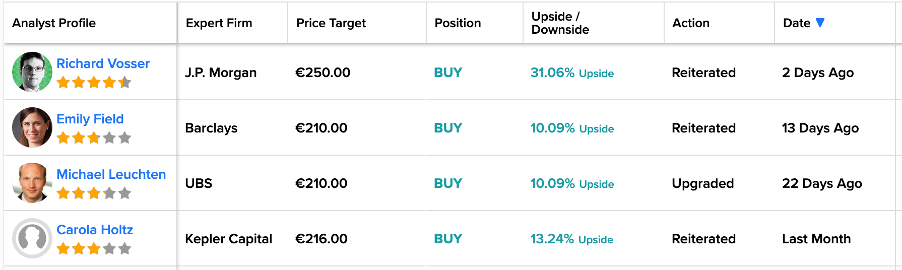

According to TipRanks’ rating consensus, Merck stock has a Moderate Buy rating.

The target price of €200.2 is 5% higher than the current price level. The target price ranges from a low of €86 to a high of €250.

Conclusion

The analysts’ confidence in these stocks, along with their growth strategy for the future, make them a good option to consider in the German market.

They are confident about Siemens due to its strong order book and stable earnings growth. On the other hand, they are rating Merck as a Buy due to its high potential to close some strategic acquisitions in 2023.