British energy giant Shell Plc (GB:SHEL) is leaning on further workforce reduction to slim costs. The job cuts would affect roles in the Low Carbon Solutions division and other units in a phased manner, as per a Bloomberg report. Employees given the pink slip will be offered redundancy packages or other roles in the organization. Year-to-date, SHEL shares have gained 14.4%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Shell announced the layoffs in an email yesterday, stating that the company will continue to “right-size the activities that deliver the most value.” The oil and gas company had earlier announced a 15% workforce reduction by 2024. Shell’s new CEO Wael Sawan is focused on making the company leaner and efficient to be competitive with U.S. rivals. Sawan aims to cut costs by up to $3 billion by 2025. Shell had roughly 93,000 employees at the end of 2022, significantly higher than its U.S. counterparts.

Oil prices have cooled down this year compared to 2022, when prices touched record high levels backed by the Ukraine-Russia war. Additionally, companies are concerned about the future as more and more countries resort to decarbonization and move towards lower fossil fuel consumption. Moreover, energy companies are seen as lucrative investments for their solid share buybacks and high dividend yields. Thus, Shell and other companies are under constant pressure to make massive profits and reward shareholders handsomely.

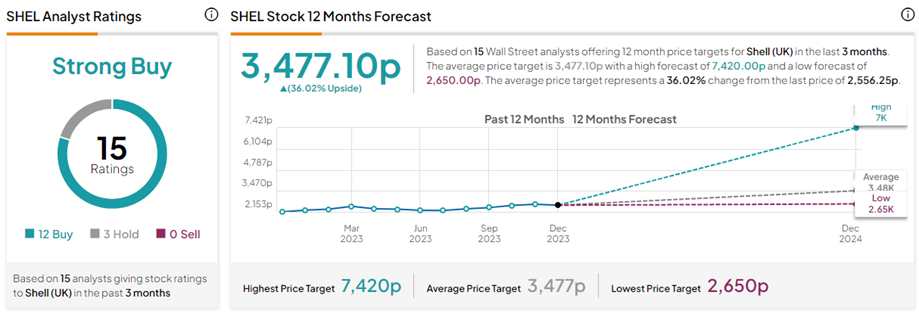

What is the Price Target for Shell Plc?

The Shell Plc share price target of 3,477.10p implies 36% upside potential from current levels. On TipRanks, SHEL stock commands a Strong Buy consensus rating based on 12 Buys versus three Hold ratings. Plus, Shell’s most recent dividend of 26.75p per share was paid on December 20, reflecting a yield of 3.93%.