UK-based energy giant Shell (GB:SHEL) is in the hot seat as a group of 27 investors have decided to jointly file a resolution for stricter action on reducing greenhouse gas emissions. The resolution, led by activist group Follow This, also includes France’s leading asset management company Amundi SA (FR:AMUN), British wealth manager Rathbones Group, and insurance company Scottish Widows, among others.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Shell will vote on the resolution at its upcoming annual general meeting in May 2024.

Shell is an oil and gas company providing a wide range of energy products, including fuels, oil, liquefied petroleum gas (LPG), lubricants, etc.

Mounting Demands to Cut Emissions

The investors, who collectively own 5% of Shell shares, are building pressure on the company to align its mid-term Scope 3 emissions goals with the Paris Climate Agreement. Scope 3 emissions result from the company’s activities but from sources not owned or directly controlled by the company. This marks the most substantial shareholder push on climate policy faced by the company.

Earlier in 2023, Shell faced a shareholder revolt for the second consecutive year, challenging the company’s energy transition strategy.

Currently, Shell’s goal is to achieve a 50% reduction in its absolute emissions (Scope 1 and Scope 2) by 2030, compared to 2016 levels, on a net basis. In 2022, the company achieved a 30% reduction in absolute emissions compared to 2016.

Are Shell Shares a Good Buy?

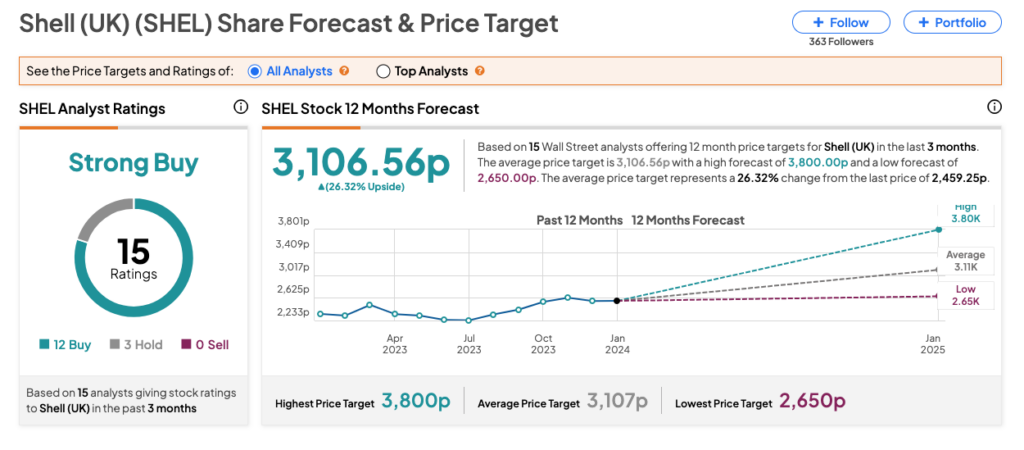

Overall, analysts hold a bullish stance on SHEL stock, with a Strong Buy consensus rating based on 12 Buy and three Hold recommendations. The Shell share price target is 3,106.56p, which implies an increase of around 26.3% on the current price.