Singapore Telecommunications Limited, or Singtel (SG:Z74), dominates the telecommunications market in Singapore as the foremost provider. It offers an extensive range of services, including mobile, fixed line, internet, TV, cloud solutions, cybersecurity, and more.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company will release its fourth-quarter earnings for 2023 this week, on May 25. Analysts expect earnings of S$0.04 per share for the quarter, up from S$0.03 per share reported in the same quarter last year. The projected sales forecast for the upcoming quarter amounts to S$3.61 billion.

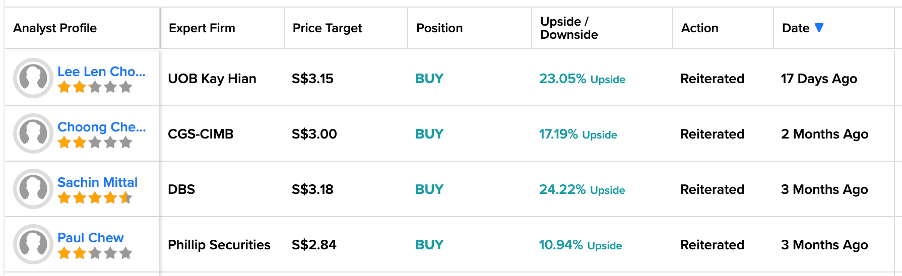

Overall, analysts are strongly bullish on the stock. 17 days ago, analyst Lee Len Chong from UOB Kay Hian reiterated his Buy rating on the stock while maintaining the price target at S$3.15. This implies a 23% growth in the share price. Chong believes that the rebound in international travel will further drive more roaming revenues for the company. He also stated that higher prices, successful monetization of 5G, and improved data roaming revenues will act as “favorable tailwinds in 2023.”

What is the Future Price of Singtel Stock?

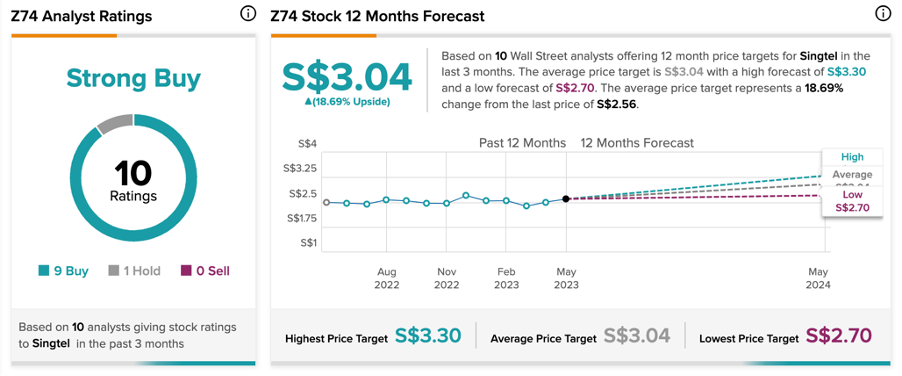

Based on the analyst consensus from TipRanks, Z74 stock has received a Strong Buy rating, supported by a total of 10 recommendations, out of which nine are Buy.

At an average target price of S$3.04, analysts are projecting a growth of 18.7% from the current level. The stock has been trading up by 5.3% in the last three months.

Is NetLink a Good Investment?

With a significant ownership stake of nearly 25%, Singtel holds the position of the largest shareholder in Singapore-based NetLink NBN Trust (SG:CJLU). NetLink designs and manages the passive fiber network infrastructure in Singapore, which is used by telecom companies like Singtel to provide broadband services to customers.

The company reported its 2023 earnings last week. NetLink reported a growth of 6.8% in its yearly revenues of S$403.6 million, as compared to the previous year. The company’s full-year earnings increased by 19.7% to S$109.3 million, driven by higher revenues and income along with lower operating expenses.

Three days ago, CGS-CIMB analyst Khang Chuen Ong maintained his Buy rating on the stock after the results. His price target of S$0.95 implies a growth rate of 5.5% in the share price.

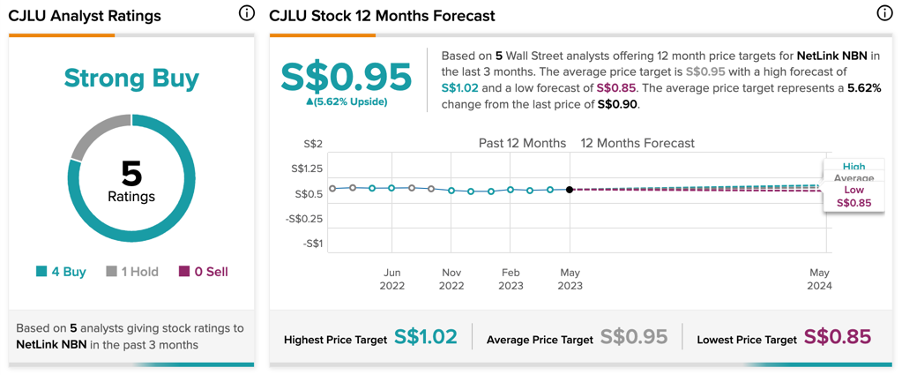

CJLU stock has a Strong Buy rating on TipRanks based on four Buy and one Hold recommendations. The average price target is S$0.95, which is 5.62% higher than the current price level.